Quarterly Macroeconomic Outlook: Economic growth slows down but fundamentals remain strong (Martin Ertl)

- The global economy continues to expand solidly with the business cycle accelerating in the United States and slowing down in the Euro Area as well as some emerging market economies.

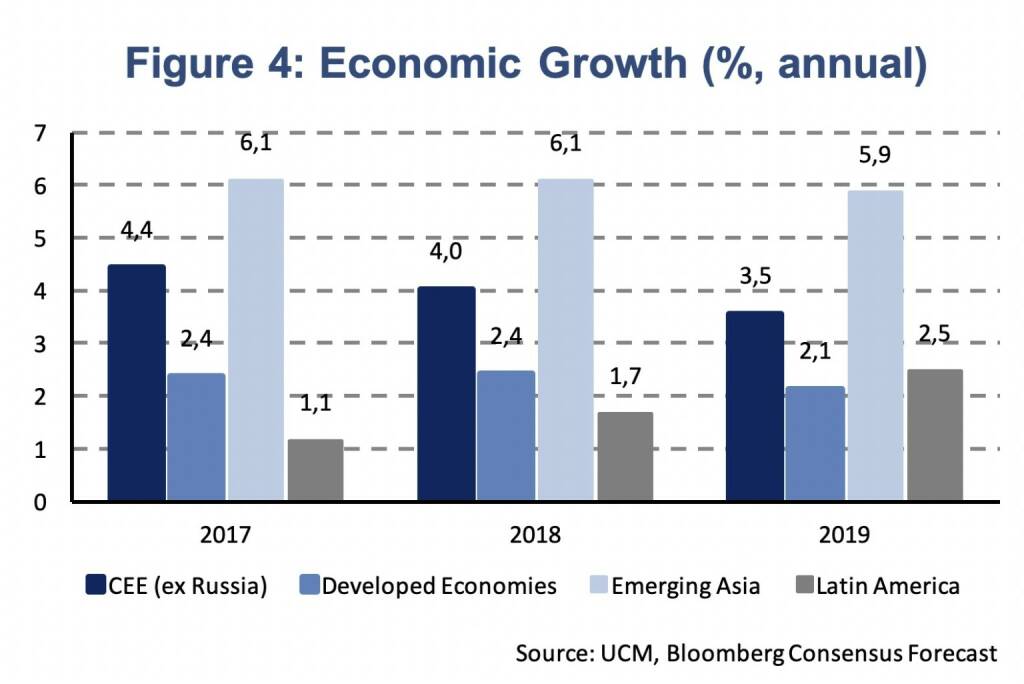

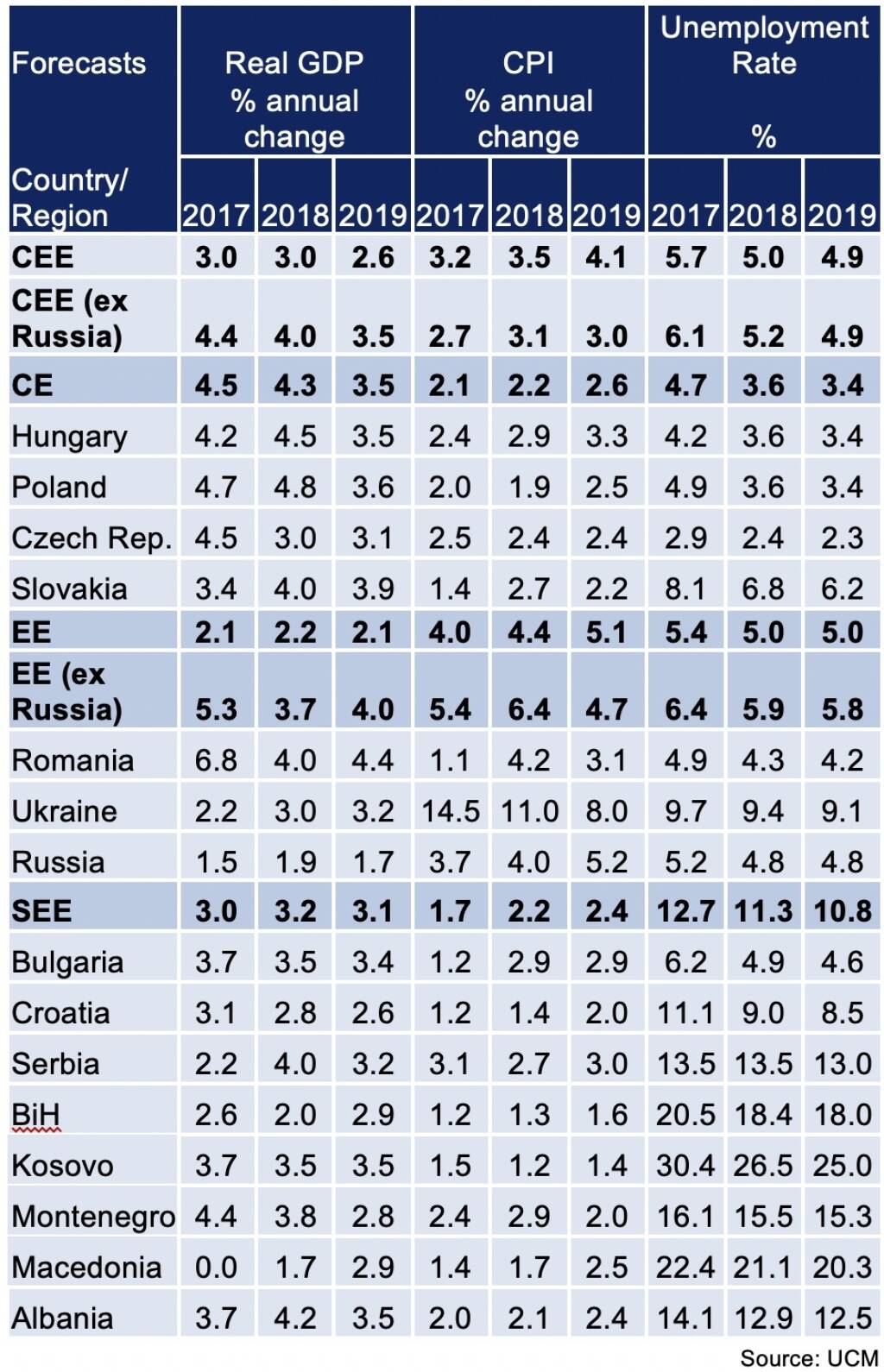

- The economic outlook of the Central Eastern European region remains favorable, despite of emerging market turbulences. We project growth at 4.0 % (2018) and 3.5 % (2019) for CEE (ex Russia).

