The Euro Area labor market in US perspective (Martin Ertl)

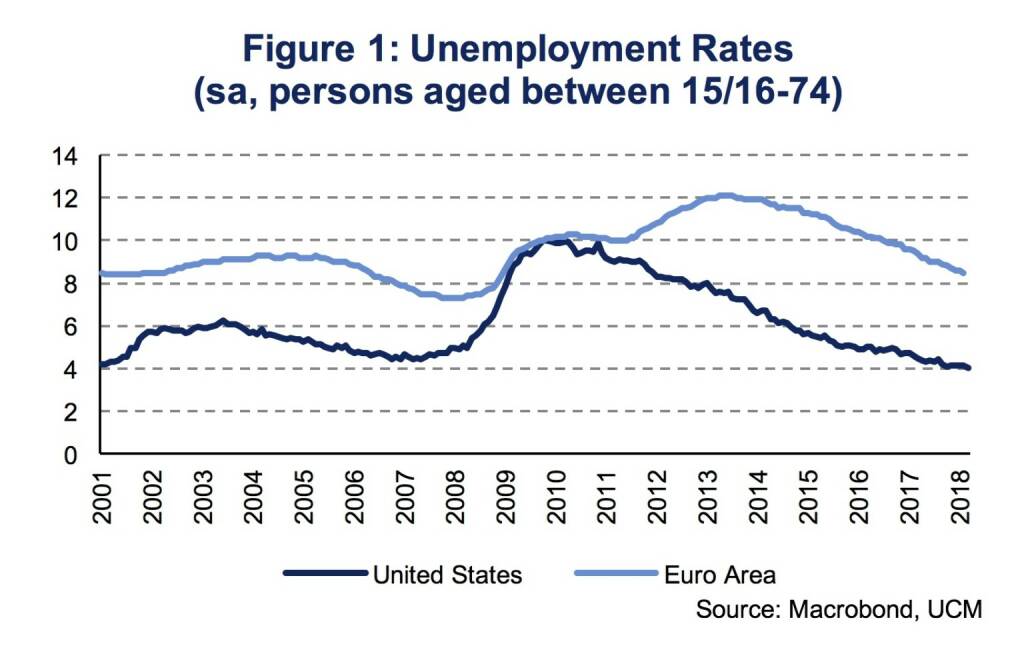

- The unemployment rate in the Euro Area (8.5 %) is twice as high as in the United States (4.1 %).

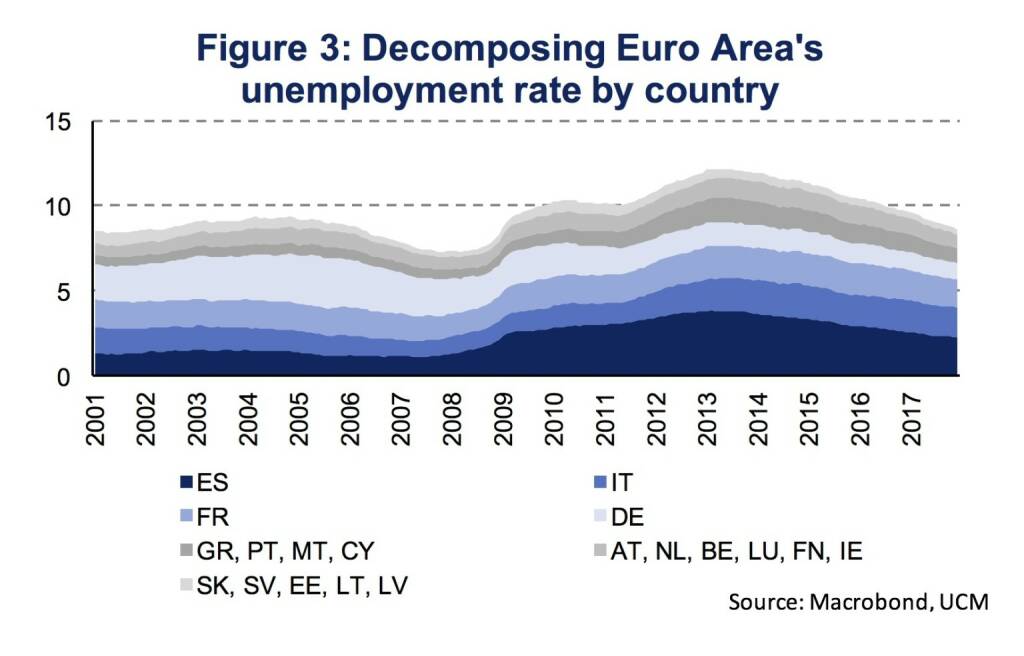

- Labor markets in Spain and Italy continue to contribute substantially to Euro Area aggregate unemployment.

