Economic resilience endures in CEE (Martin Ertl)

20 May

While the global and Euro Area business cycles slow, the economic expansion remains surprisingly strong in CEE. The region shows a high degree of economic integration with the Euro Area, yet strong domestic demand more than compensates for the weakening external conditions. Improvements in labor markets have been broad based and rising wages support household consumption as, so far, inflation remains rather muted. The region’s strong growth performance drives economic convergence. For it to persist, digital capacities will be essential to close the gap to an evolving technological frontier. Central and Eastern Europe (CEE) maintains a solid expansion albeit a weakening external macroeconomic environment. The expansion of the global economy has slowed to 3.6 % in 2018 after 3.8 % in 2... » Weiterlesen

Österreichs Wirtschaft setzt die Expansion mit einem geringeren Tempo fort. (Mart...

07 May

Auf eine Abkühlung des Wirtschaftswachstums folgt eine Stabilisierung. Die Industrie und insbesondere der Bausektor expandieren seit Beginn des Jahres. Die positive Entwicklung am Arbeitsmarkt verflacht sich, aber Jobs am Bau boomten zu Jahresbeginn. Im ersten Quartal 2019 stieg das reale Bruttoinlandsprodukt (BIP) gemäß saison- und werktags-bereinigter Eurostat-Berechnung um 0,3 % gegenüber dem Vorquartal. Die vom Wirtschaftsforschungsinstitut (WIFO) veröffentlichte Trend-Konjun-Kturkomponente, eine geglättete Berechnung, zeigte ebenfalls einen Zuwachs von 0,3 % (Q Q) an. Der von uns berechnete, wöchentliche Echtzeit-BIP Indikator (Nowcast) zeigte zuletzt für die Eurostat-Berechnung keine Veränderung des Q1 BIP und für die WIFO-Berechnung ei... » Weiterlesen

The heterogeneous development of CEE labor markets (Martin Ertl)

30 Apr

CEE labor markets have improved considerably recently, yet substantial variety persists. Labor markets in Central Europe have reached full employment while those at the Western Balkans are characterized by high structural unemployment, particularly for the youth. Gender gaps with respect to employment in the formal sector are substantial across the region. The trend of ageing populations is currently amplified by emigration, which might soften in some countries if wage growth can be sustained. The Central and Eastern European (CEE) region has managed to withstand the global economic slowdown of 2018. In many CEE economies economic growth has even gained further momentum. The resilience of the region can be explained by strong domestic demand driving GDP growth. In particular household consum... » Weiterlesen

Quarterly Macroeconomic Outlook: Imponderability (Martin Ertl)

15 Apr

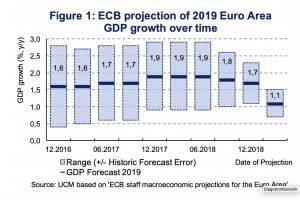

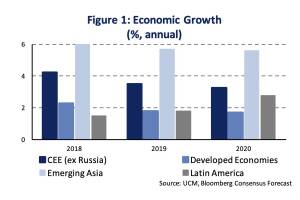

Eurozone: Down to potential growth or lower Central and Eastern Europe: Resilient though not immune Financial Markets: Monetary policy normalization is coming to an end. The global economy is expected to keep expanding in 2019 20 although at a slower pace than previously. Global output is forecast to grow by 3.3-3.5 % and 3.6 % in 2019 and 2020 after 3.6-3.7 % in 2018 (OECD, IMF). Hence, growth expectations neither imply a dramatic slowdown nor the onset of a global recession. Both developed and emerging economies exhibit a business cycle slowdown as well as all major regions around the globe; except for Latin America (Figure 1). However, a lot of imponderability surrounds the current economic outlook including the evolution of the Brexit and the trade war. We do not know how and even if the U... » Weiterlesen

Gesundheitsausgaben im demografischen Licht (Martin Ertl)

08 Apr

Die demografische Alterung führt zu einem langfristigen Anstieg der österreichischen Gesundheitskosten. Der isolierte Alterungseffekt erhöht die Gesundheitskosten (in % des BIP) bis 2060 um 3 %-Punkte auf 13,4 %. Sinken die Gesundheitsausgaben proportional zur steigenden Lebenserwartung fällt der Anstieg geringer aus (+2 %-Punkte). Unsicherheit bezüglich der Entwicklung der Nachfrage nach Gesundheitsgütern könnte die Ausgaben jedoch weiter erhöhen. Bislang werden 74 % der laufenden Gesundheitsausgaben aus öffentlicher Hand finanziert. 5 % entfallen auf private Krankenversicherer. 19 % werden out-of-pocket durch Selbstzahlungen der Haushalte beglichen. Bleiben die öffentlichen Budgetmittel für den Gesundheitssektor, relativ zu anderen Budgetber... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24