Russia: Low growth and lower interest rates (Martin Ertl)

- After a growth bounce in Q4 2018, GDP growth returned to more moderate level in 2019.

- Weak growth and declining inflation pave way for the central bank to accommodate monetary policy.

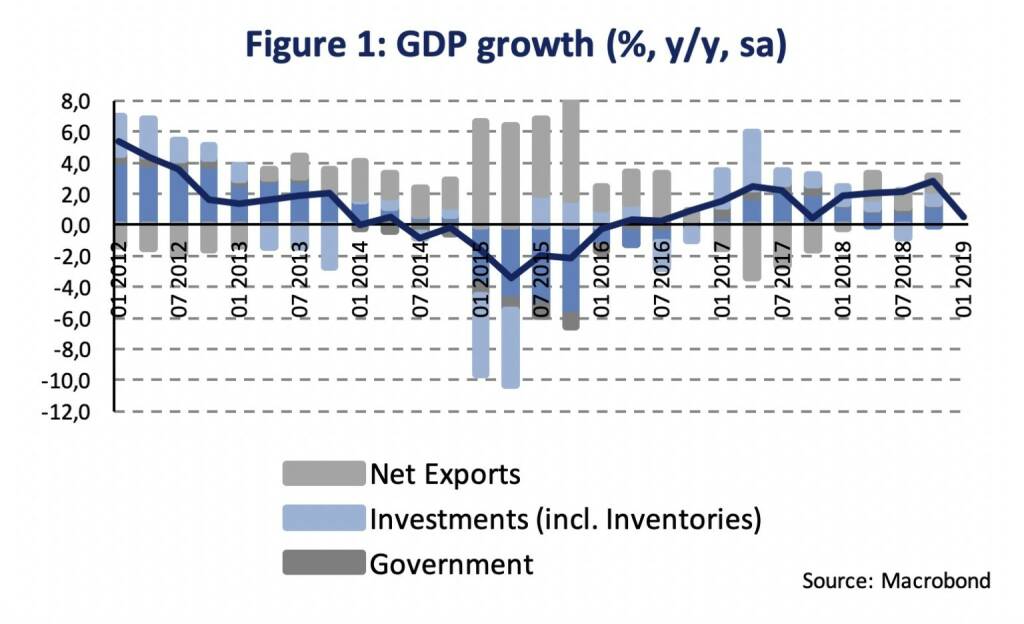

Economic growth slowed during the first quarter after a temporary spike in Q4 2018. In Q1 2019 real gross domestic product (GDP) increased moderately by 0.5 % compared to Q1 2018 and following 2.7 % GDP growth during the end-quarter 2018 (Figure 1). In seasonally adjusted terms, we calculate a drop by 0.4 % of GDP compared to the previous quarter.