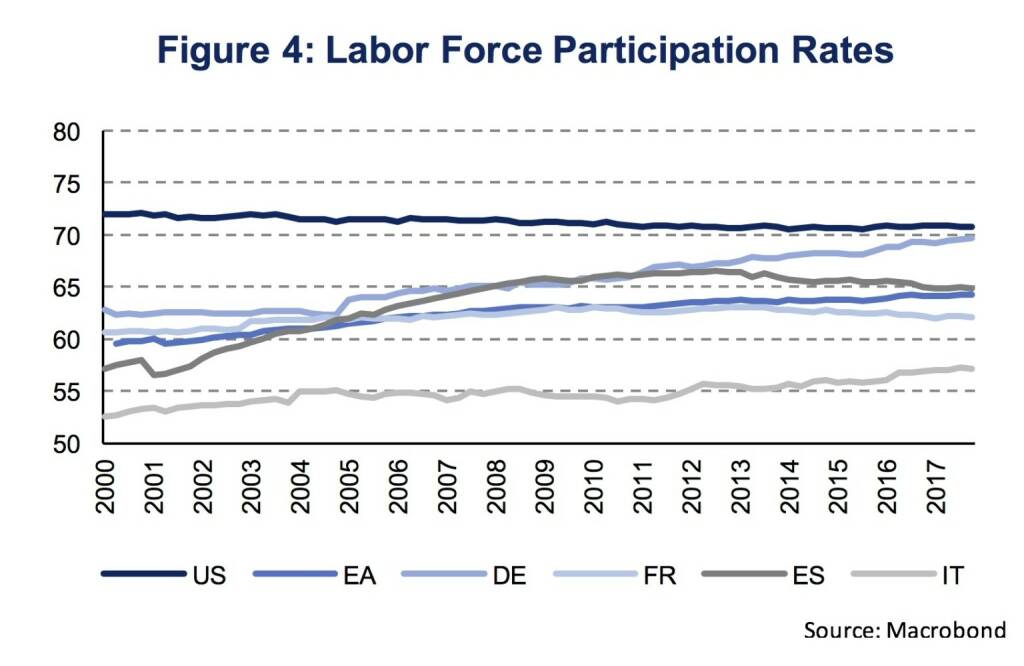

- Euro Area labor force participation rates are rising, while the US participation rate has declined moderately.

- Euro Area old age participation rates are on the rise but still below US levels.

Labor markets have become substantially tighter with unemployment rates below, or close to, their pre-crisis lows. In March, the saisonally adjusted (sa) unemployment rate was at 4.1 % in the United States, covering persons aged between 16 and 74 years. The Euro Area, however, shows a considerably higher unemplyoment rate at 8.5 % (sa, February) for the same age group. Figure 1 shows that the unemployment rate has been higher in the Euro Area already before though also less cyclical during the financial crisis. In 2010 unemployment rates were close to 10 % in both economies. During the Euro Area crisis in 2013, however, the unemployment rate found a new peak at 12 %, when the US labor market has already started to recover.

