U.S. Fed continues its interest rate hiking cycle (Martin Ertl)

02 Oct

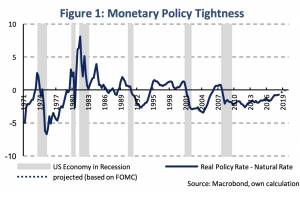

Monetary policy is becoming less accommodative as U. S. growth remains strong, inflation near the target rate and unemployment very low. The large Fed balance sheet will shrink steadily coinciding with a normalization in longer-term U. S. interest rates. In the meeting of the Federal Open Market Committee (FOMC) last week, the Fed decided to raise the target range of the federal funds rate by 25 basis points to 2-2.25 %. It was the 3 rd increase this year and the 8 th hike since the Fed embarked on an interest rate hiking cycle in 2015. The FOMC statement remained mostly unchanged compared to the June statement. It says that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong and the unemployment rate has stayed lo... » Weiterlesen

The comparative economic development of Serbia and Kosovo (Martin Ertl)

17 Sep

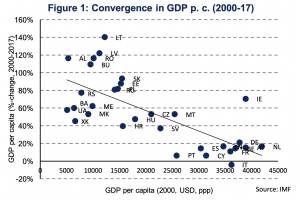

Serbia made comparably more economic progress than Kosovo, but both countries underperform with respect to income convergence in Eastern Europe. Recently, both countries had a solid recovery. Serbia‘s recovery is boosted by construction. The current GDP growth rate is likely not sustainable but the macro environment remains sound. Foreign remittances, rising wages and lending growth support consumption in Kosovo. Central and Eastern Europe (CEE) makes substantial progress in closing the income gap relative to Western Europe. Figure 1 shows the level of per capita gross domestic product (GDP p. c.) in 2000 and the percentage change between 2000 and 2017. Countries with lower GDP p. c. exhibit higher growth rates. After the dissolution of the Socialist Federal Republic of Yugoslavia in the... » Weiterlesen

What should we expect finance ministers to discuss at the Eurogroup meeting this w...

03 Sep

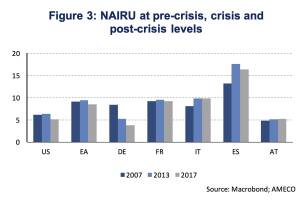

The upcoming Eurogroup meeting in Vienna intends to discuss inefficiencies in Euro Area labor and product markets to boost productivity. Productivity developments have been quite heterogeneous with adverse consequences for labor markets. Unemployment is high in international comparison and structurally weak labor markets remain a vital policy concern in some Euro Area member states. Labor market reforms have already been initiated targeting youth unemployment, long-term unemployment and labor market segmentation. However, effective implementation needs to be further strengthened. Euro Area economic and finance ministers will meet in Vienna this Friday, ahead of the informal EU Ecofin meeting, to discuss “policies geared at strengthening longer-term growth and employment prospects&rdquo... » Weiterlesen

Russia’s economic resilience against sanctions (Martin Ertl)

28 Aug

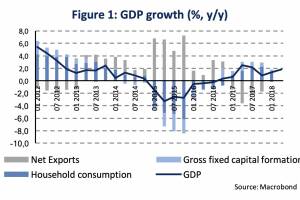

The Russian economy weathers financial sanctions amid macroeconomic stability supported by prudent fiscal and monetary policy. External debt is well covered by foreign currency reserves. The equilibrium real ruble exchange rate has been determined by the terms-of-trade due to oil price fluctuations. Recently, US sanctions might have loosened the exchange rate co-movement with the price of oil. In June, Russian government debt held by non-residents (OFZ) amounted to 2 trillion rubles (25.6 bn EUR) or 28 % total outstanding ruble-denominated government debt. The share of government debt held by non-residents has been declining (34 % in January). The total outstanding nominal of Eurobonds (securities issued in hard currency in the international bond markets) amounts to 31.4 bn EUR with 2.2 bn repa... » Weiterlesen

Turkey: A typical emerging market crisis? (Martin Ertl)

21 Aug

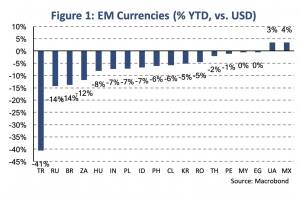

Political tensions with the US, lack of central bank independence and structural macro-economic vulnerabilities have contributed to a sell-off of the Turkish Lira. Low levels of reserve adequacy in combination with a structural current account deficit has made Turkey vulnerable to financial shocks. This combination is also present in South Africa and Ukraine, while the latter is already recovering from an emerging market crisis. During the last two weeks, the Turkish Lira has depreciated by 17 % (Friday-to-Friday) against the USD. Since the beginning of the year the Turkish currency has even lost more than 40 % of its value (Figure 1). The recent sell-off is based on a combination of macroeconomic vulnerabilities, financial markets’ questioning the central bank’s independence and po... » Weiterlesen

31.07.24

31.07.24

global market. 7 Monate 2024 sind vorbei und die Wiener Börse hat in diesen sieben Monaten mehr Handelsvolumina verbuchen können als in den ersten 7 Monaten 2023, der Zuwachs ist im einstelligen Prozentbereich, aber immerhin. Auch im früher stark promoteten global market ist es erstmals seit Jahren wieder etwas nach oben gegangen, im Gesamtjahr 2021 lag dort das Jahresvolumen noch bei 5,5 Mrd. (das ist ca. ein Monatsumsatz im Prime Market), 2022 waren es nur noch 1,3 Mrd.. und 2023 gab es sogar den Fall unter die Mrd. Euro. In den ersten sieben Monaten 2024 ist es wieder leicht nach oben gegangen, ob die Mrd. End of Year wieder erreicht werden kann, ist aber unklar. Es gibt zwar im global market günstige Konditionen, aber die Broker stellen Wien bei den internationalen Aktien nicht so in die Pole Position und die Markttiefe könnte natürlich ebenfalls besser sein. Keine einfache Aufgabe, diese wichtigste Aktienfacette im Vienna MTF, denn es geht immerhin um die wichtigsten Aktien der Welt. Ich bin ja der Meinung, dass das Tagesgeschäft viel mehr promotet gehört, davon würde auch der global market profitieren.

17.07.24

17.07.24