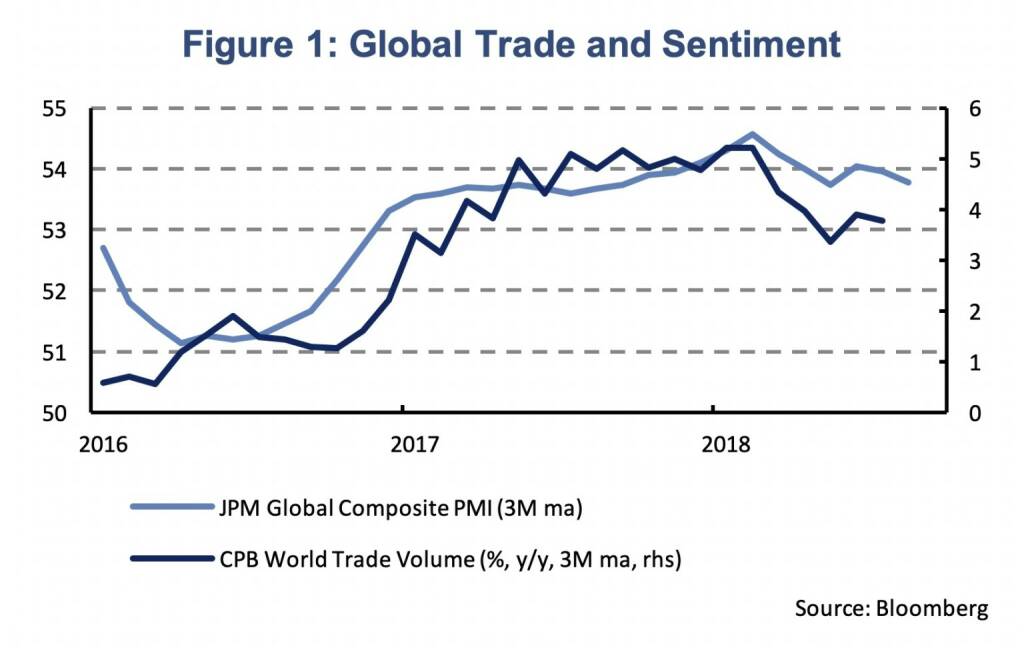

The global economy continues to grow at a solid pace, the peak has, however, most likely been reached and downside risks related to trade protectionism have intensified. The September 2018 economic outlook by the OECD projects world GDP to grow at 3.7 % in 2018 and 2019. The growth rate in the volume of world trade has decelerated during the last 4 quarters from 5.2 % in Q3 2017 to 3.9 % in Q2 2018. Global economic sentiment, though also declining, remains elevated as the Purchasing Manager Index (PMI) remains expansionary at 53.4 (August 2018).

