Czech Republic - key interest rate increased by 25 basis points to 0.5 % (Martin Ertl)

- The Czech National Bank has increased its key interest rate by 25 basis points to 0.5 %.

- The corridor around the key rate was expanded to 95 basis points, keeping the discount rate unchanged at 0.05 %.

- Tighter monetary policy reflects a booming Czech economy with unemployment at its pre-crisis low.

- EUR/CZK exchange rate poses risk to the CNB’s inflation path.

Last Thursday (November 2nd) the Czech National Bank (CNB) took the next step towards monetary policy normalization by increasing the 2-week repo rate by 25 basis points to 0.5 %. The interest rate corridor was expanded to 95 basis points by keeping the discount rate unchanged at 0.05 % and increasing the Lombard rate by 50 basis points to 1 %. The rate hike was in-line with market expectations and the CNB’s forward guidance.

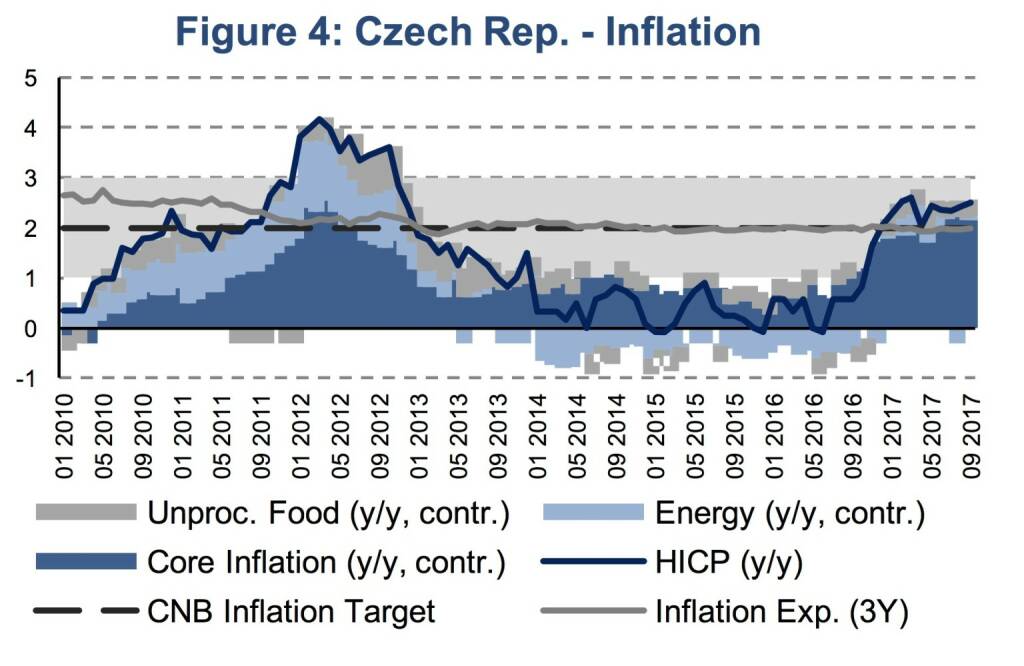

In August 2017, the CNB was the first CEE Central Bank to tighten monetary policy by increasing the 2-week repo rate to 0.25 %. In its November macroeconomic forecasts the CNB expects the inflation rate to be above the central bank’s 2 % target until Q4 2018 only reaching 2 % in Q1 2019. Compared to the previous macroeconomic forecast from August, the new figures reflect a 0.4 %-points upward revision for Q4 2018. In September 2017 inflation reached 2.5 % (HICP, y/y) while core inflation (HICP excluding energy and unprocessed food, y/y) was at 2.7 %. Nevertheless, long-term inflation expectations (3 years) are well anchored at the CNB’s inflation target of 2 %, based on a CNB survey among financial market participants (Figure 4).