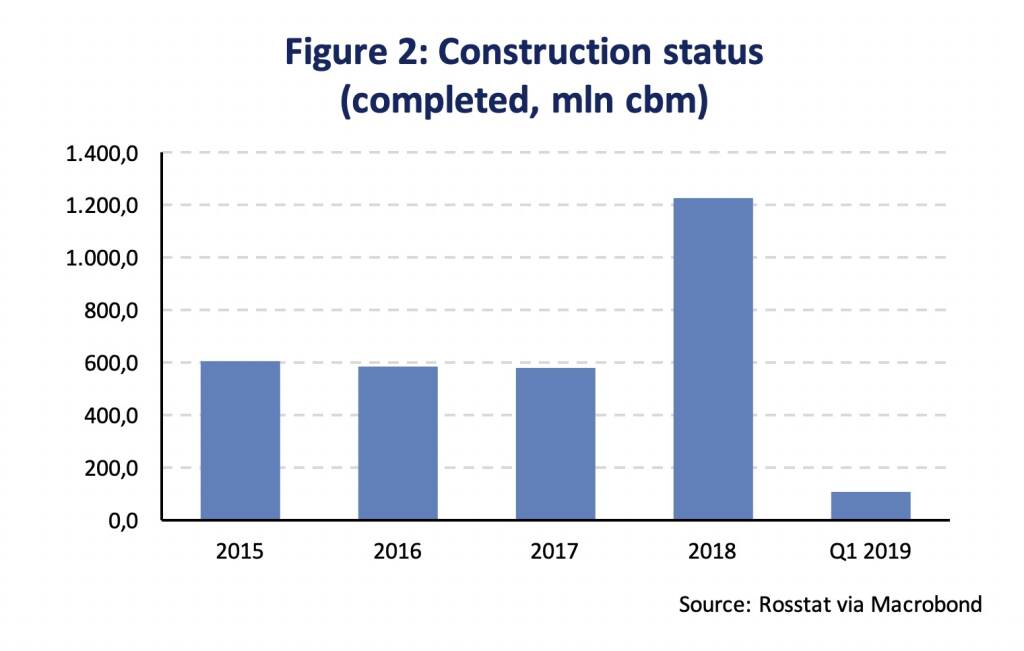

There were no expenditure details released yet by the Russian statistics office (Rosstat). By year-end 2018, national accounts data showed a surprising pick-up compared to previous quarters [1]. A reason which we detected for volatile growth data is construction activity (Figure 2). The volume of completed construction projects increased significantly during 2018, however, it returned to a more normal level in Q1 2019 (104 mln cubic meters or -1.5 % compared to Q1 2018). Major investment projects – including the Yamal natural gas plant – are being developed by the government. In Q4, construction contributed 0.4 %-age points to growth in gross value added (GVA) being the largest growth contribution after mining & quarrying (0.7 %-age points). Major projects with state participation include the construction of North Stream 2 and Power of Siberia gas pipelines in the Tyumen region, the railway section of the Crimea Bridge and the reconstruction of the Baikal-Amur mainline.

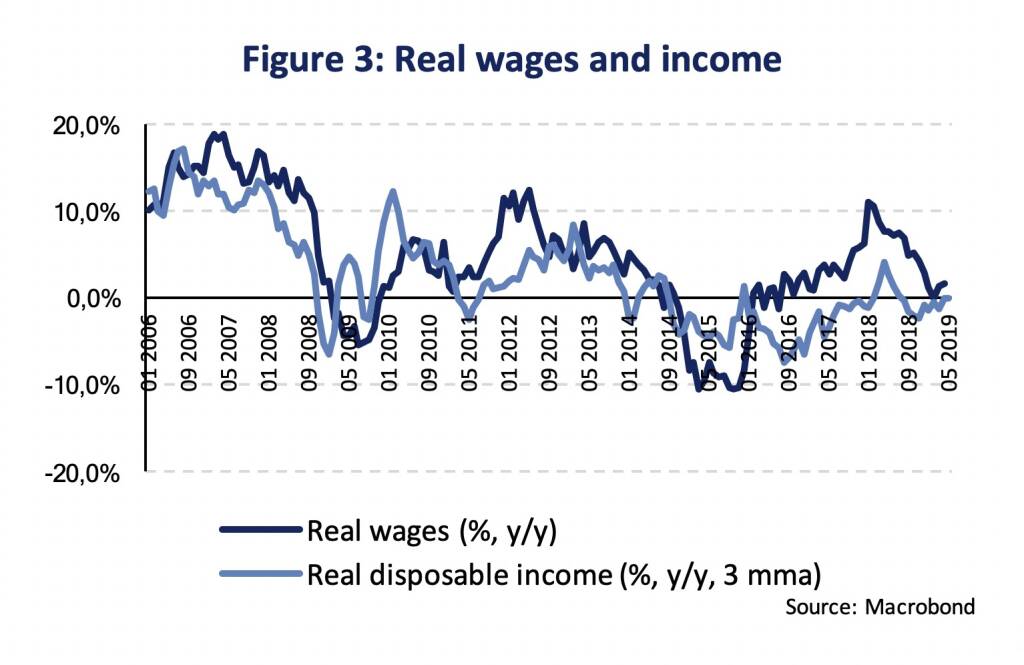

Household consumption has recently been a growth driver. Lending underpins consumption but slowing wage growth constrains a further rise in private demand (Figure 3). Lending to households has further accelerated rising by 23.4 % (y/y) in April. Total loans to corporates increased by 10.9 % in the same month. Since 2016, real wages had picked up after public wage hikes and coinciding with slowing inflation. However, in April, real wages enhanced by meagre 1.6 % after average increases by 7.0 % during last year. Slowing consumer demand is also indicated by weak growth in retail sales (averaging plus 1.6 % during the 3 months until April) and a decline in vehicle sales (-2.5 % over the last 3 months).