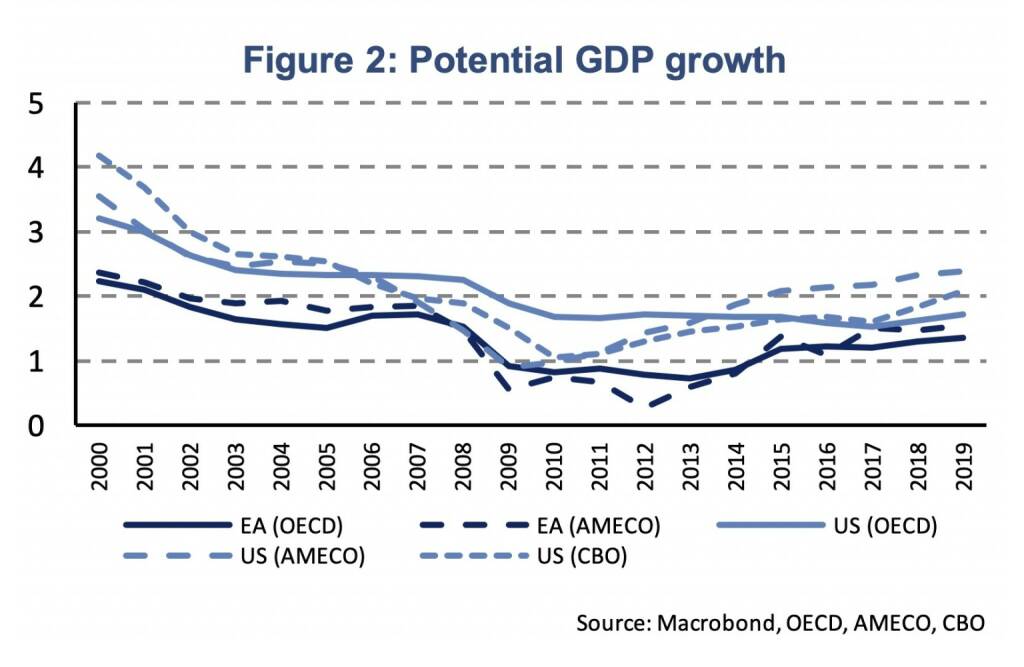

Among developed economies a divergent growth pace between the Euro Area and the United States has emerged. While the United States has seen a gradual upward revision of growth projections for the year 2018, the opposite was the case for the Euro Area. ECB staff macroeconomic projections from March 2018 indicated growth at 2.4 % for the year 2018, while the latest ECB projections from September show GDP growth at 2.0 %. The Federal Reserve Bank, on the other hand, revised growth projections upwards from 2.7 % for the year 2018 (March projection of the Federal Reserve Board members and Federal Reserve Bank presidents) to 3.1 % in September. While President Trump’s tax reform provides a fiscal stimulus to domestic demand boosting GDP growth in the United States, the softer external demand in the global economy has caused growth to slow down in the Euro Area. Economic growth in the Euro Area, however, remains solid and has not fallen below its long-term growth potential being supported by solid growth of domestic demand. Differences in growth rates for the year 2018 do, however, not only reflect short-term business cycle momentum but do also reflect lower Euro Area potential growth (Figure 2).

