Challenges for Monetary Policy: News from the Jackson Hole Economic Symposium (Mar...

05 Sep

Trade policy uncertainty is the Fed’s main concern and cannot be easily incorporated into its monetary policy framework. Further clarification of central bank communication can shield from the perception that monetary policy decisions might be politically motivated, Orphanides suggests. Jordà and Taylor argue that central banks cannot escape adopting a global perspective in setting monetary policy. An international perspective is also emphasized by Kalemli-Özcan who focuses on international spillovers of US monetary policy stressing the importance of changes in risk perception. Krishanumurthy and Lustig emphasize the continued importance of the US dollar exchange rate in the global credit cycle, driven by the convenience yield of US Treasuries. The Fed is fighting sympto... » Weiterlesen

Central Europe: Resilience weakens & Russia: Growth variability (Martin Ertl)

19 Aug

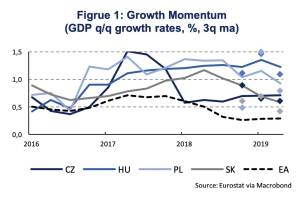

Central Europe: Resilience weakens Economic growth continues at a slightly more moderate pace in Central Europe. Recent industrial production figures might herald weakening resilience to the slowing Euro Area’s business cycle. The dovish turn by the ECB has stopped monetary policy normalization in Central Europe. Economic growth momentum in Central Europe (CE) remains well above the Euro Area (EA), yet uncertainty about CE’s resilience to the EA’s business cycle slowdown rises. Last week’s release of gross domestic product (GDP) for the second quarter (Q2 19) showed growth at 1.1 % in Hungary, 0.8 % in Poland, 0.6 % in the Czech Republic and 0.4 % in Slovakia (quarter-on-quarter, seasonally adjusted). The Euro Area economy expanded at 0.2 % (q q, sa) during the same... » Weiterlesen

Does the US economy need a mid-cycle adjustment? (Martin Ertl)

06 Aug

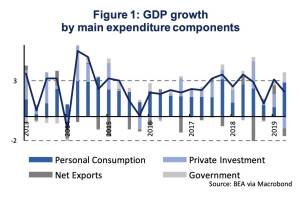

The US business cycle remains healthy, despite being the longest in history. Personal consumption drives the expansion, supported by a strong labor market. Fed lowered interest rate to 2.25 %, in light of trade related uncertainty and downside risks to the outlook. There is no clear-cut monetary policy case for the Fed’s mid-cycle adjustment, which remains ambiguous also within the FOMC. The US economy continues its longest expansion since the end of WW II, exceeding the Great Moderation (03 1991-02 2001) by two months. The Bureau of Economic Analysis (BEA) has recently released its preliminary estimate of gross domestic product (GDP) for the second quarter of 2019 (Q2 19) at 2.1 % (seasonally adjusted at annual rates). With GDP growth at 3.1 % in Q1 2019, the US economy has expanded ... » Weiterlesen

ECB’s departure from monetary policy normalization (Martin Ertl)

31 Jul

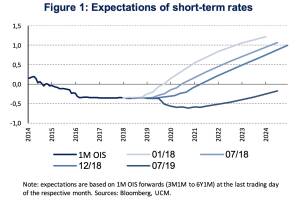

ECB prepares new steps to provide additional monetary stimulus (lower deposit rate, QE). Medium-term inflation outlook is no longer in line with ECB’s inflation aim and deterioration of inflation expectations has become more evident. Moderate EA growth endures and risks remain tilted to the downside as uncertainties prolong. The European Central Bank (ECB) has stopped its monetary policy normalization and went into reverse before interest rates have even been raised once. Last week’s meeting has brought substantial changes to the central bank’s communication, strongly indicating additional easing measures to be introduced in September, the ECB’s next Governing Council meeting. A lowering of the deposit facility rate, currently at -0.4 %, alongside changes to the forward ... » Weiterlesen

Quarterly outlook: Prolonged uncertainty seems enough to justify monetary policy e...

16 Jul

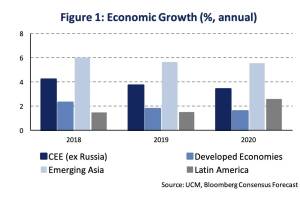

Prolonged uncertainty is enough to justify monetary policy easing The Euro Area outlook is split between mounting uncertainty about business and investors’ sentiment – implying a continuing slowdown – and a profound labor market picture. CEE outstrips growth in advanced economies substantially. Eastern European EU member states remain the growth leaders among EU countries. Low inflation and interest rates as well as multi-year lows in unemployment underpin a favorable business environment. Monetary policy easing is back on the table Major developments Prolonged uncertainty seems to justify monetary policy easing. Financial investors express their fears about a nasty response of the global economy to the trade war with lower and lower yields and, following their heavy fro... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24