Turkey: A typical emerging market crisis? (Martin Ertl)

- Political tensions with the US, lack of central bank independence and structural macro-economic vulnerabilities have contributed to a sell-off of the Turkish Lira.

- Low levels of reserve adequacy in combination with a structural current account deficit has made Turkey vulnerable to financial shocks.

- This combination is also present in South Africa and Ukraine, while the latter is already recovering from an emerging market crisis.

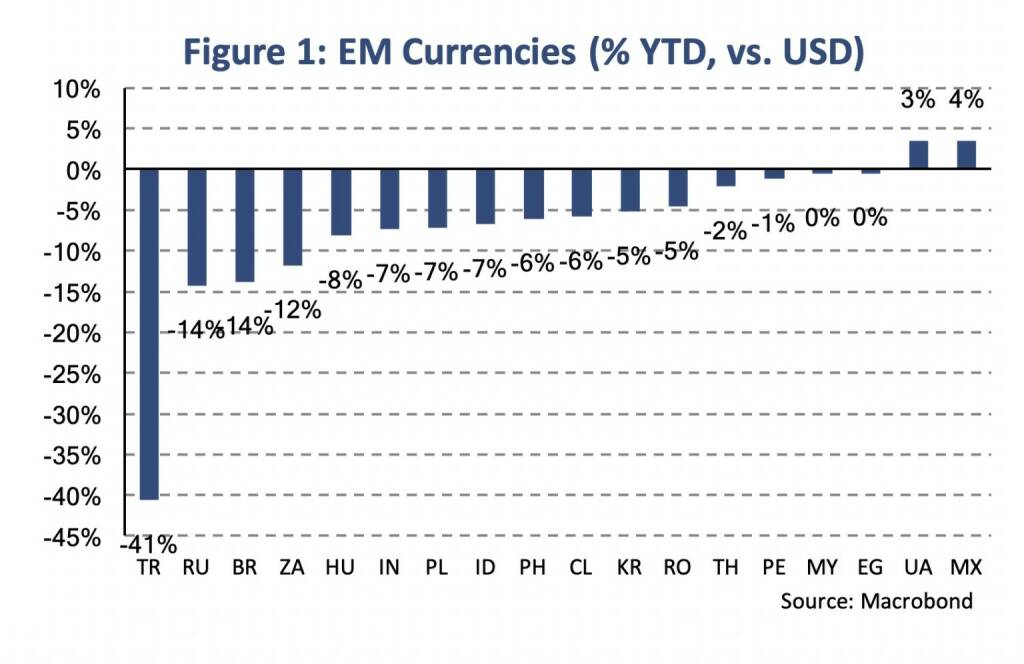

During the last two weeks, the Turkish Lira has depreciated by 17 % (Friday-to-Friday) against the USD. Since the beginning of the year the Turkish currency has even lost more than 40 % of its value (Figure 1). The recent sell-off is based on a combination of macroeconomic vulnerabilities, financial markets’ questioning the central bank’s independence and political tensions between Turkey and the United States. Political tensions have lately been intensified by President Trump announcing to double import tariffs on steel and aluminum against Turkey. President Trump tweeted as follows: „I have just authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey as their currency, the Turkish Lira, slides rapidly downward against our very strong Dollar! Aluminum will now be 20 % and Steel 50 %. Our relations with Turkey are not good at this time!” Additionally, in early August sanctions were imposed on the Turkish justice and interior ministers, which were intended to force the Turkish president Erdogan to release Andrew Brunson, an American pastor, who has been imprisoned on terrorism charges.

