The heterogeneous development of CEE labor markets (Martin Ertl)

- CEE labor markets have improved considerably recently, yet substantial variety persists.

- Labor markets in Central Europe have reached full employment while those at the Western Balkans are characterized by high structural unemployment, particularly for the youth.

- Gender gaps with respect to employment in the formal sector are substantial across the region.

- The trend of ageing populations is currently amplified by emigration, which might soften in some countries if wage growth can be sustained.

The Central and Eastern European (CEE) region has managed to withstand the global economic slowdown of 2018. In many CEE economies economic growth has even gained further momentum. The resilience of the region can be explained by strong domestic demand driving GDP growth. In particular household consumption has developed dynamically during past quarters, having been supported by continued job creation, declining unemployment rates and accelerating wage growth.

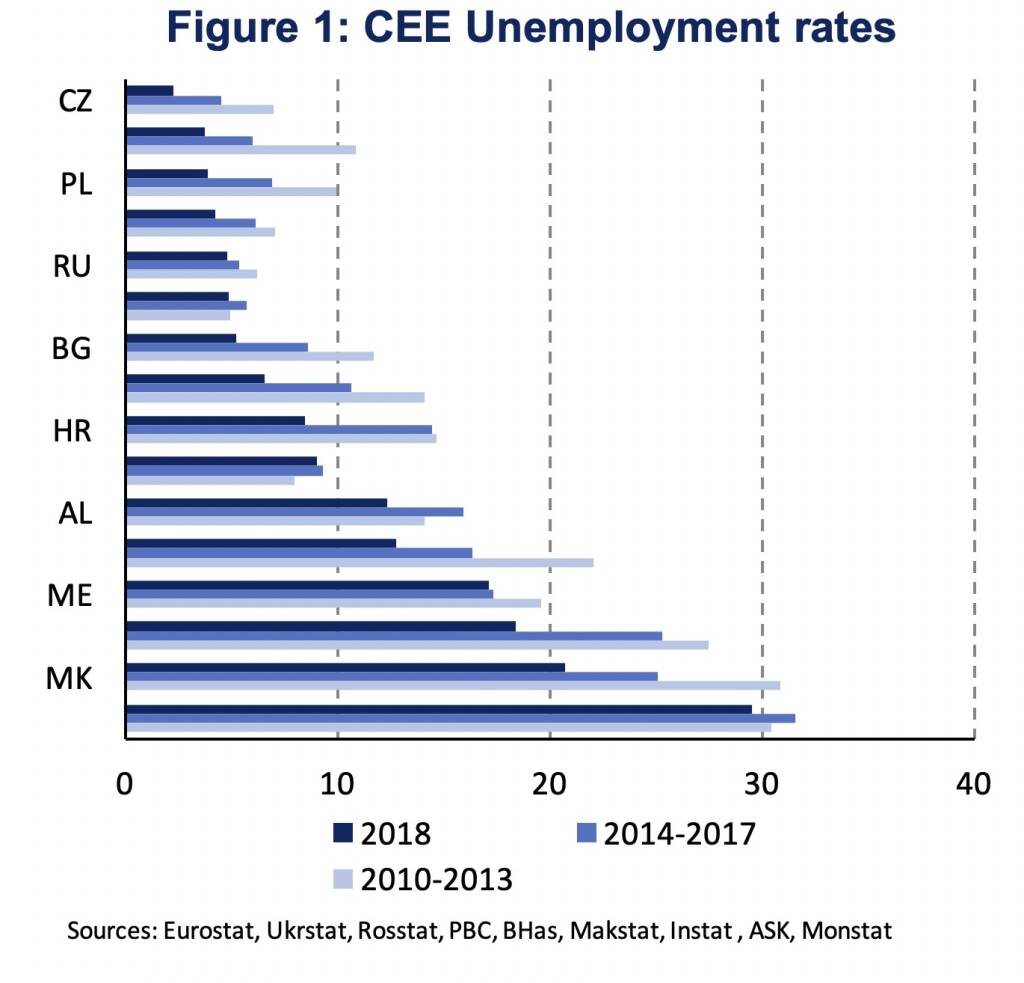

The improvements of CEE labor markets can best be observed by looking at unemployment rates (Figure 1). In 2018, unemployment rates have been substantially lower than in previous periods, with the exception of Ukraine where the unemployment rate increased until 2017. Yet, labor markets continue to be heterogeneous. Unemployment rates range from 2.2 % in the Czech Republic to almost 29.5 % in Kosovo. They tend to be lower in European Union member states and higher at the Western Balkan.

