Central banks’s forecast adjustments (Martin Ertl)

18 Dec

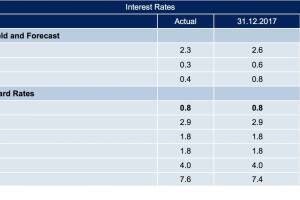

USA Fed FOMC increases the federal fund rate for the third time this year Federal fund rate target range at 1.25-1.5 % December economic projections show stronger labor market and higher GDP growth In line with market expectations, the Federal Open Market Committee (FOMC) has decided to increase the target range of the federal funds rate by 25 basis points (bp) to 1.25-1.5 % from previously 1-1.25 %. This is the third rate hike this year after a 25 bp increase in March as well as June. The FOMC expects “economic conditions to evolve in a manner that will warrant gradual increases in the federal funds rate”. The statement also emphasises that the key policy rate is likely to remain below its longer run level “for some time”. According to the December economic project... » Weiterlesen

CEE: Poland (Martin Ertl)

11 Dec

The National Bank of Poland has kept its monetary policy rate unchanged at 1.5 %. The minutes of the November meeting show a lively discourse within the Monetary Policy Council. Headline inflation has reached the 2.5 % inflation target but core inflation remains low. Wage pressure on inflation remains limited, so far, as unit labor costs remain stable. Strong growth in construction activity points towards a recovery in investment. Two weeks after our analysis of the introduction of new unconventional monetary policy instruments in Hungary, we take a look at the National Bank of Poland (NBP). The NBP shows the most stable interest rate outlook among the Central European central banks, with its governor Glapinski signaling no rate hike until the end of 2018. At its two-day Monetary Policy M... » Weiterlesen

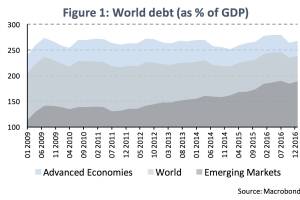

China - Patient zero of the next debt crisis (Martin Ertl)

07 Dec

The Rise of Debt in China Stylized facts document the astonishing rise of corporate debt in China. The Great Recession stopped the rise of private debt in advanced economies, while governments bear a larger part of the debt burden. Since 2002, the total world debt as a percentage of global output increased by 44.6 %-age points according to the Bank for International Settlements (BIS). In 2017, the total private and public debt as a percentage of world GDP was 238.4 %. The Great Recession did not stop the trend: In 2017, total global debt to GDP was again 33.8 %-age points above the level immediately after the crisis in 2008. The surge in debt was more pronounced in the emerging world (EM) than in the advanced economies (DM). Emerging markets debt rose by 50.1 %-age points since 2010, while d... » Weiterlesen

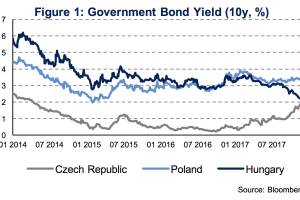

CEE: Diverging monetary policy in Hungary (Martin Ertl)

27 Nov

CEE Divergence of monetary policy trajectories continues among CE central banks. The National Bank of Hungary introduces two unconventional instruments to flatten the yield curve (effective from January 2018) while other CE central banks start with monetary policy normalization. New instruments: interest rate swaps (maturities: 5Y and 10Y); purchasing programme of mortgage bonds (maturities: +3Y). The divergence of monetary policy trajectories among the central banks of the Central European (CE) region continues. The most pronounced difference can be found between the Czech National Bank (CNB) and the National Bank of Hungary (NBH). While the former increased its monetary policy rate (2 week repo rate) by 25 basis points to reach 0.5 % earlier this month, the latter announced the introducti... » Weiterlesen

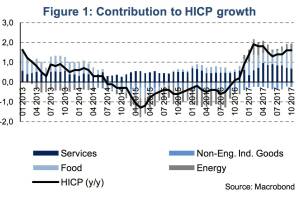

Eurozone: Solid Q3 growth in Germany and around the Euro Area (Martin Ertl)

26 Nov

Solid Q3 growth in Germany and around the Euro Area German economic growth continued at a high rate in Q3 2017. The Federal Statistical Office (Destatis) reported last week that real quarterly GDP rose by 0.8 % (after 0.9 % in Q2). Positive contributions came from foreign trade, as the increase in exports was higher than that of imports, and from fixed investment. Especially, investment in machinery and equipment increased on the previous year, according to the Destatis release (GDP details are not yet available). In annual terms, GDP rose by 2.8 % and – assuming a rise of 0.6 % q q in Q4 – it will have expanded by around 2.5 % (swda) over the total of 2017. Germany’s growth acceleration is in line with solid pan-Eurozone results (Figure 1). In Italy , GDP growth accelerate... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24