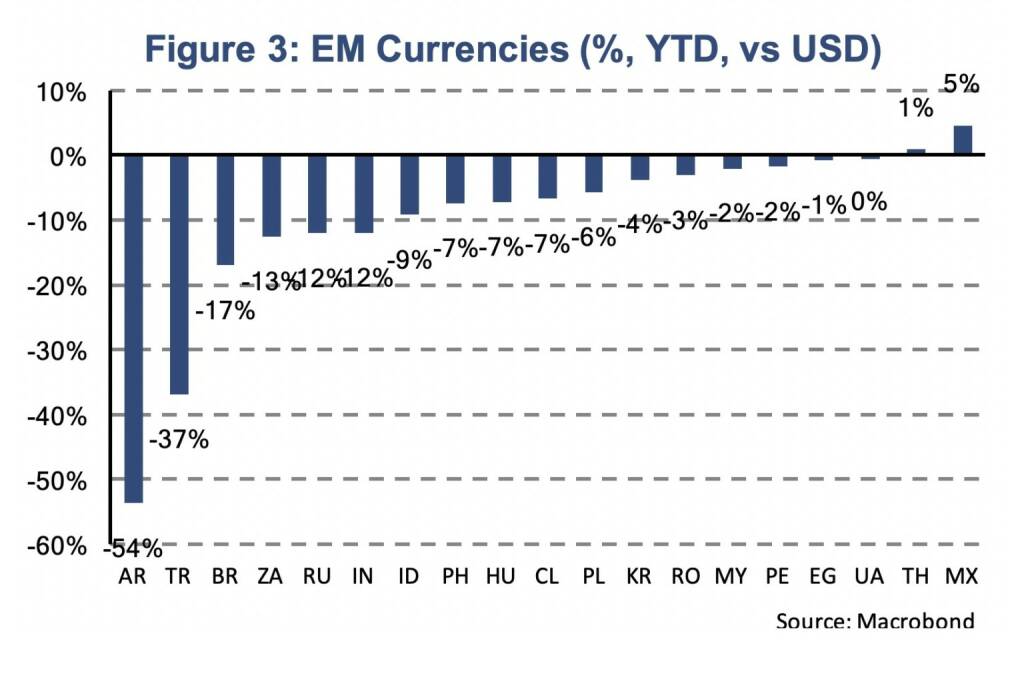

In 2018, GDP growth will be below 2017 in most emerging markets. Financial market pressure has been felt most severely in Argentina and Turkey, where growth projections have been revised downwards significantly. Compared to the USD, the Argentine Peso (-54 %) and the Turkish Lira (-37 %) have depreciated substantially since the beginning of the year (Figure 3). Monetary tightening in combination with rising inflation (Turkey) and fiscal consolidation (Argentina) weighs on domestic demand. Contagion has not been limited to countries with similarly weak macroeconomic fundamentals (South Africa), as financial pressure has also spread to economies with lower external vulnerabilities due to political uncertainty, like US sanctions in Russia.