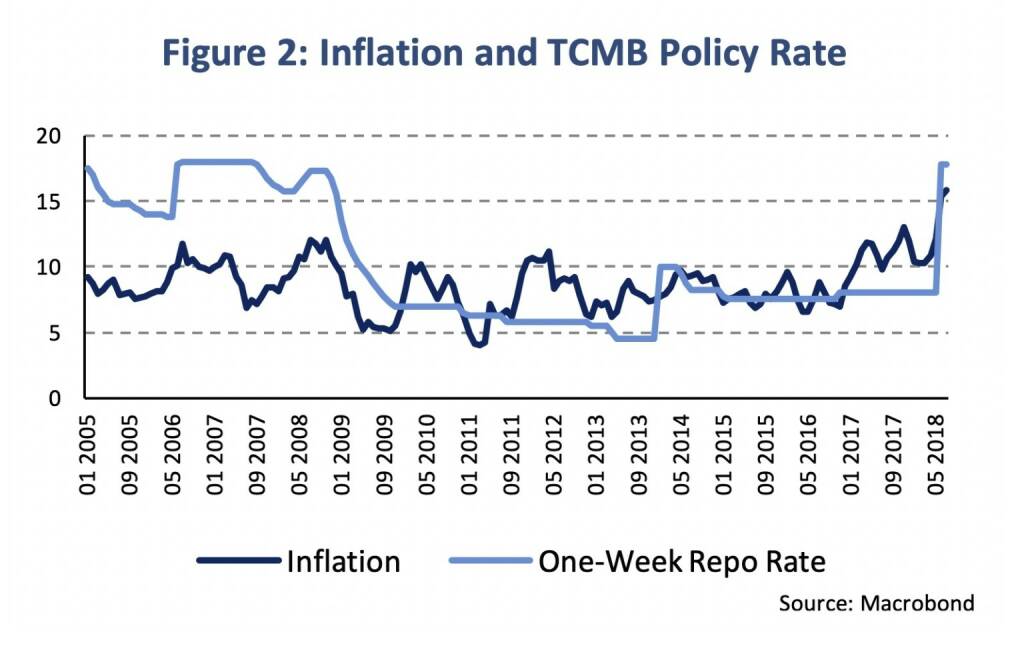

The Turkish economy has been growing rapidly for quite some time with signs of overheating increasing. Average economic growth for the period 2010 to 2016 was 6.9 % with above average growth during the last quarters. Growth was 7.3 % in 2017 and the first quarter of 2018 has supported this trend (7.4 %, y/y). At the same time, however, inflation has accelerated. Inflation tends to be high in Turkey with 8.5 % being the average between 2005 and 2017. The latest reading from July, though, was at 15.8 %. In an attempt to fight double-digit inflation, the Turkish central bank (TCMB) increased the one-week repo rate to 17.75 % in early June. Financial markets, however, question the TCMB’s independence, not at least, due to Erdogan’s preference for low interest rates. The TCMB’s decision to keep interest rates unchanged in July has been interpreted as confirming government interference.

