Slowing growth – the dilemma of the ECB (Martin Ertl)

17 Dec

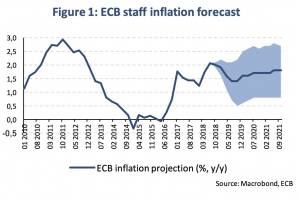

Exit from QE has been confirmed, reinvestment of accumulated stock continues to provide accommodative monetary conditions. The December macro projections include downward revisions in GDP growth and inflation. Redemptions will be reinvested past the first increase in key interest rates. New ECB capital keys requires portfolio reallocation. In the meeting of the governing council (GC) last Thursday, the ECB confirmed its exit from ultra-loose monetary policy or quantitative easing (QE). Net asset purchases under the asset purchase program (APP) will end by December. The accumulated stock of assets will, however, be reinvested, in full, for an extended period of time and past the date when the GC starts raising key interest rates. This was not unexpected as the US Federal Reserve has only starte... » Weiterlesen

Equilibrium exchange rates and currency imbalances in CEE (Martin Ertl)

17 Dec

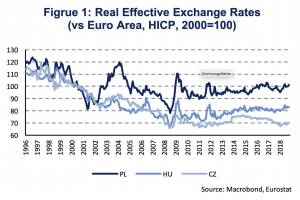

Real exchange rates in CEE have appreciated strongly in the pre-crisis period, though, have mainly stagnated since then. Currency undervaluation has been used as an unconventional monetary policy measure in the Czech Republic. An estimate of the equilibrium real exchange rate shows that undervaluation was around 4 %. Any currency misalignments have been closed and the current economic outlook points towards a real appreciation until 2020. Exchange rates have caught considerable attention in 2018, both in emerging markets as well as advanced economies. The Euro (EUR) has depreciated to the US Dollar (USD) by about 5 % since the beginning of the year (5.2 %, YTD). More volatility occurred in emerging markets led by a fall in the Argentine Peso (-51 % to the USD, -48 % to the EUR) and the Turk... » Weiterlesen

Der Rückzug der Babyboomer und das lange Erwerbsleben der Nachgeborenen (Martin Ertl)

10 Dec

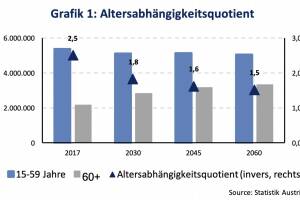

In den aktuellen Bevölkerungsprognosen der Statistik Austria steigt die Altersabhängigkeit in den nächsten Jahren stark. Frauen sollen ihr Erwerbsverhalten an jenes der Männer angleichen. Bei der Erwerbsbeteiligung soll sich Österreich in Zukunft an die Fersen eines internationalen Musterschülers heften. Die neuen Ergebnisse der Bevölkerungsprognose 2018 der Statistik Austria zeigen in der Hauptvariante eine nur gering unterschiedliche Entwicklung gegenüber den letztjährigen Prognosen. Wie die Statistik Austria anmerkt, wächst Österreichs Bevölkerung und altert, was sich durch eine anhaltende Zuwanderung, stagnierende Geburtenzahlen und eine weiterhin steigende Lebenserwartung ergibt. Die geburtenstarken Babyboom-Jahrgänge kommen in ... » Weiterlesen

No signs of abrupt growth slowdown in CEE (Martin Ertl)

20 Nov

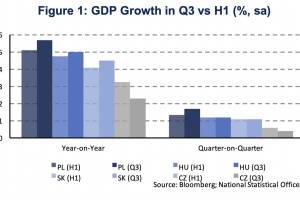

Czech Republic, Hungary, Slovakia and Poland Growth momentum in Central Europe remains strong during the third quarter, even accelerating in Poland. In Hungary and Slovakia growth momentum remains elevated with inflationary pressures building up gradually. While core inflation has moved beyond 2 % in Hungary and Slovakia it remains subdued in Poland at below 1 %. Growth has slowed down in the Czech Republic compared to strong growth in 2017. Capacity constraints are intensifying as firms face the tightest labor market in the region. During the third quarter (Q3) economic growth in Central Europe (CE) was stronger than expected in all CE economies except for the Czech Republic (CZ). Economic growth was strongest in Poland (PL) at 5.7 %, seasonally adjusted (sa), compared to Q3 2017 (y y)... » Weiterlesen

Divergence of growth momentum continues: US, Euro-Area and CEE (Martin Ertl)

14 Nov

US Federal Reserve Bank kept monetary policy unchanged to get active again in December. Euro Area growth slowdown in Q3 might be transitory due to one-of effects of the German car industry. Strong growth is set to prolong in CEE, yet gradually approaching more sustainable levels. United States: No news from the Fed in the November statement. Wait for December for next increase of the federal funds rate. Last week, the Federal Open Market Committee (FOMC) of the Federal Reserve Bank (Fed) has decided to keep interest rates on hold. The target range for the federal funds rate was increased to 2-2.25 % in September and is expected to be raised by another 25 basis points (to 2.25-2.5 %) in December 2018. The Fed communicates that further gradual increases in the target range for the federal ... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24