Russia’s growth miracle & Czech monetary policy normalization loses speed (Martin ...

12 Feb

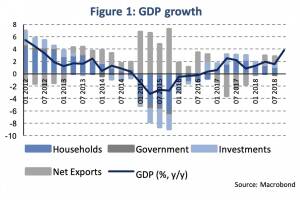

Russia’s growth miracle Russia’s statistics office released a large Q4 GDP growth surprise which lacks additional evidence so far. Central Bank of Russia assessing if further key rate hikes are needed to bring back inflation to the target. According to the release from the Russian State Statistics Service (Rosstat), the real gross domestic product increased by 2.3 % in the total of 2018 posting a big growth surprise against previous expectations around 1.7 % GDP growth and growth of 1.6 % in 2017. The rise was not predictable and does not match the numbers of the quarterly GDP releases for Q1-Q3. Rosstat did not yet revise quarterly GDP and the annual growth rate implies that Q4 GDP increased by 6.6 % (q q, non-seasonally adjusted) and 3.8 % (y y) (Figure 1). In Q3 y y-growth was ... » Weiterlesen

Fed patiently awaits greater clarity, Euro Area: No growth rebound occurred in Q4...

04 Feb

Fed patiently awaits greater clarity Fed shifts to wait-and-see approach regarding future policy changes. Case for raising rates has weakened somewhat as inflation pressure muted and downside risks to an overall solid economic outlook intensified. January labor market report shows a strong job picture with the unemployment rate near historic lows and strong wage gains. Balance sheet normalization might be reached sooner rather than later, though, no comments were made about the equilibrium size. Last week the Federal Open Market Committee (FOMC) has made substantial changes to its monetary policy statement. In a nutshell, the FOMC has signaled to shift to a wait-and-see approach regarding future changes in its monetary policy rate. Whether the Fed will further increase the federal funds r... » Weiterlesen

The dilemma of the ECB continues (Martin Ertl)

29 Jan

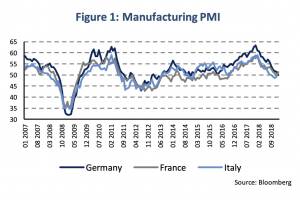

Leading survey-based indicators send warning signal for Euro Area business cycle. ECB leaves monetary policy stance unchanged. Risk for growth are tilted to the downside. Additional long-term refinancing operations (LTRO, TLTRO) would be a signal though imperfect tools to address a growth slowdown. In January, the composite purchase manager index (PMI), a major survey-based business cycle indicator, dropped to a new low (50.7 after 51.1). The index remained above the expansion threshold (50) and keeps indicating weak growth in economic activities in the Euro Area. The manufacturing and services sector components fell to 50.5 (after 51.4) respectively 50.8 (after 51.2). The German manufacturing PMI index tipped below the expansion threshold (49.9) for the first time since 2014 (Figure 1). In F... » Weiterlesen

Decoding Euro Area’s inflation: on oil prices, labor costs & profit shares (Martin...

22 Jan

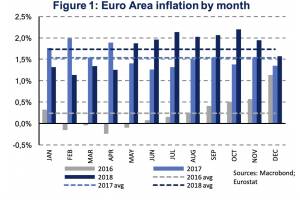

Final release shows Euro Area inflation at 1.7 % in 2018. Core inflation remained subdued at 1.0 % while rising energy prices drove inflation higher. Recent developments in oil prices as well as oil futures indicate energy price inflation to decline in 2019 and 2020. Wage growth has picked up gradually since 2017 being well-balanced among Euro Area economies and sectors. Profit shares are declining, thus, confidence in underlying inflationary pressures to emerge is rising. Last week on Thursday the European Statistical Office (Eurostat) published the final release of Euro Area inflation for the year 2018. Consumer prices in the Euro Area were 1.7 % higher than in 2017. The year 2018 started with an inflation rate at 1.3 % in January, peaked at 2.2 % in October and closed at 1.6 % in Decemb... » Weiterlesen

Quarterly Macroeconomic Outlook: Risks shift to the downside yet fundamentals rema...

14 Jan

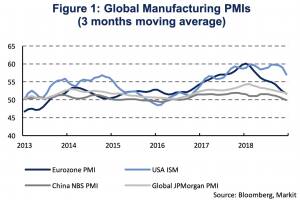

The global economic outlook remains constructive, though, with deteriorating expectations. Short-term cyclical risks are titled to the downside in the Euro Area, yet, the fundamental factors underpinning the economic expansion remain in place. Following a strong economic expansion in Austria, a pleasant slowdown is underway. Solid labor market conditions keep supporting consumer sentiment and private consumption. In CEE there are no signs of an abrupt growth slowdown. Economic growth has remained surprisingly resilient. Nevertheless, growth will slow down gradually over the medium-term. The global expansion has passed its peak. The global economy is projected to grow at 3.5 % in 2019 and 2020 after 3.7 % in 2018 (OECD Economic Outlook No 104 – November 2018). Projections of global GD... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24