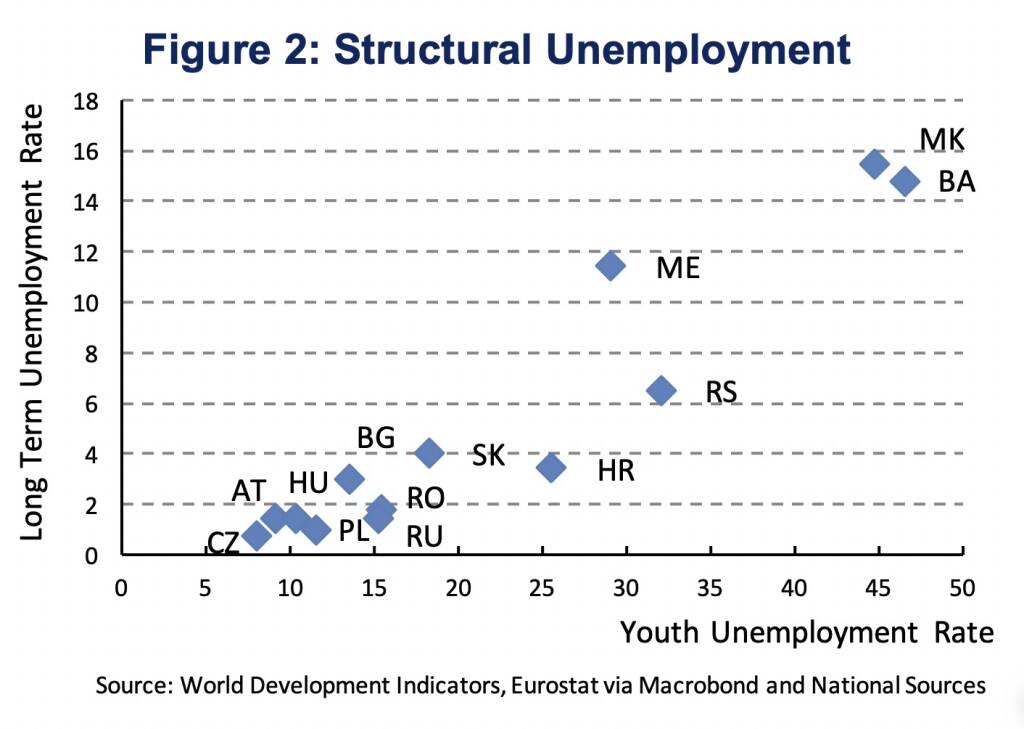

Differences in unemployment rates coincide with structural differences among labor markets. Figure 2 plots youth unemployment rates (age 15 to 24) on the horizontal axis and long-term unemployment rates (unemployed for longer than one year) at the vertical axis, two indicators of structural unemployment. It can be seen that the labor markets of the Czech Republic, Hungary and Poland are more similar to the Austrian labor market with comparatively low levels of youth unemployment and long-term unemployment. Within the same geographical region, Slovakia’s labor market is structurally weaker. In 2018, the long-term unemployment rate was 4 % which corresponds to 62 % of total unemployed, and youth unemployment was at 18 %, the highest rate in Central Europe (CE). High rates of youth unemployment are more common in South Eastern Europe (SEE) with Bulgaria (13.5 %) being the exception. The highest youth unemployment rates can be found in North Macedonia (45 %) and Bosnia & Herzegovina (47 %). Additionally, more than half of those people being unemployed have been unemployed for longer than one year. Long-term unemployment rates are particularly elevated in Montenegro (11 %), Bosnia & Herzegovina (15 %) and North Macedonia (16 %). Hence, labor markets at the Western Balkan perform poorly with respect to bringing people back into employment.

