ECB affirms its monetary policy outlook & Buoyant U.S. growth continues (Martin Ertl)

- The ECB Governing Council sees no need to change its monetary policy and economic outlook. Recent data have been “somewhat weaker than expected” but remain broadly in line.

- Core inflation is expected to pick-up in Q4 and to be supported by accelerating wage growth over the medium-term.

- Economic growth is expected to remain close to the current pace over the medium-term with slight downside potential in Q3.

- Euro Area sentiment continues its decline, though still remaining in expansionary territory.

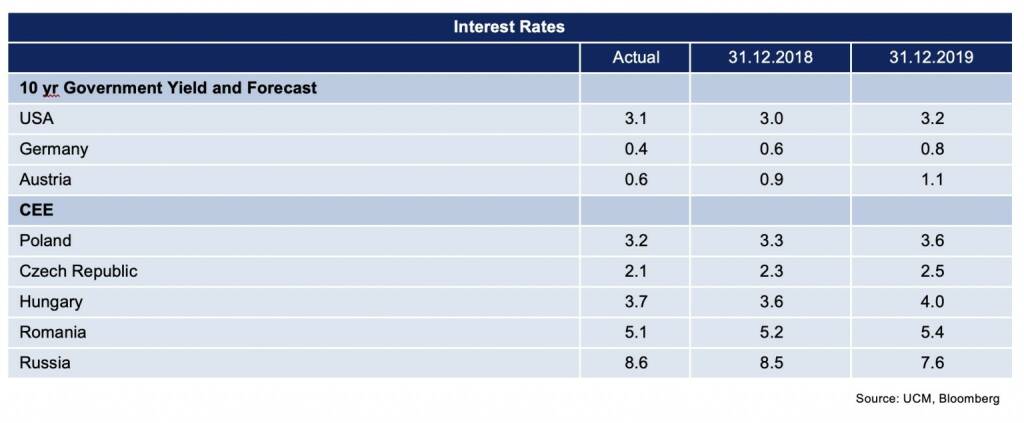

The ECB has kept interest rates unchanged at last week’s monetary policy meeting of the ECB Governing Council. The ECB’s key monetary policy interest rate remains at 0 % and the marginal and the deposit facility interest rates are kept at 0.25 % and -0.4 %. This is well in line with the ECB’s forward guidance which signals “ECB interest rates to remain at their present levels at least through the summer of 2019”. Moreover, there was no change to the anticipated end of net purchases under the asset purchase program (APP, or QE) by year-end. Net purchases have already been reduced to 15 billion EUR per month in October. Even after the end of net asset purchases, the principal payments from maturing securities under the APP will be reinvested “for an extended period of time”, maintaining favorable liquidity conditions and an ample degree of monetary accommodation. The end of net asset purchases as well as the anticipated start of an interest rate hiking cycle in late 2019 are conditional on the medium-term inflation outlook.