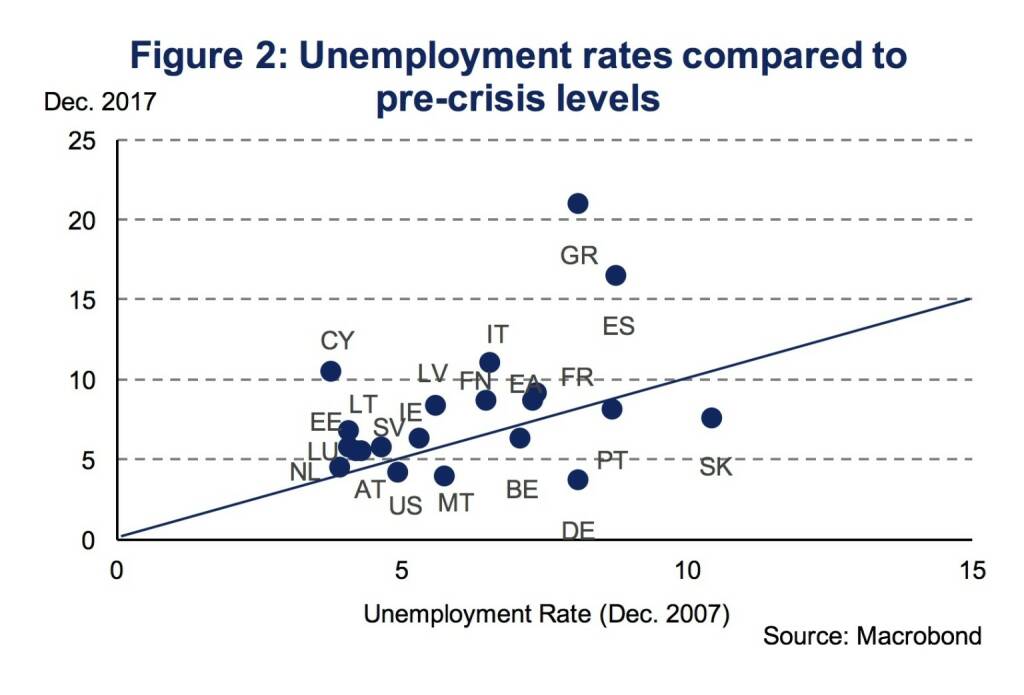

Comparing current individual Euro Area member states’ unemployment rates with their pre-crisis levels, shows that most countries haven’t reached pre-crisis lows yet. Figure 2 displays the unemployment rate in Decmber 2017 at the vertical axis and the unemployment rate in December 2007 at the horizontal axis. The blue line identifies whether countries’ current unemployment rates are above or below their pre-crisis level. Among the large Euro Area economies, only the German labor market is tighter than in 2007. In Spain, the unemployment rate remains elevated at above 16 %, even though, it has already decreased considerably from above 26 % in 2013. Furthermore, Italy’s labor market is still much looser compared to December 2017.

Unless labor markets in Spain and Italy improve, the aggregate Euro Area unemployment rate will remain elevated. Figure 3 disaggregates the Euro Area unemployment rate by groups of member states and shows their contributions. Particularly Spain has a large weight with 3.7 million people unemployed at the end of 2017, which is equal to 2.3 % of Euro Area’s labor force. In 2007, Spain’s contribution to the Euro Area unemployment rate was 1.1 %-age points lower. Italy contributes 0.8 %-age points more than in 2007. It is only due to Germany, where the labor market has imporved considerably, that the Euro Area unemployment is close to its pre-crisis low. Germany’s contribution to the Euro Area unemplyoment rate was 0.9 %-age points in December 2017, compared to 2.2 %-age points in 2007.

Unemployment rates give a good indication of the current state of the labor market. However, they should not be studied in isolation. Important additional information comes from labor force participation rates. Unemployment rates are specified as the share of people who actively seek for employment over the total labor force (employed + unemployed). Hence, once a person stops to actively seek for employment, he or she falls out of the labor force and is not included in the unemployment rate. A lower labor force participation rate might, therefore, indicate hidden unemployment. The labor force participation rate is defined as the labor force as a share of the total population within a certain age group. Figure 4, shows the development of labor force participation rates for the age group 15-74 in the United States, the Euro Area, Germany, France, Spain and Italy [1]. It is clear that a lower unemployment rate in the US does not stem from a large share of hidden unemployment, at least compared to the Euro Area. The United States has the highest labor force participation rate throughout the whole period. It has never fallen below 70 %. In the Euro Area, the labor force participation rate has increased continuously reaching 64.2 % at the end of 2017. Among the selected countries, Italy has the lowest participation rate at 57.1 %. Germany has almost caught up with the United States.