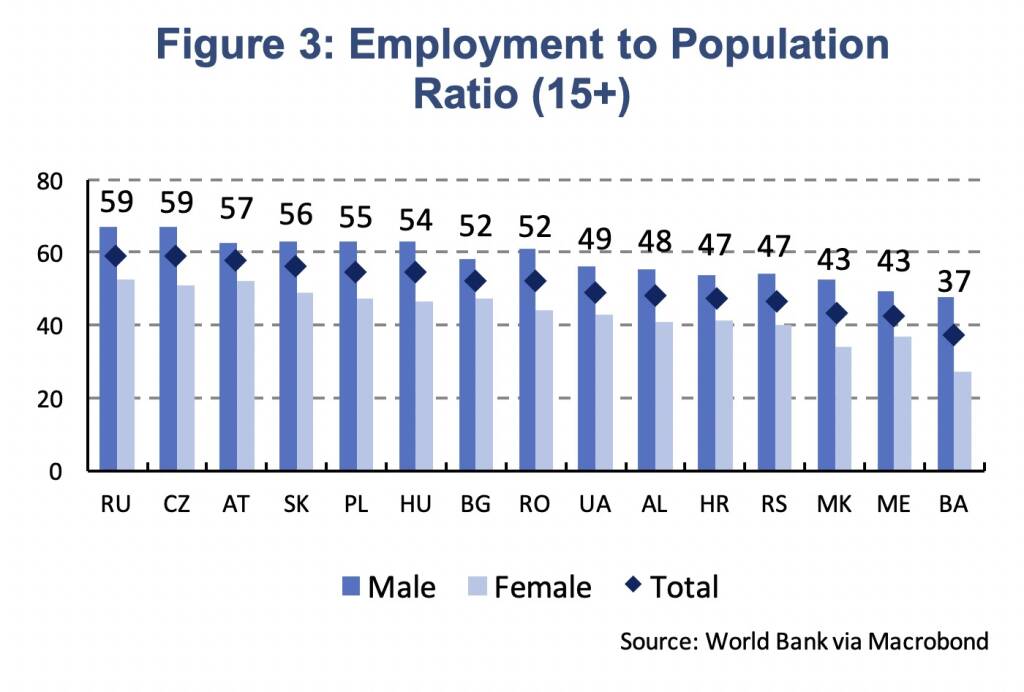

In addition to unemployment rates, a key indicator of labor markets is the employment to population ratio. Unemployment rates do only reflect those who are looking for a job, thus, actively participate in the labor market and remain part of the labor force. If chances of finding employment are low, however, some people might give up to actively seek for employment and fall out of the labor force. A more holistic indicator is the employment to population ratio above the age of 15. Figure 3, which shows employment to population ratios by gender in 2018, reflect a similar regional picture. At the Western Balkan employment rates are low, particularly so for women. In Bosnia & Herzegovina, for instance only 27 % of women, older than 15, are employed in the formal sector compared to 48 % of men. The highest female employment rates can be found in Russia and Austria both at 52 %. Men have the highest employment rates in the Czech Republic and Russia, both at 67 %. Gender specific differences are substantial across the whole region. Besides Bosnia & Herzegovina (20 %) and North Macedonia (18 %) also Romania (17 %) and the Czech Republic, Hungary and Poland (16 %) are characterized by large %-age point differences between male and female employment rates. It should be noted that employment rates at the age of 15+ also reflect age-specific differences.

