CEE: Romania - NBR goes tighter but more will be needed soon (Martin Ertl)

13 Nov

NBR keeps monetary policy rate unchanged at 1.75 % but narrows the interest rate corridor September inflation is driven by volatile food prices, the monetary policy relevant core inflation increased only moderately. Strong economic growth and tight labor market conditions will require the NBR to act soon. The National Bank of Romania (NBR) has kept its monetary policy rate unchanged at 1.75 %. By narrowing the corridor around the monetary policy rate from + - 1.25 to + - 1 %-points the NBR continued its gradual monetary policy normalization. The deposit facility rate was raised to 0.75 % while the lending facility rate was lowered to 2.75 %. The NBR’s interest rate corridor bounds overnight interbank rates, which are highly correlated with longer maturity interbank rates. The 3 months R... » Weiterlesen

CEE: Serbia - Inflation has been well anchored and growth picked up in Q3 (Martin ...

13 Nov

Inflation has been well anchored and growth picked up in Q3 while the real yield in Serbia is already very low. At the monetary policy meeting that took place last on Thursday 9 th November, the executive board of the National Bank of Serbia (NBS) decided to keep the key policy rate on hold at 3.5 %. Previously, the NBS had lowered the policy rate twice this year by 25 basis points in September and October. The executive boards assessed that inflationary pressures remain low. In September, the inflation rate was 3.2 % (y y) and lower than previously expected. The drought effects on food prices were weaker than expected. In addition, domestic inflation expectations seem to adjust to a lower level (Figure 4). The real, inflation-adjusted interest rate has also reached a low (< 1 % on average) this... » Weiterlesen

Czech Republic - key interest rate increased by 25 basis points to 0.5 % (Martin E...

07 Nov

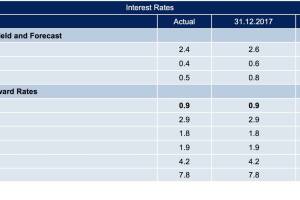

The Czech National Bank has increased its key interest rate by 25 basis points to 0.5 %. The corridor around the key rate was expanded to 95 basis points, keeping the discount rate unchanged at 0.05 %. Tighter monetary policy reflects a booming Czech economy with unemployment at its pre-crisis low. EUR CZK exchange rate poses risk to the CNB’s inflation path. Last Thursday (November 2 nd ) the Czech National Bank (CNB) took the next step towards monetary policy normalization by increasing the 2-week repo rate by 25 basis points to 0.5 %. The interest rate corridor was expanded to 95 basis points by keeping the discount rate unchanged at 0.05 % and increasing the Lombard rate by 50 basis points to 1 %. The rate hike was in-line with market expectations and the CNB’s forward guida... » Weiterlesen

Solid Q3 GDP released last week for Austria and the total of the Euro Area (Martin...

07 Nov

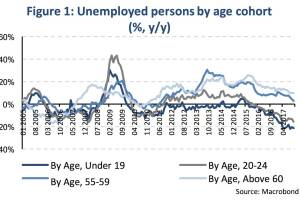

Solid Q3 GDP released last week for Austria and the total of the Euro Area. The conditions in the Austrian labor market keep improving amid the sound business cycle. The Austrian economy continues a strong growth trajectory. According to the flash estimate from the Austrian Institute of Economic Research (Wifo), real GDP increased by 0.8 % (q q) in the third quarter after it had expanded by 0.9 % quarterly in H1 2017 (trend business cycle component). In seasonally and working day adjusted terms (Eurostat), the quarterly increase in GDP was 0.6 % in Q3. The recovery is broad based across expenditure components. Both household consumption (0.4 % q q) and fixed investment (07 %) as well as net exports make the economy grow. Exports and imports rose by 0.8 % each in Q3. In annual terms, GDP expanded... » Weiterlesen

ECB continues a gradual path of monetary policy normalization (Martin Ertl)

03 Nov

Eurozone ECB continues a gradual path of monetary policy normalization by extending QE at a slower pace. If the Euro Area economy evolves along the lines projected, the begin of an interest rate hiking cycle is likely in 2019. At the governing council (GC) meeting on Thursday last week, the European Central Bank left the interest rates on the main financing operations, the marginal lending facility and the deposit facility unchanged at 0.0 %, 0.25 % and -0.4 % respectively. In the pivotal forward-looking statement (“forward guidance”), the GC says that it “continues to expect the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases.” The phrase was unchanged from the previous GC stat... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24