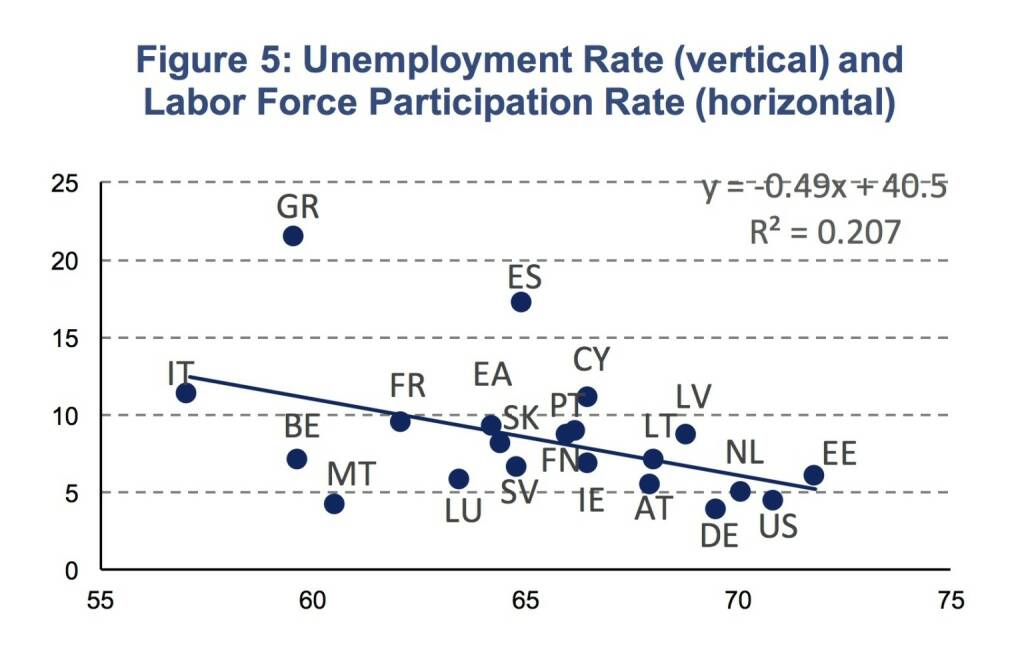

Nevertheless, the rising labor force participation rate in the Euro Area might imply the unemployment rate to decrease more slowly compared to the US, where the participation rate has declined. At a cross-sectoral perspective, however, structural differences seem to dominate the relationship. Figure 5 even suggests a negative relationship between unemployment rates (vertical axis) and labor force participation rates (horizontal axis). Countries with higher labor force participation rates have lower unemployment rates.

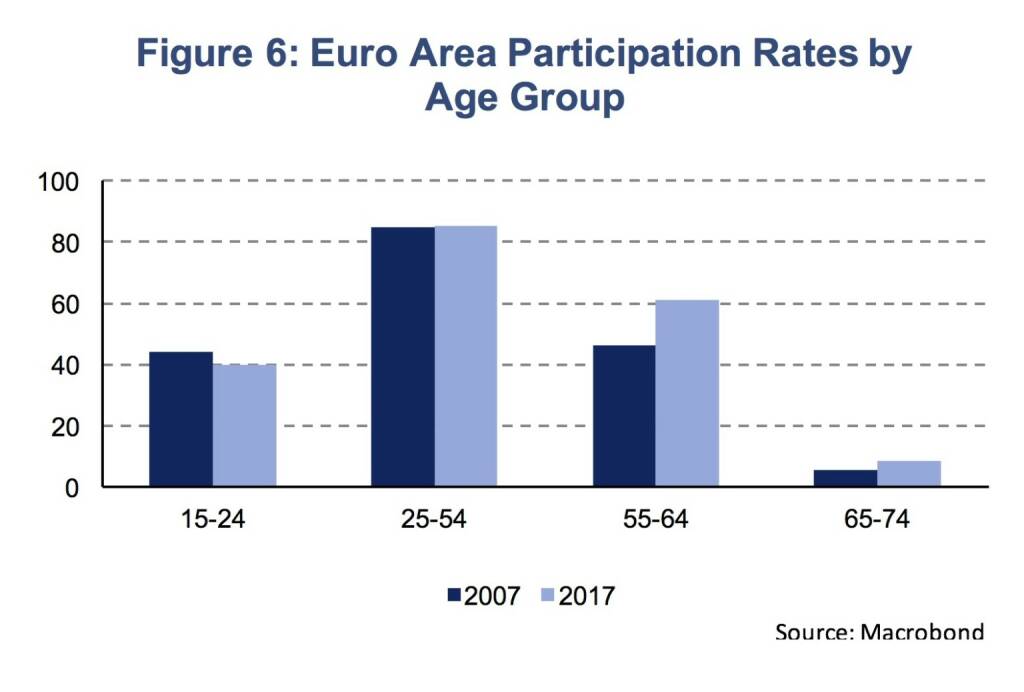

The rise in participation rates among the major Euro Area countries has mainly been driven by rising participation rates of older age groups, which might be related to the phasing-out of early retirement schemes. However, participation rates of older age groups continue to be lower (Figure 6). Given the prevailing demographic trends, a rising aggreagte participation rate can only be achieved if old age participation rates continue to rise, as the share of older age groups in the total working age population is increasing. Compared to the United States, where 64 % of the age group 55-64 are part of the labor force and 27 % of the age group 65-74, participation rates of older age groups remain low in the Euro Area.

[1] The most commonly looked at labor force participation rate for the United States covers the age group 16+, which lies below the participation rate for the age group 15-74. To make participation rates comparable across economies, all variables have been converted to the age group 15-74.

Latest Blogs

» BSN Spitout Wiener Börse: Erste Group über...

» Österreich-Depots: Weekend-Bilanz (Depot K...

» Börsegeschichte 19.4.: Rosenbauer (Börse G...

» Aktienkäufe bei Porr und UBM, News von VIG...

» Nachlese: Warum CA Immo, Immofinanz und RB...

» Wiener Börse Party #633: Heute April Verfa...

» Wiener Börse zu Mittag schwächer: Frequent...

» Börsenradio Live-Blick 19/4: DAX eröffnet ...

» SportWoche Party 2024 in the Making, 19. A...

» Börse-Inputs auf Spotify zu u.a. Sartorius...

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...