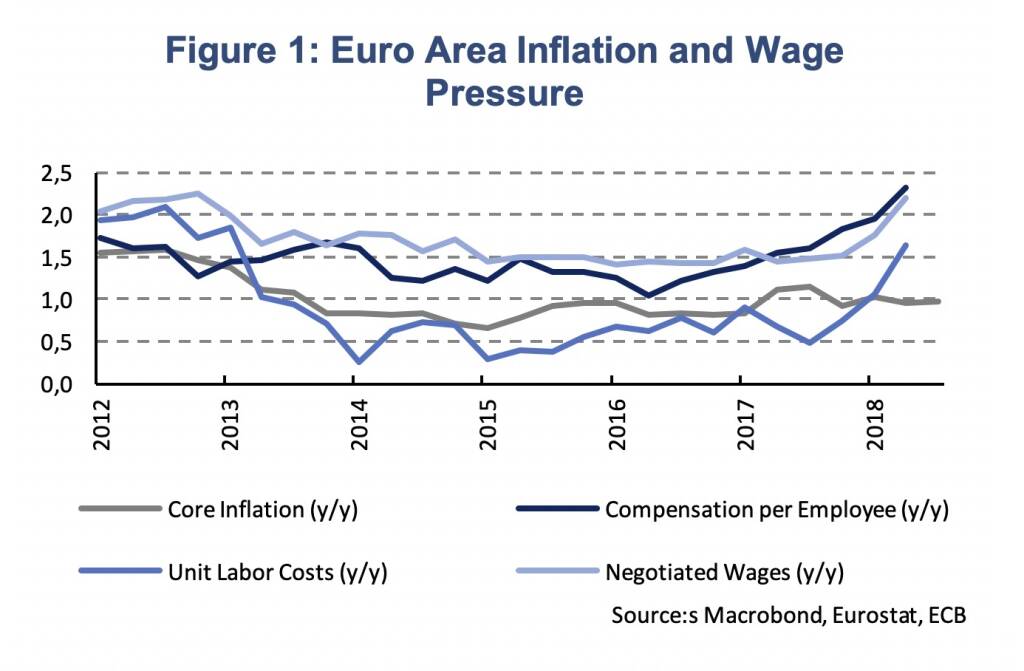

Interest rates will be kept at their current level for “as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2 % over the medium term.”. Based on the September 2018 ECB staff macroeconomic projections, the ECB expects core inflation to gradually rise to 1.8 % in 2020, after 1.1 % in 2018 and 1.5 % in 2019. So far, core inflation has remained rather subdued around 1 % (September: 0.9 %). Seasonal effects should push inflation higher towards the end of the year, which will also be crucial to fulfill the projection for 2019. This week’s core inflation release (Wednesday) will, thus, be important for next year’s inflation outlook. Confidence in gradually rising inflation is supported by developments on the Euro Area labor market. Various measures of wage growth have picked up over the past few months, leading the way to rising prices if firms pass on rising wage costs to consumers (Figure 1). Negotiated wages have increased by 2.2 % (y/y) in Q2 compared to 1.5 % in 2017. The compensation per employee increased by 2.3 % in Q2 (2017: 1.6 %) and unit labor costs, which adjust for changes in labor productivity, increased by 1.6 % (2017: 0.7 %). Rising wages tend to influence inflation with a time, such that wage growth is anticipated to support inflation over the medium-term. The ECB sees incoming data as “overall consistent with […] gradually rising inflation pressures.”

With respect to the economic expansion of the Euro Area, President Draghi highlights that incoming information was “somewhat weaker than expected”, though, does not alter the overall assessment of “an ongoing broad-based expansion”. Quarter-on-quarter (q/q) GDP growth has averaged 0.4 % during the first two quarters of the years, slowing down from an average of 0.7 % in 2017. A flash estimate of Euro Area GDP growth during the third quarter will be released this week on Tuesday. Economists expect growth to be 0.3 % (Bloomberg Consensus), thus, keeping the pace of the first two quarters. Our nowcasting framework, which tracks GDP growth based on high-frequency business cycle indicators, predicts growth at 0.3 % in Q3 and 0.4 % in Q4. This would result in year-on-year growth of 1.8 % in Q3, 1.5 % in Q4 and 2.0 % for the whole year of 2018. Hence, in spite of a possible slow-down in Q3 the ECB’s growth projection for 2018 at 2.0 % (September 2018 ECB staff macroeconomic projections) would still hold. Due to a lower base, the pace of economic expansion would need to accelerate in 2019 in order to reach the ECB’ forecast at 1.8 %.