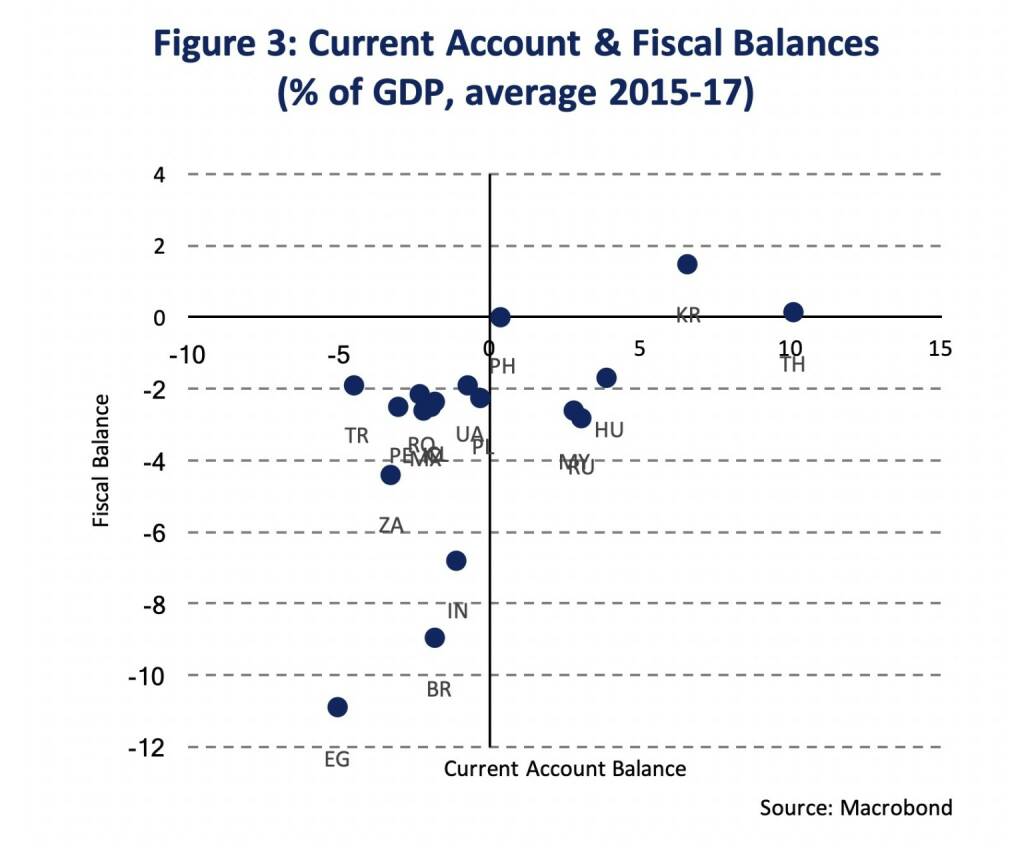

In addition to political tensions and the reactive, rather than proactive, behavior of the Turkish central bank, the Turkish economy is characterized by macroeconomic vulnerabilities. Turkey has a structural current account deficit (2010-2017: -5.7 % of GDP), which has further widened, lately. In the first quarter of 2018, the current account deficit accounted for -7.9 % of GDP. Hence, the Turkish economy relies heavily on foreign capital inflows which makes it vulnerable to external shocks. That Turkey is, indeed, a net borrower of financial assets is shown by its negative net international investment position of -459 billion USD (IMF), or -54.1 % of GDP. The EU macroeconomic imbalance procedure scoreboard includes this indicator with a threshold of -35 % of GDP. In addition to a structural current account deficit, which contributes to the growing external debt, the general government balance has also turned negative in 2016 after three years of balanced government finances. In spite of this twin deficit, the fiscal deficit is not excessive and projected to decline to -1.4 % of GDP in 2019 (European Commission). A comparison with other emerging markets shows that twin deficits are mainly a concern in Egypt and South Africa, where the 3 years backward looking moving average (2015-17) was below -3 % of GDP both for the current account and fiscal balance (Figure 3).