Raising employment rates, particularly at the Western Balkan, remains a key challenge, which becomes even more relevant when looking at population projections. Europe is ageing and populations are declining. By 2030 the work force (15-64) in the average CEE country will be 8 % lower than in 2018, 23 % lower by 2050 and 44 % lower by 2100 (Source: United Nations). Until 2050 the decline is most significant in Bulgaria (-32 %), Poland (-30 %), Croatia (-28 %), Ukraine (-27 %), Romania (-27 %) and Bosnia & Herzegovina (-26 %), while being more modest in Austria (-14 %), Montenegro (-16 %), Russia (-17 %) and the Czech Republic (-19 %).

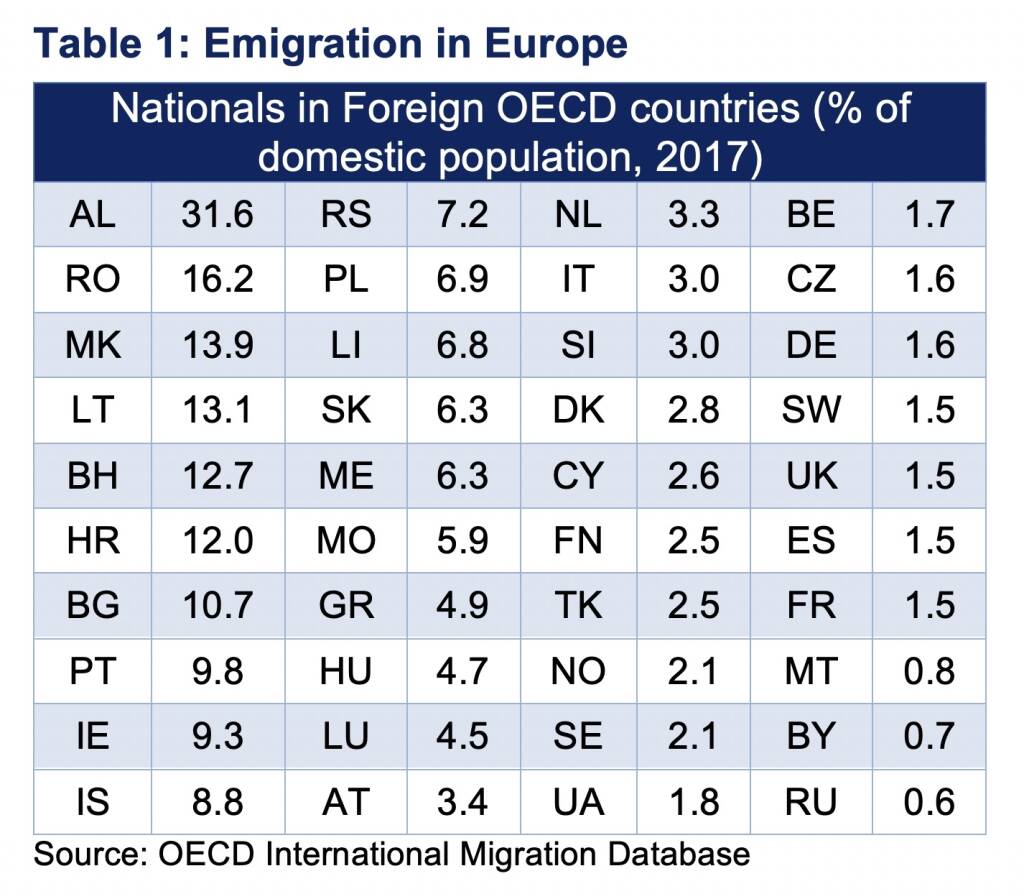

Migration can either improve, through immigration, or worsen, through emigration, the demographic trend. Countries with structurally weak labor markets tend to be countries of emigration rather than immigration. Ordered by the number of nationals in foreign OECD countries (as a share of the domestic population in 2017), table 1 indicates that some CEE countries are subject to substantial emigration. Albania tops the list. The stock of Albanian citizens in OECD countries add up to almost 32 % of the domestic population. Romania comes second (16 %) and this emigration indicator is above 10 % also in North Macedonia, Lithuania, Bosnia & Herzegovina, Croatia and Bulgaria.