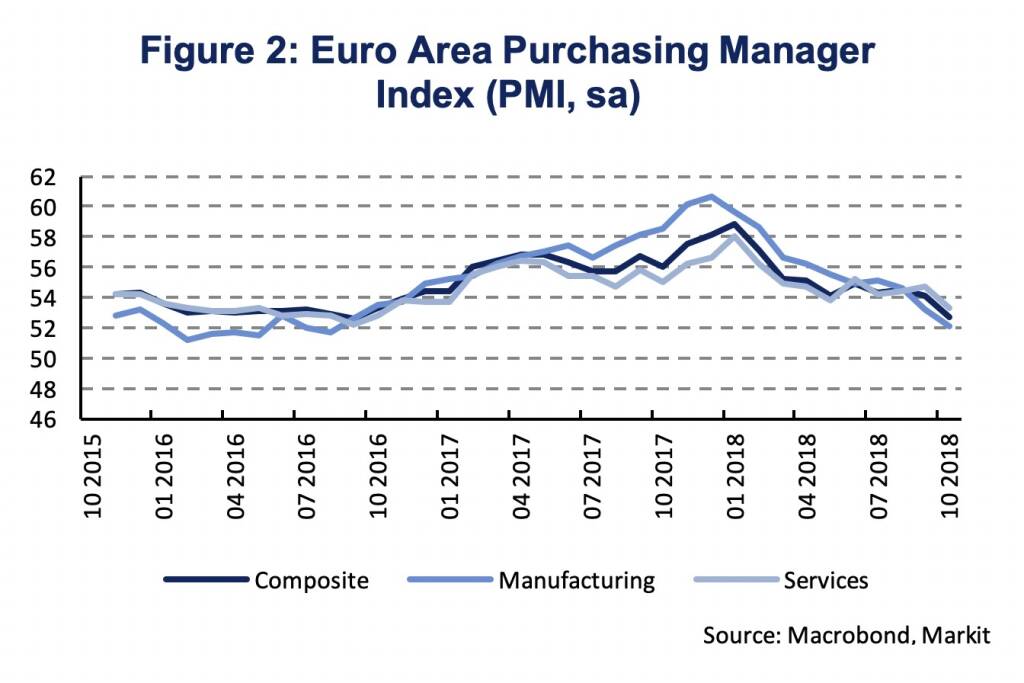

Economic sentiment in the Euro Area has been declining for some time now which has been further affirmed by last week’s Purchasing Manager Index (PMI) release. Euro Area PMIs for October declined in all segments (Composite, Manufacturing, Services). Yet, PMIs remain in expansionary territory (> 50) declining from all-time highs in late 2017 (Figure 2). So far, economic growth continues to be supported by strong domestic demand (consumption and investment). Strong labor market trends and rising wages should further contribute to rising household consumption. Moreover, favorable financing conditions, based on accommodative monetary policy, should further stimulate investment activity as long as economic sentiment does not fall substantially below current levels.

Buoyant U.S. growth continues

- Household consumption remains on a solid pace besides noisy inventories and net exports.