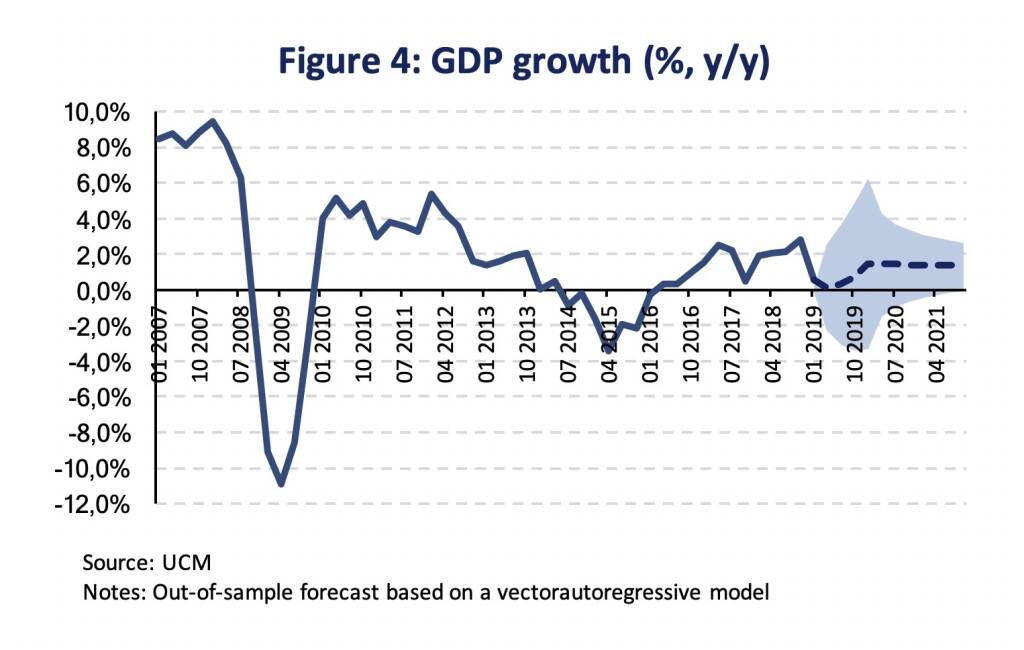

Technically, low Q1 GDP growth leads to downward revisions for growth expectations for the total of the year. In the absence of exogenous shocks (f. ex. rising oil prices), the pace of economic growth will likely revert to its potential growth rate (~1.5 %), though national investment projects – based on successful implementation – are an upside chance for the economy (Figure 4).

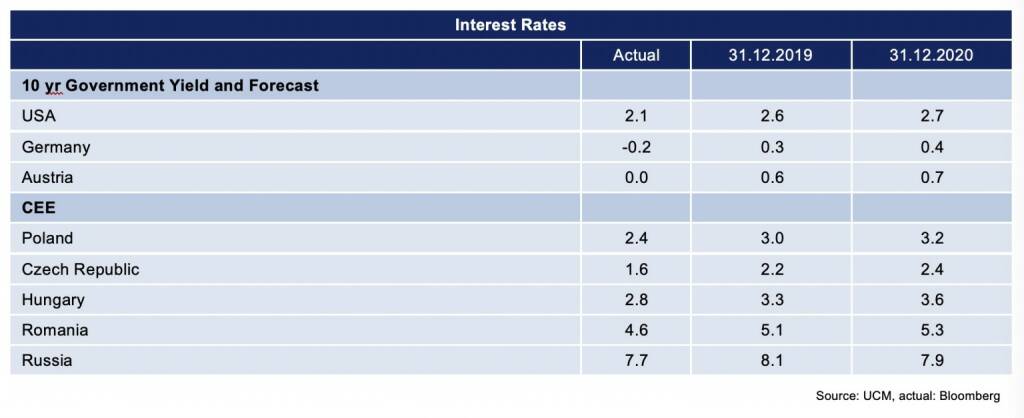

On Friday, the Central Bank of Russia (CBR) lowered the key interest rate from 7.75 to 7.50 %. The decision was well anticipated and prepared as the CBR mentioned the possibility to cut the key rate in the previous meeting.

