ECB continues a gradual path of monetary policy normalization (Martin Ertl)

Eurozone

- ECB continues a gradual path of monetary policy normalization by extending QE at a slower pace.

- If the Euro Area economy evolves along the lines projected, the begin of an interest rate hiking cycle is likely in 2019.

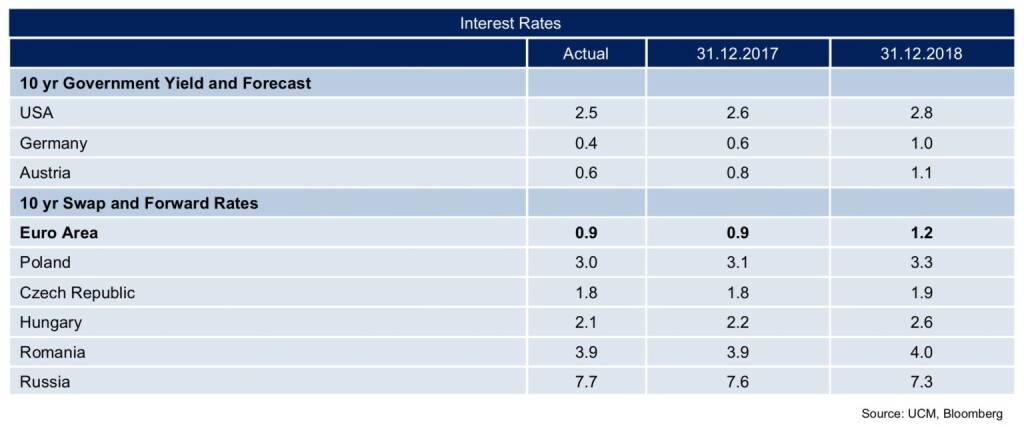

At the governing council (GC) meeting on Thursday last week, the European Central Bank left the interest rates on the main financing operations, the marginal lending facility and the deposit facility unchanged at 0.0 %, 0.25 % and -0.4 % respectively. In the pivotal forward-looking statement (“forward guidance”), the GC says that it “continues to expect the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases.” The phrase was unchanged from the previous GC statement.

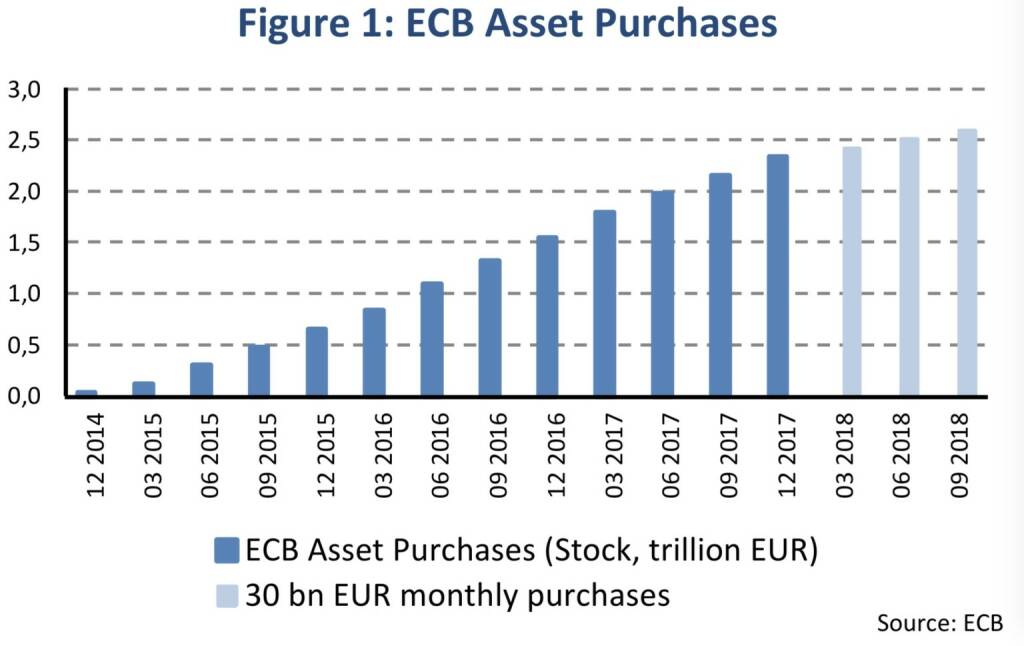

As broadly anticipated, the ECB recalibrated the asset purchase programmes (“QE”) beyond the end of the year. The ECB will continue to purchase 60 bn EUR assets each month until December 2017. From January 2018, the net asset purchases are intended to continue at a monthly pace of 30 bn EUR until September 2018.