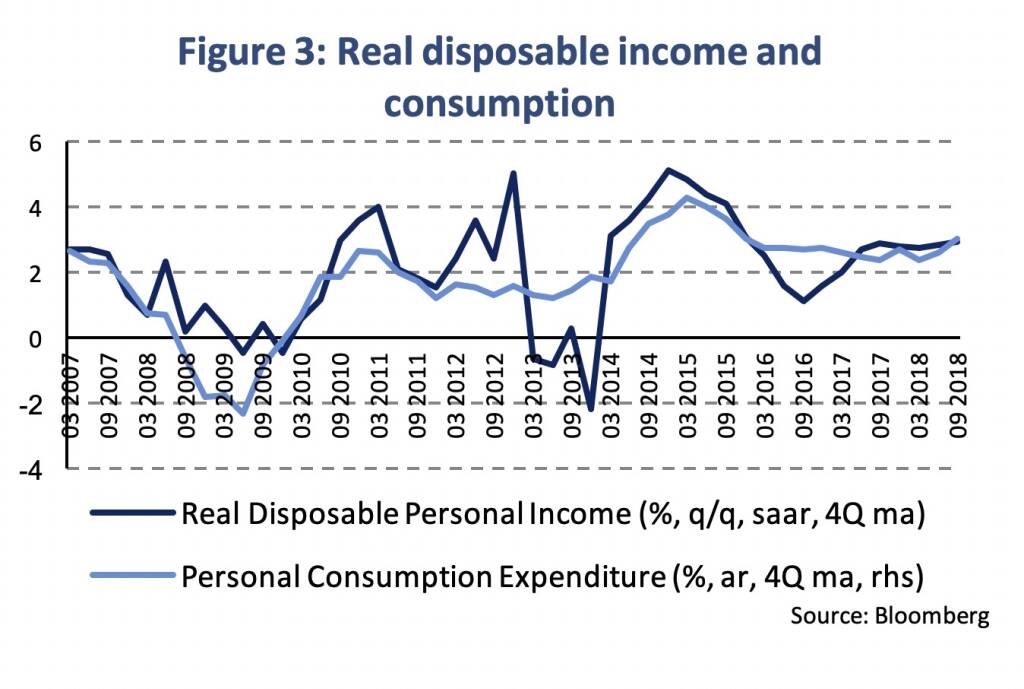

The U.S. economic boom is continuing. According to the advance estimate, the real GDP increased by 3.5 % compared to the previous quarter (annualized rate) in Q3 2018. Previously, the GDP rose by 4.2 % in Q2. Personal consumption expenditure remained an engine of growth in the domestic economy (+4.0 % after 3.8 % in Q2). Government consumption rose by 3.3 %. Gross domestic investment (+12 % after -0.5 %) was boosted by a large increase in inventories. On the other side, nonresidential fixed investment was rather weak (+0.8 % after 8.7 %) and residential investment declined (-4.0 % after -1.3 % in Q2). Investment in structures was dragged down by reduced investment in mining exploration (-10.4 %), what could be related to a rising oil price. The external trade dynamics reversed compared to the previous quarter. Exports dropped by 3.5 % after having increased by 9.3 % in Q2, and imports rose strongly (+9.3 % after -0.6 %). Overall, two unusually large factors went in offsetting directions – a large contribution from inventories and a large subtraction from net exports). Otherwise, the growth in household consumption remained fairly strong. Household consumption growth coincides with a decent growth path in real disposable income (2.5 % in Q3).

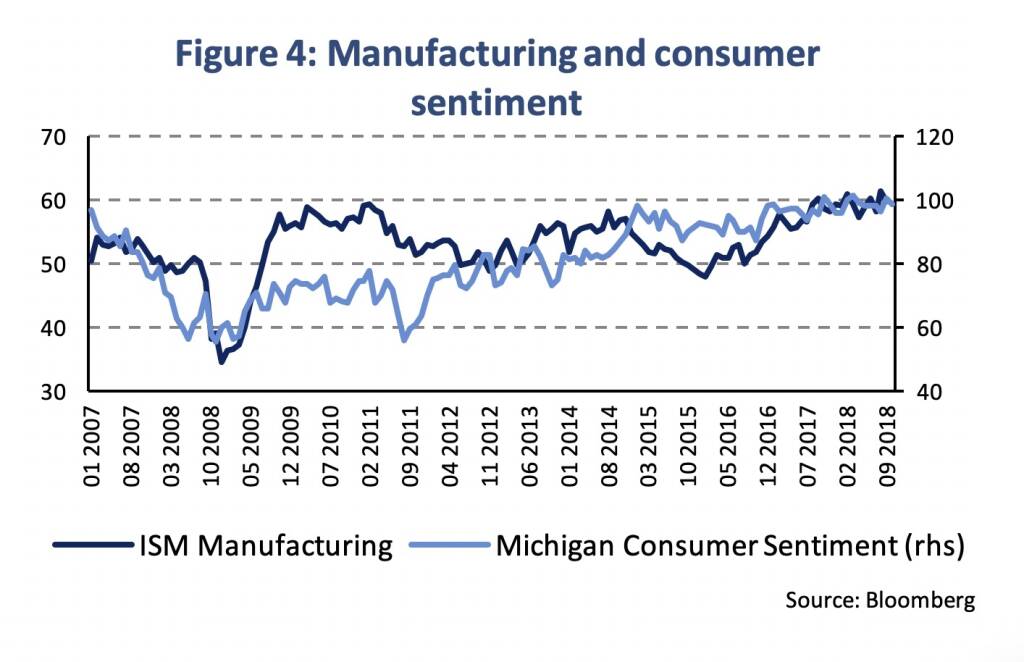

The advance estimate of Q3 GDP growth is basically in line with Bloomberg consensus expectations of 2.9 % annual GDP growth in 2018, while the Fed projection (3.1 %) would presume that GDP will advance at least at an equally strong pace in the final quarter of the year. Several forward-looking surveys support continuing strong growth. The U. S. Markit composite purchase manager index (PMI) for October rose to 54.8 (after 53.9) last week coinciding with solid consumer sentiment (Figure 4).

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» SportWoche Podcast #124: Liam Ferguson, de...

» Österreich-Depots: Ultimo-Bilanz mit Addik...

» Börsegeschichte 30.8.: Warren Buffett (Bör...

» PIR-News: Zahlen von Warimpex, Strabag, Ne...

» Nachlese: Karin Bauer, LLB Aktien Österrei...

» Wiener Börse Party #727: Nächster Rekord-T...

» Börsenradio Live-Blick 30/8: DAX krönt Erh...

» Börse-Inputs auf Spotify zu u.a. ATX TR, L...

» ATX-Trends: Immofinanz, UBM, CA Immo, S Im...

» Börsepeople im Podcast S14/17: Karin Bauer

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...