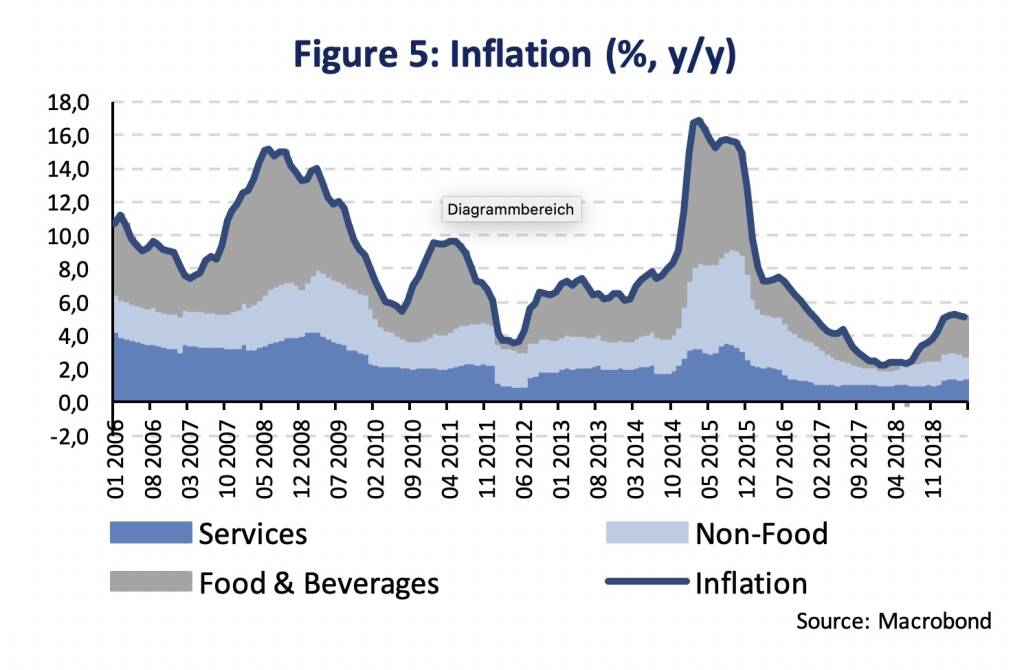

In its March projection, the CBR forecast GDP growth of 1.2-1.7 % for 2019 and a growth acceleration afterwards (2020: 1.8-2.3 %, 2021: 2.0-3.0 %). The acceleration is expected to come from planned fiscal measures and national projects once successfully implemented [2]. The inflation rate peaked in March (5.3 %) and fell to 5.1 % in May (Figure 5).

The contribution of food & beverage prices to overall inflation has risen to 2.4 % from an average of 0.6 % in 2018. Furthermore, contributions from non-food (1.3 %) and services prices (1.4 %) gradually rose compared to 2018 (1.2 % respectively 1.1 %). The CBR’s inflation forecast was already revised from 5.0-5.5 % to 4.7-5-2 % in March amid lower than expected pass-through from the VAT rate hike and ruble’s strengthening. The quarterly inflation rate will slow to the central banks’ inflation target of 4 % in H2 2019. Weak growth, declining inflation and inflation expectations as well as external stability pave way for the CBR to lower the interest rate. On last Friday, the CBR further lowered its inflation forecast to 4.2-4.7 % for this year. Going forward, the CBR expects the inflation rate to stay close to its inflation target at 4 %. In addition, the central bank decreased its GDP growth projection to 1.0-1.5 % for 2019. If the situation develops in line with the forecast, the CBR admits “the possibility of a further key rate reduction at one of the upcoming board meetings and a transition to neutral monetary policy until mid-2020”.

The anticipated transition to a neutral level of the key interest is in line with our expectation. The key policy rate would reach a level around 7 %. Deducting expected inflation rate (around 4 % for 2020), the CBR gave an indication that it sees the real neutral rate of interest around 3 %. While estimates for real (inflation-adjusted) neutral rates of interest are vast for developed economies, they are scarce and conceptually more demanding for emerging markets like Russia. A recent estimate suggested a real neutral interest of 4 % for Russia [3].

The Russian economy continues to expand albeit growth of GDP will remain behind recent expectations after a weak first quarter. Our baseline expectation remains that the economy continues to expand around its potential growth rate, however, the completion of national investment projects offers some upside. As the inflation rate as well as inflation expectations have been declining, the central bank cut the key interest rate and anticipates continuing with a key rate cutting cycle until mid of 2020.

[1] See UNIQA Capital Markets Weekly as of 1st April 2019: https://press-uniqagroup.com/news-uniqa-capital-markets-weekly?id=81974&menueid=1684&l=deutsch

[2] Central Bank of Russia (2019): Monetary Policy Report, No. 1, March 2019

[3] Grafe, C., Grut, S. and L. Rigon (2018): „Neutral Interest Rates in CEEMEA – Moving in Tandem with Global Factors“, Russian Journal of Money and Finance, March 2018, p. 6-25

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» SportWoche Podcast #124: Liam Ferguson, de...

» Österreich-Depots: Ultimo-Bilanz mit Addik...

» Börsegeschichte 30.8.: Warren Buffett (Bör...

» PIR-News: Zahlen von Warimpex, Strabag, Ne...

» Nachlese: Karin Bauer, LLB Aktien Österrei...

» Wiener Börse Party #727: Nächster Rekord-T...

» Börsenradio Live-Blick 30/8: DAX krönt Erh...

» Börse-Inputs auf Spotify zu u.a. ATX TR, L...

» ATX-Trends: Immofinanz, UBM, CA Immo, S Im...

» Börsepeople im Podcast S14/17: Karin Bauer

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...