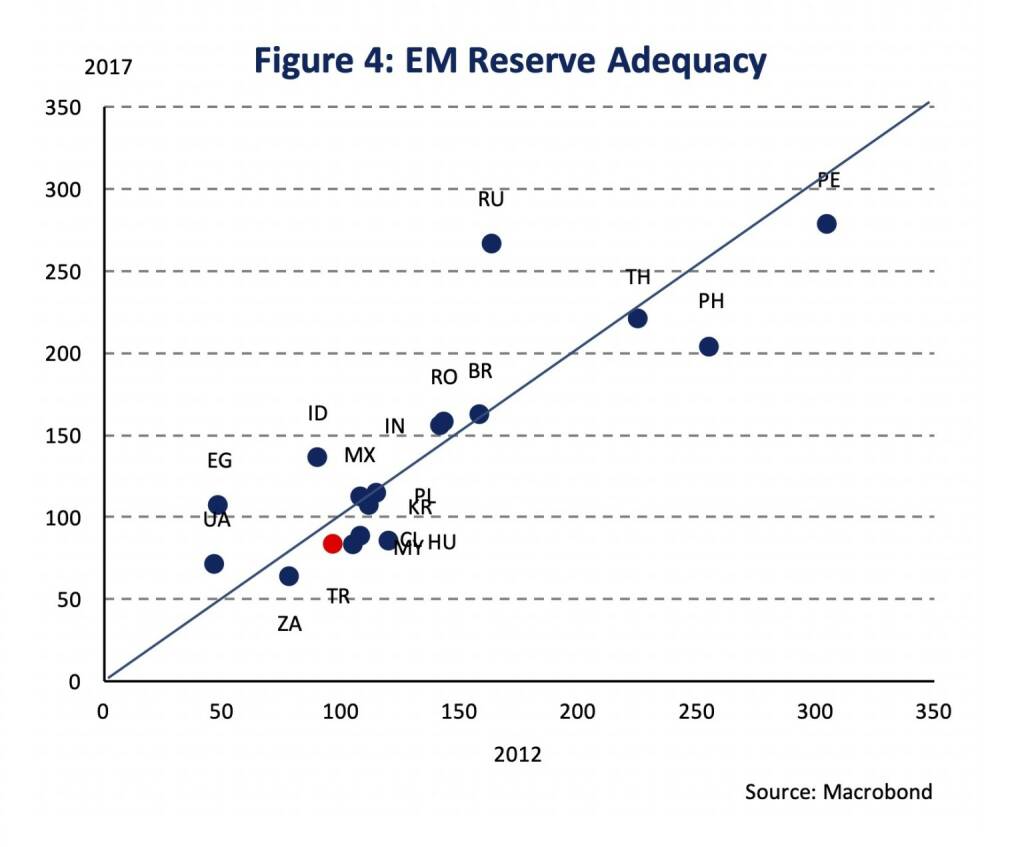

The extent of vulnerability, particularly in the short-term, is largely determined by the availability of foreign reserves. Foreign reserves have decreased continuously during the previous months, reaching 98.4 billion USD in June. The stock of reserves has not been below 100 billion USD since July 2012. The adequacy of reserves can be assessed by using the IMF’s composite EM reserve adequacy metric, which is a weighted average of four components reflecting potential drains on the balance of payments (export income, broad money, short-term debt, other liabilities). Expressing reserves as percentage of this metric results in a ratio of 80.4 % (2017), with a declining trend. That Turkey tends to hold insufficient reserves is also highlighted by the fact that the range of 100 to 150 %, which the IMF considers broadly adequate for precautionary purposes, has only been met once (2013: 102 %).

Macro-economic vulnerabilities are useful to assess potential spillovers to other emerging markets. In a sample of 18 emerging markets, Turkey shows the third lowest reserve adequacy. In 2017, only South Africa (63.8 %) and Ukraine (71 %) had lower reserve adequacy ratios than Turkey, based on the IMF’s composite EM reserve adequacy metric. Figure 4 shows EM reserve adequacy ratios for the whole sample in 2012 and 2017. A country below/above the 45° line indicates a worsening/improvement in reserve adequacy between 2012 and 2017. Besides South Africa and Turkey, Malaysia (82 %), Hungary (85.1 %) and Chile (86.7 %) show ratios below the IMF’s threshold of 100 %. In the case of Hungary, however, the IMF projects the reserve adequacy ratio to increase above 100 % already in 2018. A positive development is also projected for Malaysia, while a further deterioration is expected in Turkey, South Africa and Chile. In Egypt, official reserve assets have increased substantially in 2017 such that the reserve adequacy ratio has increased from 66 % in 2016 to 107 % in 2017.