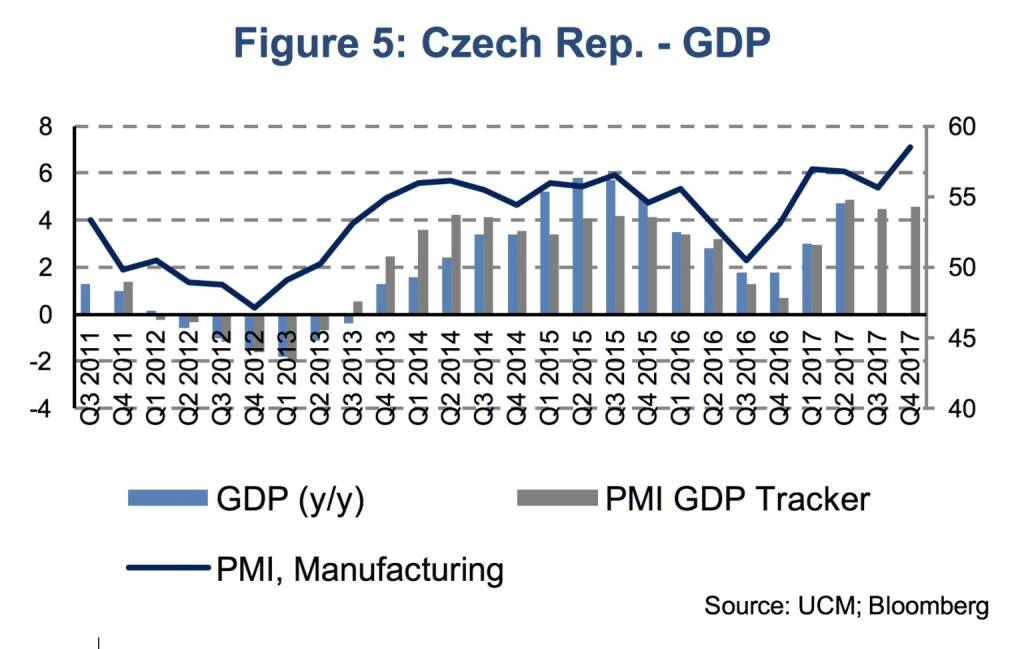

Stable long-term inflation expectations reflect the CNB’s credible commitment to its inflation target. Tighter monetary policy by the CNB is, thus, intended to stabilise inflation over the monetary policy horizon. Inflationary pressure stems from a booming domestic economy. The unemployment rate has reached its pre-crisis low of 3.8 in September and gross manufacturing wages increased by 8.4 % in Q2. Economic growth has recently surprised to the upside with 4.7 % in Q2 (y/y, sa). This is also reflected in the CNB’s GDP forecasts for 2017, which was revised upwards by 0.9 %-points to 4.5 %. The PMI economic sentiment indicator further reaffirms the positive outlook recording a new peak at 58.5 in October. Using the PMI Manufacturing Index as a simple GDP forecasting tool for the third and fourth quarter of 2017 (Figure 5) predicts annual economic growth of 4.2 %.

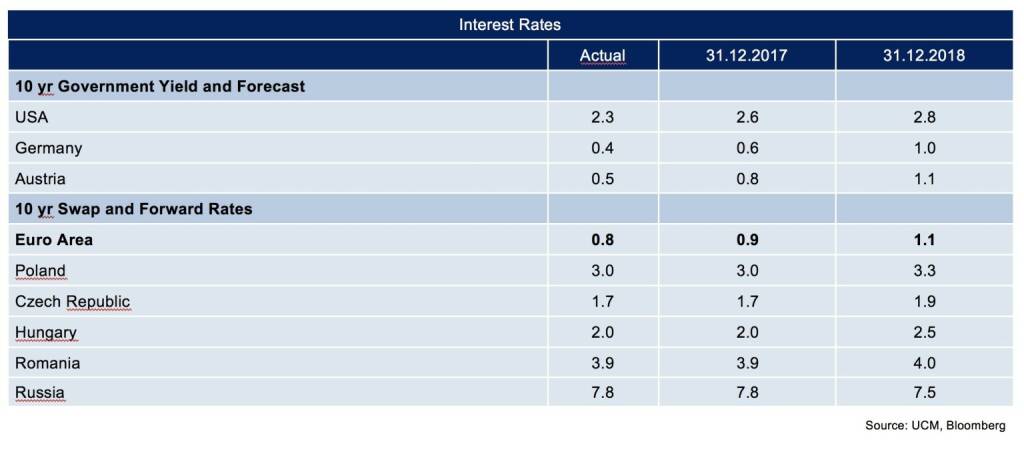

Considering the slow and very gradual monetary policy normalization in the Euro Area, monetary tightening by the CNB implies widening interest rate differentials. The first rate hike by the ECB can only be expected after the end of the Asset Purchasing Programme (APP), so the central bank’s forward guidance. We do not expect the first rate hike by the ECB before the second half of 2019. The 3 months Euro interbank rate (EURIBOR) currently stands at -0.33, while the equivalent Czech interbank rate (PRIBOR) increased to 0.65 on Friday. This implies a current interest rate differential for short term rates of approximately 1 %-point. Until the end of 2018, the spread is expected to widen to 1.2 % with a PRIBOR rate of 1 % based on the latest update of the CNB’s forecast. This implies two further rate hikes by the CNB until the end of 2018.