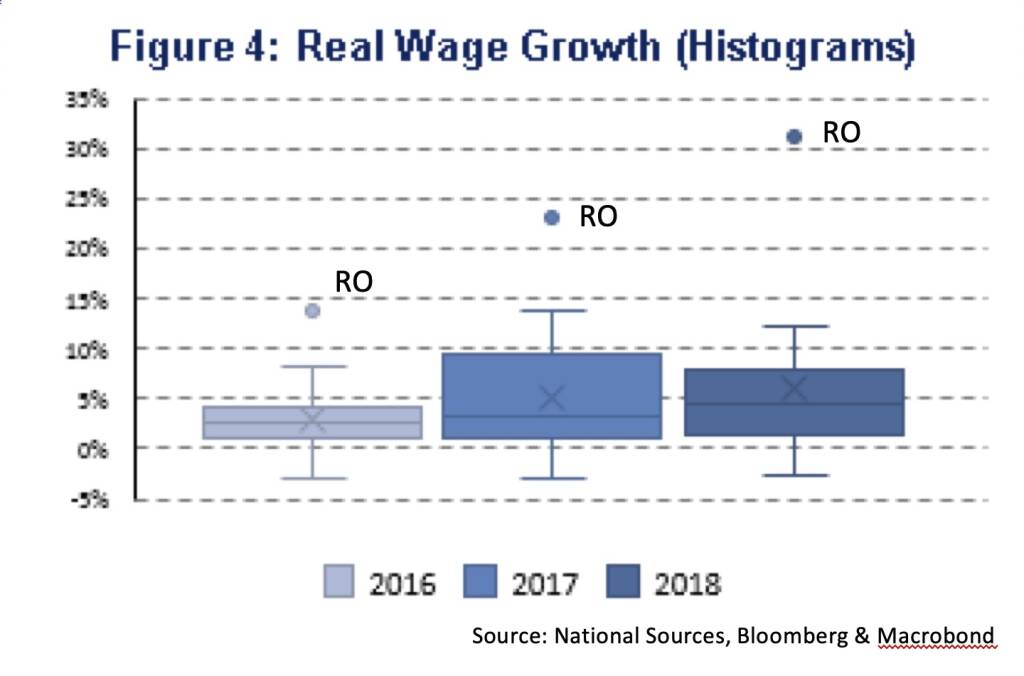

Emigration has many determinants one of which being the gap in real wages with respect to potential countries of destination. Alongside tightening labor markets in CEE, even though from varying levels, wages have increased more rapidly than, for instance, in the Euro Area. In 2018 real wages in CEE increased by 6.2 % (Euro Area: 0.5 %) after 5.1 % in 2017 and 3.1 % in 2016 (Figure 4). In Romania, gross wages, after accounting for inflation, increased by 32 % (2018), in Ukraine it was 12 % and 8 % in Hungary and Russia. Wage growth in Central Europe (CZ, HU, PL, SK) was quite homogenous with 6 % in the Czech Republic and Poland and 4 % in Slovakia. In South Eastern Europe (SEE) wage growth is weaker, averaging 2 %. Bulgaria has the highest growth rate in SEE (5 %) while real wages declined by 3 % in Montenegro. Over the medium term, wage growth needs to be accompanied by sufficient gains in productivity to be sustainable. If that’s the case convergence in real wages might decrease the incentives to emigrate and soften the demographic trend.

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» SportWoche Podcast #124: Liam Ferguson, de...

» Österreich-Depots: Ultimo-Bilanz mit Addik...

» Börsegeschichte 30.8.: Warren Buffett (Bör...

» PIR-News: Zahlen von Warimpex, Strabag, Ne...

» Nachlese: Karin Bauer, LLB Aktien Österrei...

» Wiener Börse Party #727: Nächster Rekord-T...

» Börsenradio Live-Blick 30/8: DAX krönt Erh...

» Börse-Inputs auf Spotify zu u.a. ATX TR, L...

» ATX-Trends: Immofinanz, UBM, CA Immo, S Im...

» Börsepeople im Podcast S14/17: Karin Bauer

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...