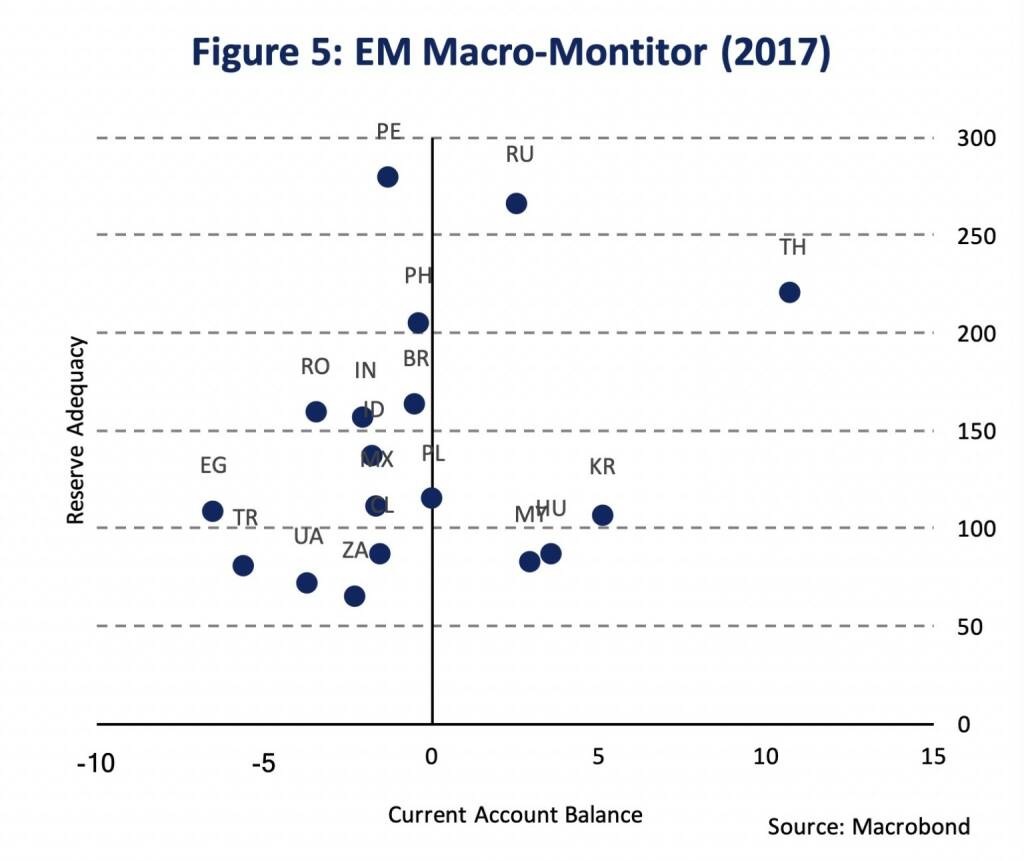

Combining reserve adequacy ratios with current account balances gives a good indication for potential spillover effects. Figure 5 shows the reserve adequacy on the vertical axis while the current account balance is displayed on the horizontal axis. Among the emerging market economies without an adequate reserve ratio (< 100 %) Turkey, Ukraine, South Africa and Chile show a current account deficit and are, thus, most vulnerable to financial shocks.

Russia, on the other hand, looks quite resilient to financial shocks, at least from a macro-economic perspective. Nevertheless, looking at emerging market currencies’ year-to-date performance against the USD, shows a depreciation of more than 10 % not only for the Turkish Lira (-41 %) but also for the Russian Ruble (-14 %), the Brazilian Real (-14 %) and the South African Rand (-12 %) (Figure 1).

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» Wiener Börse Party 2024 in the Making, 21....

» SportWoche Party 2024 in the Making, 21. A...

» Wiener Börse Party 2024 in the Making, 20....

» BSN Spitout Wiener Börse: Zumtobel zurück ...

» Österreich-Depots: Stockpicking Österreich...

» Börsegeschichte 23.4: Euromarketing (Börse...

» News zu Erste Group, Strabag, Rosinger Gro...

» Wiener Börse Party #635: ATX stark, viele ...

» Nachlese: Varta bzw. die verborgene 13-Bil...

» Wiener Börse zu Mittag stärker: RBI, Bawag...

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...