The programme is ‘open-ended’, i. e. there is no (automatic) process of reducing QE to zero and, if necessary, it will run beyond September in case the GC does not see a sustained adjustment in the path of inflation consistent with its inflation aim. Even so, if the outlook becomes less favourable, the GC stands “ready to increase the asset purchases in terms of size and/or duration”. In addition, the ECB will reinvest the principal payments from maturing securities for an extended period of time after the end of its net asset purchases. Hence, there is a sequencing between asset purchases and reinvestment of principal payments and there is a sequencing with respect to asset purchases and the main central bank rates. However, as discussed during Thursday’s Q&A session, there is no sequencing between reinvestment of principal proceeds and changes in the main policy rates. This implies that reinvestment could still run when the ECB starts to move the policy interest rates (like in the case of the US central bank Fed). In other words, the ECB could start reducing its balance sheet when interest rate normalization is already well underway.

President Draghi stressed the growing confidence in the gradual convergence of inflation rates towards the central bank’s inflation goal on account of an increasingly robust and broad-based economic expansion. At the same time, domestic price pressures are still muted overall and remain conditional on support from monetary policy. Monetary policy therefore remains highly accommodative in the Euro Area and, as President Draghi summarized, is reflected by the additional asset purchases, by the sizeable stock of acquired assets and the forthcoming reinvestment and by the forward guidance on interest rates.

In its September macroeconomic projections, the ECB had forecast Euro Area real GDP to increase by 1.8 % and 1.7 % in 2018 and 2019. Annual inflation was projected at 1.2 % and 1.5 % for 2018 and 2019. If growth and inflation evolve along the line that is projected, a further reduction of monthly asset purchases after September 2018 is likely. It could take another three to six months to bring monthly asset purchases to zero. It follows that the begin of an interesting rate hiking cycle is likely to take place over the course of 2019.

Respondents to the ECB Survey of Professional Forecasters (SPF) for the fourth quarter of 2017 (released last week) reported forecasts for annual inflation averaging 1.4 % and 1.6 % in 2018 and 2019 respectively. Longer-term inflation expectations were revised upwards from 1.8 % to 1.9 % implying increased confidence in the central bank ability to ‘anchor’ inflation expectations.

Disclaimer

This publication is neither a marketing document nor a financial analysis. It merely contains information on general economic data. Despite thorough research and the use of reliable data sources, we cannot be held responsible for the completeness, correctness, currentness or accuracy of the data provided in this publication.

Our analyses are based on public Information, which we consider to be reliable. However, we cannot provide a guarantee that the information is complete or accurate. We reserve the right to change our stated opinion at any time and without prior notice. The provided information in the present publication is not to be understood or used as a recommendation to purchase or sell a financial instrument or alternatively as an invitation to propose an offer. This publication should only be used for information purposes. It cannot replace a bespoke advisory service to an investor based on his / her individual circumstances such as risk appetite, knowledge and experience with financial instruments, investment targets and financial status. The present publication contains short-term market forecasts. Past performance is not a reliable indication for future performance.

)

Latest Blogs

» BSN Spitout Wiener Börse: Wienerberger zur...

» SportWoche Party 2024 in the Making, 14. A...

» SportWoche Party 2024 in the Making, 15. A...

» Österreich-Depots unveändert (Depot Kommen...

» Börsegeschichte 18.4.: Mayr-Melnhof (Börse...

» SportWoche Party 2024 in the Making, 18. A...

» Reingehört bei A1 Telekom Austria (boersen...

» News von Verbund und VIG, Research zu Palf...

» Nachlese: Matejka Poetry Slam, B&C, 10% au...

» Wiener Börse Party #631: XXS-Folge mit ein...

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...