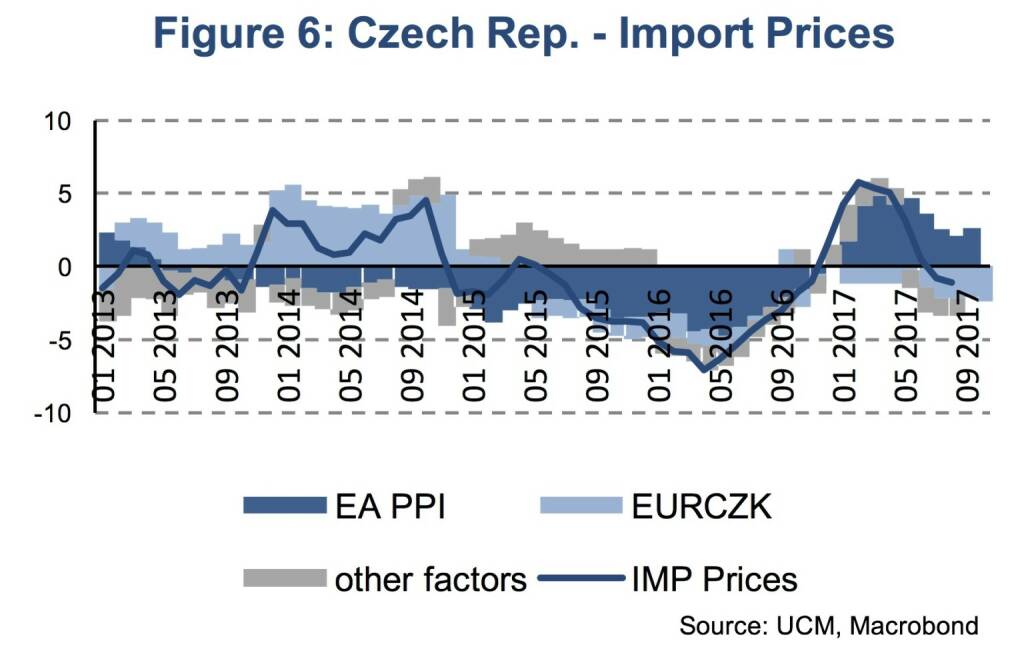

These differences among the central banks’ rate hiking cycles should directly impact the EURCZK exchange rate. A stronger CZK cools down the economy by making Czech exports relatively more expansive. Moreover, a stronger CZK should act deflationary by lower import prices helping the CNB to achieve its inflation target. Based on a decomposition of Czech import prices, figure 6 shows that the appreciation of the CZK has had a significant deflationary effect on Czech import prices since June 2017. Euro Area producer price inflation of 3.3 % (y/y, avg. Jan.-Aug. 2017) has, however, counterbalanced the negative exchange rate effect for most of 2017. A slower than anticipated EURCZK appreciation would thus pose an inflationary risk which might lead the CNB to increase rates faster than expected.

Authors

Martin Ertl, Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Disclaimer

This publication is neither a marketing document nor a financial analysis. It merely contains information on general economic data. Despite thorough research and the use of reliable data sources, we cannot be held responsible for the completeness, correctness, currentness or accuracy of the data provided in this publication.

Our analyses are based on public Information, which we consider to be reliable. However, we cannot provide a guarantee that the information is complete or accurate. We reserve the right to change our stated opinion at any time and without prior notice. The provided information in the present publication is not to be understood or used as a recommendation to purchase or sell a financial instrument or alternatively as an invitation to propose an offer. This publication should only be used for information purposes. It cannot replace a bespoke advisory service to an investor based on his / her individual circumstances such as risk appetite, knowledge and experience with financial instruments, investment targets and financial status. The present publication contains short-term market forecasts. Past performance is not a reliable indication for future performance.

Imprint

Information required pursuant to the Austrian Media Act

Publisher of this publication:

UNIQA Insurance Group AG

Untere Donaustraße 21, A-1029 Vienna, Austria

Media owner of this publication:

UNIQA Capital Markets GmbH

Untere Donaustraße 21, A-1029 Vienna, Austria

Management Board of UNIQA Capital Markets GmbH:

Dr. Andreas Bertl, Mr. Franz Hagmann

UNIQA Capital Markets GmbH is constituted as a limited liability company; the media owner is licenced as an investment firm and regulated by the Austrian Financial Market Authority (FMA-Finanzmarktaufsicht).

Ownership structure of the media owner:

UNIQA Insurance Group AG is 100% owner of UNIQA Capital Markets GmbH.

Basic tendency of the content of this publication:

Information on general economic data.

Latest Blogs

» News zu Erste Group, Strabag, Rosinger Gro...

» Wiener Börse Party #635: ATX stark, viele ...

» Nachlese: Varta bzw. die verborgene 13-Bil...

» Wiener Börse zu Mittag stärker: RBI, Bawag...

» ABC Audio Business Chart #101: Die verborg...

» Börsenradio Live-Blick 23/4: Gold runter, ...

» Börse-Inputs auf Spotify zu u.a. Bayer, Be...

» ATX-Trends: AT&S, RBI, Addiko, UBM, S Immo...

» BSN Spitout Wiener Börse: Oberbank zurück ...

» Österreich-Depots: Stabil (Depot Kommentar)

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...