CEE Central Bank Update (Martin Ertl)

02 Apr

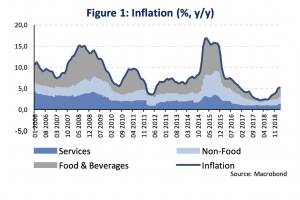

Russia: more clarity on growth, inflation & yields Hungary: tighter monetary policy with a cautious note *** Russia: more clarity on growth, inflation & yields The Russian central bank sees inflation lower than previously expected and anticipates the possibility to cut the key interest rate in 2019. The economy is set to grow around its potential growth rate. Public investment will increasingly contribute to growth. On 22 nd March, the Central Bank of Russia (CBR) decided to keep the key interest rate unchanged at 7.75 %. In February, the consumer price inflation (Figure 1) was 5.2 % (after 5 % in January). An increase in inflation was expected due to the VAT rate hike, however, it was lower so far than expected by the CBR. Households’ and businesses’ inflation... » Weiterlesen

US Fed confirms wait-and-see approach (Martin Ertl)

25 Mar

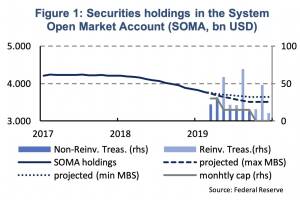

US Fed refrains from raising interest rates in 2019 due to slowing business cycle momentum. Balance sheet normalization ends in September and the pace of normalization is slowing from May onwards. Last week the Federal Open Market Committee (FOMC) of the US central bank (Fed) has confirmed a more cautious approach towards monetary policy in 2019. New economic projections of FOMC members, which are released at a quarterly frequency, do not indicate any further changes in the federal funds rate in 2019. After four interest rate increases in 2018, the upper bound of the federal funds target rate stands at 2.5 %. With signs of the US economic expansion losing steam and the level of the federal funds rate within estimates of its longer-run neutral level, the Fed sees no need to further tighten monetary... » Weiterlesen

U.S. central bank Fed adjusts to data-dependence (Martin Ertl)

19 Mar

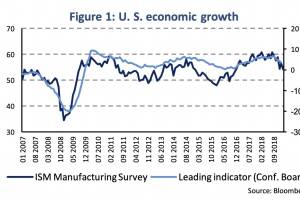

Mixed data signals magnify uncertainty about the state of the U. S. business cycle. On Wednesday, the Fed is unlikely to change its growth and inflation outlook significantly, however, it will be interesting seeing how its expectations about policy changes evolve. After a solid economic expansion until the end of last year (real gross domestic product increased by 2.4 % in Q4), the expectations for the current quarter growth have gradually diminished. Real-time GDP estimates from the Atlanta and New York Fed signal growth of meagre 0.4 % and 1.4 % (q q, annualized rate) for Q1 2019. Other coincidence indicators (for example, the leading indicator of the Conference Board) or forward-looking surveys, like the ISM manufacturing survey, confirm slowing economic momentum (Figure 1). In January, growt... » Weiterlesen

Romanian economy at a crossroads (Martin Ertl)

04 Mar

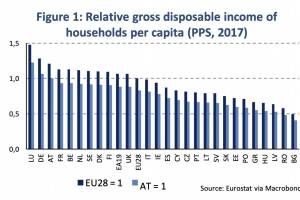

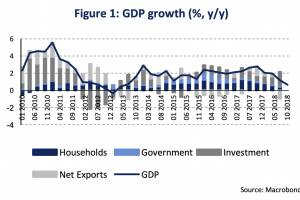

Economic growth slowed to 4.1 % in 2018 and is now more consistent with Romania’s longer-term growth potential. Increasing reliance on household consumption makes Romania’s growth structure rather unbalanced. Household consumption is fueled by a tight labor market and substantial gains in real wages. Yet, productivity growth cannot keep up with rising labor costs deteriorating Romania’s international cost competitiveness. The current account deficit has widened lately and the stock of foreign currency reserves, though remaining stable above 30 bn Euro, is declining relative to imports and short-term external debt. Romania is among the poorest countries within the European Union. The purchasing power of Romanian households is only 48 % of the Austrian level and 58 % of the E... » Weiterlesen

Germany’s growth outlook and CEE’s resilience (Martin Ertl)

20 Feb

Germany’s growth outlook Economic growth slowed significantly in H2 2018. A foregone opportunity: We discuss Germany’s lack of public investment. Germany’s real gross domestic product (GDP) stagnated during the last quarter of 2018 after it had declined by 0.2 % (q q) in the previous quarter. In seasonally-adjusted terms, the year-on-year growth rate decreased to 0.6 % (after 1.2 % in Q3 and 2.0 % during H1 2018). Annual GDP growth slowed from 2.5 % in 2017 to 1.5 % last year. In non-seasonally adjusted terms, the annual growth rate of GDP was 1.4 % and, hence, slightly lower than reported in January (1.5 %) by the German statistics office (Destatis [1]). There were no expenditure details yet released by Destatis, however, it was noted in the press release that domestic deman... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24