Stabilization at a moderate pace (Martin Ertl)

19 Nov

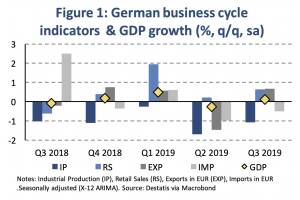

Business and sentiment indicators have stabilized at low levels, a turning point has not yet been fully confirmed by the data. The German economy has avoided a technical recession in Q3 with 0.1 % GDP growth. Manufacturing industries remain in contraction. Growth in CEE countries continues to be above the EU average, being particularly strong in Poland and Hungary. During the third quarter, the Euro Area economy has avoided a further deterioration in economic momentum. GDP growth has been confirmed at 0.2 % (quarter-on-quarter, seasonally adjusted), which is unchanged to the previous quarter. Further, the expected technical recession in Germany (two consecutive quarters of negative q q GDP growth) has not materialized. The pace of economic expansion seems to have stabilized for now at a moderat... » Weiterlesen

USA: The ‘Mid-cycle’ adjustment in key interest rates is done & Euro Area: Germany...

04 Nov

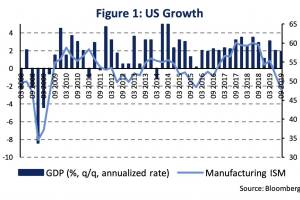

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adjustment in the key interest rate as the economy continues a solid expansion but some weak spots occur. In Q3 2019 the US economy continued its expansion. Real gross domestic product (GDP) rose by 1.9 % (q q, annualized rate) after 2.5 % during H1 2019. The expenditure components reveal that growth remains driven by personal consumption expenditure (2.9 %), while the second consecutive decline in fixed investment (-1.3 %) indicates weakening business dynamism. Investment in structures and equipment fell by 15.3 % and 3.8 % whereas residential investment rose by 5.1 %. In addition, net exports again deducted from GDP growth as imports growth outpaced exports (1.2 % and 0.7 %). Finally, government consumption c... » Weiterlesen

Quarterly Macroeconomic Outlook: Lower growth ahead (Martin Ertl)

16 Oct

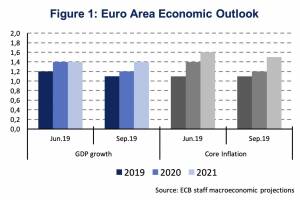

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has become increasingly synchronized. Conflicting business cycle signals raise the uncertainty about the short-term Euro Area outlook. Sentiment and growth have been slowing, yet labor markets appear robust. Austria’s economy is cooling. While household consumption and construction provide support, manufacturing industries herald a slowdown. Central- and Eastern Europe continues to outpace growth in the Euro Area. It is unlikely that the region can fully decouple from the Euro Area business cycle, yet substantial improvements in labor markets have made CEE more resilient. Leading central banks (ECB & Fed) have added monetary policy stimulus. Without a major reversal in monetary policy, the cu... » Weiterlesen

Macroeconomic effects of unconventional monetary policy & the ECB’s new stimulus p...

16 Sep

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a monthly pace of 20 billion Euro (open ended). Previous unconventional monetary policy has led to a rise in inflation by 0.6 %-age points. The European Central Bank provides additional monetary stimulus by lowering the interest rates further into negative territory and restarting net asset purchases (QE). The cut of the interest rate on the deposit facility by 10 basis points (bp), to -0.5 %, was widely expected. Part of the banks’ excess liquidity holdings will be exempt from negative deposit rates, introducing a two-tier system. The exempt tier, which is initially set at 6 times an institution’s minimum reserve requirements, is remunerated at an annual rate of 0 %. QE will start in November ... » Weiterlesen

New ECB QE and its effects on interest rates (Martin Ertl)

09 Sep

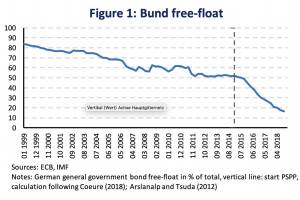

The ECB is expected to introduce new unconventional monetary policy measures. First, we calculate the free-float of German government bonds, which has become very low. In addition, we make use of recent evidence about QE effects on term premia to sketch monetary policy options. Large scale asset purchases (LSAP), or “quantitative easing” (QE), are intended to decrease long-term yields and ease financing conditions thereby stimulating aggregate demand and bring inflation back in line with the central bank’s price stability objective. The ECB launched the asset purchase programme (APP) in January 2015, which initially pledged the purchase of 60 billion EUR of securities each month. The asset purchases ended in December 2018 when the portfolio had reached around 2.6 trillion EUR.... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24