The Euro Area labor market in US perspective (Martin Ertl)

25 Apr

The unemployment rate in the Euro Area (8.5 %) is twice as high as in the United States (4.1 %). Labor markets in Spain and Italy continue to contribute substantially to Euro Area aggregate unemployment. Euro Area labor force participation rates are rising, while the US participation rate has declined moderately. Euro Area old age participation rates are on the rise but still below US levels. Labor markets have become substantially tighter with unemployment rates below, or close to, their pre-crisis lows. In March, the saisonally adjusted (sa) unemployment rate was at 4.1 % in the United States, covering persons aged between 16 and 74 years. The Euro Area, however, shows a considerably higher unemplyoment rate at 8.5 % (sa, February) for the same age group. Figure 1 shows that the unemploym... » Weiterlesen

Russia: How resilient is the economy to financial sanctions? (Martin Ertl)

16 Apr

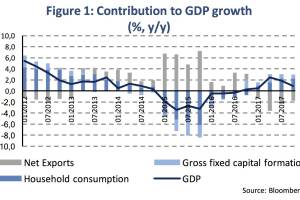

While the recovery has been weak, we have been arguing that Russia gained in macroeconomic stability in recent years. Financial shock-absorbing factors include low inflation and the transition to a new monetary policy framework, rebuilt FX reserves, a prudent fiscal rule and a consumption-driven recovery. In a surprise action, on Friday 6 th April, the US Office of Foreign Assets Control (OFAC) designated Rusal, a Russian corporate issuing foreign currency denominated bonds, as a specially designated national (SDN). US persons holding debt and equity in the company must sell its holdings until 7 th May 2018. How resilient is the macroeconomy to financial shocks such as the tightening in foreign currency financing conditions? Higher firm borrowing cost lower investment and employment. Currency d... » Weiterlesen

CEE and the global economy: The big picture (Martin Ertl)

10 Apr

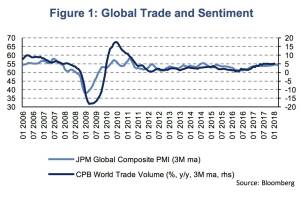

The global economic expansion is in full swing and accompanied by intensifying world trade. The growth outlook for the United States has brightened, also due to the tax reform, and the Euro Area is continuing its recovery. CEE remains Europe’s growth engine with GDP growth of 4.4 % in 2017 (y y, excluding Russia). Monetary policy continues to be accommodative despite of a gradual normalization. In 2017 we have seen the broadest synchronized global upsurge since 2010. The global economy expanded by 3.7 % (y y) and according to the IMF’s latest update of its World Economic Outlook, global growth will be even higher, at 3.9 % (y y), in 2018 and 2019. The prolonged growth momentum is supported by growing international trade. Growth in the volume of global trade has accelerated fr... » Weiterlesen

The US Fed, its Taylor rules, the natural rate of interest and term premia (Martin...

26 Mar

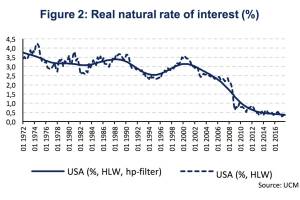

USA: The US central bank Fed hiked the key interest rate last week, as expected. Taylor rules seem overall in line with the rate hiking cycle. The natural rate of interest and term premia shed some light on understanding the Fed projections. The market implied risk-neutral 10Y treasury yield is at 3.2 %. The term premium remains negative. The Federal Open Market Committee (FOMC) of the US central bank Fed decided last week to raise the target range by 25 basis points to a range between 1.5 and 1.75 %. It was the sixth hike of the federal funds rate since the Fed embarked on an interest rate hiking cycle in December 2015 and the move was broadly anticipated. Since the FOMC met in January, the labor market has continued to strengthen and economic activity has been rising at a moderate rate. ... » Weiterlesen

Austria: Productivity growth without wage growth? (Martin Ertl)

19 Mar

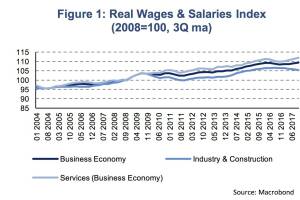

Hourly nominal wages and salaries rose by 2.3 % in 2017. However, wages and salaries have remained flat since 2016, when adjusted for inflation. Hourly labor productivity, on the other hand, has picked up with average growth close to 5 %. Nevertheless, since the financial crisis Austrian real hourly wage growth has been among the fastest in Europe. In 2017, the growth in hourly wages and salaries has accelerated. Austrian businesses have paid 2.4 % higher hourly wages and salaries in 2017, compared to growth of 0.9 % in 2016. Wage growth is, however, less dynamic as it might seem. The fourth quarter of 2017 shows weaker growth than the two preceding quarters. Moreover, looking further back in time, makes clear that nominal wage growth is still below growth rates seen in the 2013-2015 period... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24