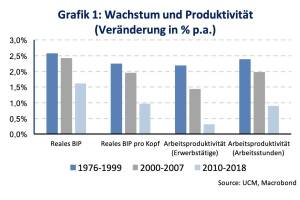

Die neue Normalität des Wachstums in Österreich (Martin Ertl)

11 Jul

Wie die Früchte der Digitalisierung und Automatisierung noch nicht geerntet wurden und der Rückzug der Babyboomer den Wohlstand bestimmt. Wenn Mario Draghi vor den Abwärtsrisiken für den Wirtschaftsausblick warnt – wie jüngst beim Forum der Notenbanker in Sintra, dann spricht er über die Konjunktur. Wenn er davon spricht, dass man sich nicht mit einer zu niedrigen Inflation zufriedengeben möchte und eine weitere Lockerung der Geldpolitik in Aussicht stellt, dann soll der Effekt über die Konjunktur kommen. Firmen bekommen durch niedrigere Zinsen einen Anreiz zu Investitionen, Haushalte profitieren von mehr Jobs und steigenden Löhnen, die Zinslast der Staaten sinkt und schafft fiskalischen Spielraum, steigende Aktienkurse heben die Vermögen, kurz: es ... » Weiterlesen

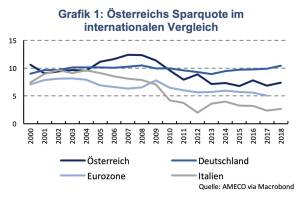

Vorsorge in Zeiten von Negativzinsen (Martin Ertl)

24 Jun

Rund 40 % des Finanzvermögens österreichischer Haushalte liegt am Sparbuch. Alternative Anlageformen sind vergleichsweise unterrepräsentiert, nur 5 % der Haushalte investieren in Aktien. Finanzwissen beeinflusst das Anlageverhalten und auch in Österreich zeigen sich deutliche Unterschiede nach Ausbildungsgrad. Bei negativen Realzinsen ist das Sparbuch als Altersvorsorge ungeeignet, denn es gewährt keinen langfristigen Werterhalt des Finanzvermögens. Österreichs Haushalte gelten als durchaus sparfreudig. Im Jahr 2018 wurden 7,4 % des verfügbaren Einkommens privater Haushalte nicht für den Konsum verwendet, sondern stattdessen gespart. Im internationalen Vergleich liegt Österreich damit im oberen Mittelfeld, über der Eurozone aber hinter Deutsch... » Weiterlesen

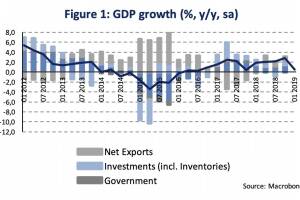

Russia: Low growth and lower interest rates (Martin Ertl)

21 Jun

After a growth bounce in Q4 2018, GDP growth returned to more moderate level in 2019. Weak growth and declining inflation pave way for the central bank to accommodate monetary policy. Economic growth slowed during the first quarter after a temporary spike in Q4 2018. In Q1 2019 real gross domestic product (GDP) increased moderately by 0.5 % compared to Q1 2018 and following 2.7 % GDP growth during the end-quarter 2018 (Figure 1). In seasonally adjusted terms, we calculate a drop by 0.4 % of GDP compared to the previous quarter. There were no expenditure details released yet by the Russian statistics office (Rosstat). By year-end 2018, national accounts data showed a surprising pick-up compared to previous quarters [1]. A reason which we detected for volatile growth data is construction activity... » Weiterlesen

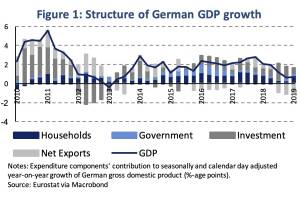

German business cycle strengthens despite weak sentiment (Martin Ertl)

28 May

Q1 GDP growth at 0.4 % (q q) was driven by household consumption and investment activity. Strong service sector performance compensated for a continued decline in manufacturing. Sentiment indicators support the divergence between manufacturing and service sectors despite indications of weaker service sentiment. The German business cycle has still some steam left. After stagnating during the second half of 2018, growth in gross domestic product (GDP) bounced back to 0.4 % in Q1 2019 (quarter-on-quarter, seasonally and calendar day adjusted). This translates into 0.7 % GDP growth when compared to Q1 2018 (year-on-year). Thus, the German economy has regained some of its momentum growing at a pace which is similar to the first two quarters of the previous year (Q1-Q2 2018: 0.4 % q q growth). Dom... » Weiterlesen

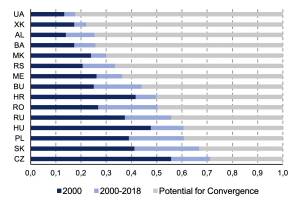

Unconditional insurance convergence in CEE (Martin Ertl)

24 May

The Czech economy is the first to reach current German income per capita in 2046, while Ukraine would be the last to reach today’s German living standards in 2077. Insurance markets grow with income by more than 1:1 during transition. Thus, continued convergence in income levels is set to foster convergence in insurance penetration. Countries with lower income per capita have higher growth prospects and a catch-up with richer countries implies a higher growth rate of insurance premiums. Important determinants of insurance development include income, wealth, the price of insurance, anticipated inflation, real interest rates, the role of the stock market, unemployment, demographic factors, risk aversion, the educational level, religion and culture, financial development, market structure, soci... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24