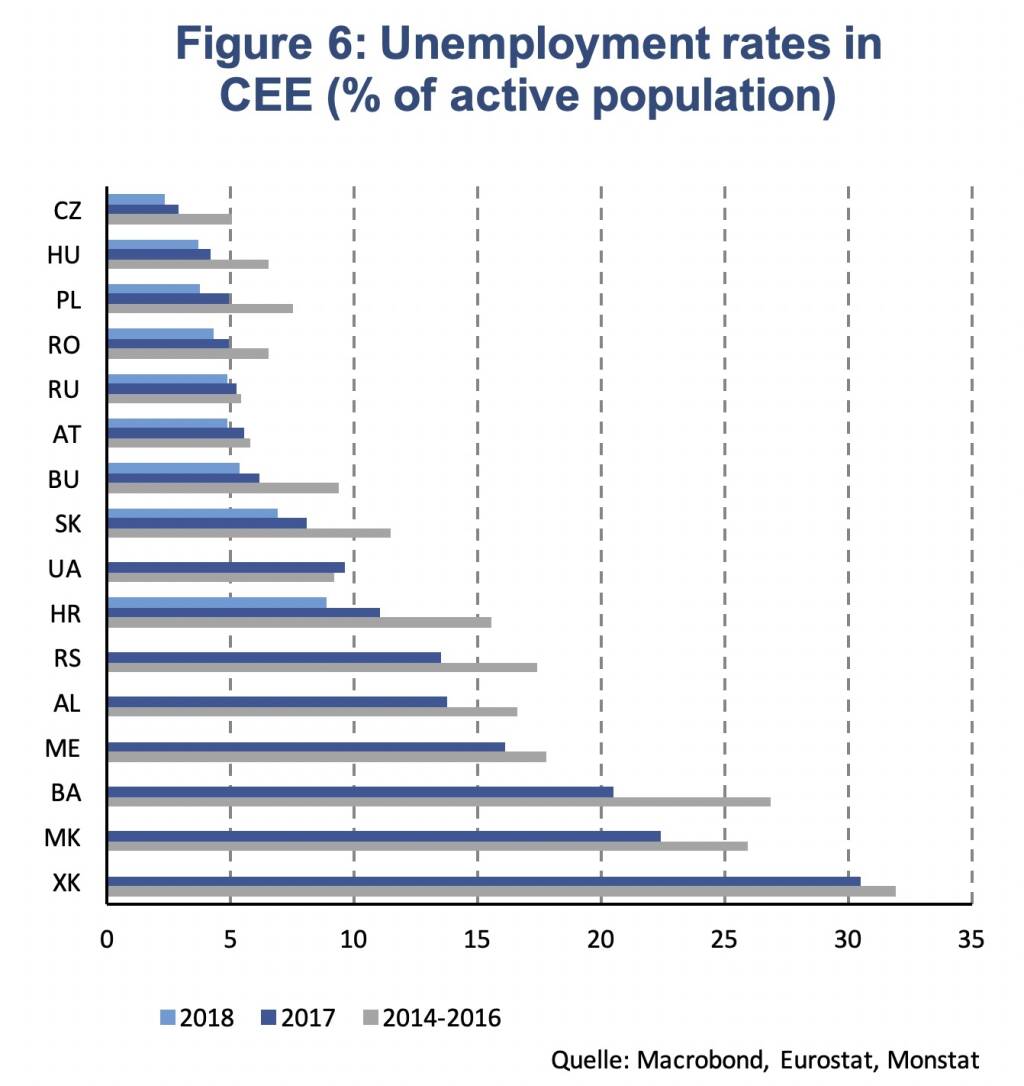

Despite increased market turbulences, the Central Eastern European (CEE) region continues to thrive and shows a favorable economic outlook. GDP growth was 4.4 % in 2017 (CEE ex Russia), by which it is the second fastest growing world region only surpassed by Emerging Asia (Figure 4). We project growth to remain elevated and growth rates to decrease only gradually in 2018 (4.0 %) and 2019 (3.5 %). Domestic demand remains strong in most CEE economies and labor markets are historically tight. Labor shortages might, therefore, become even larger, putting additional upward pressure on wages and inflation. Considerable improvements are also visible among several structurally weak labor markets of the SEE region.

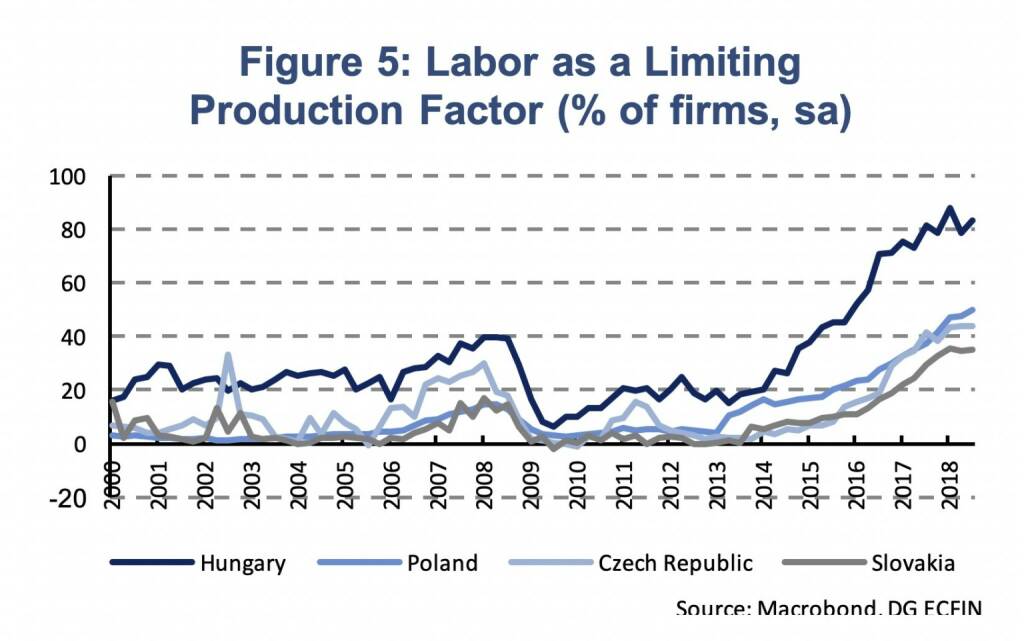

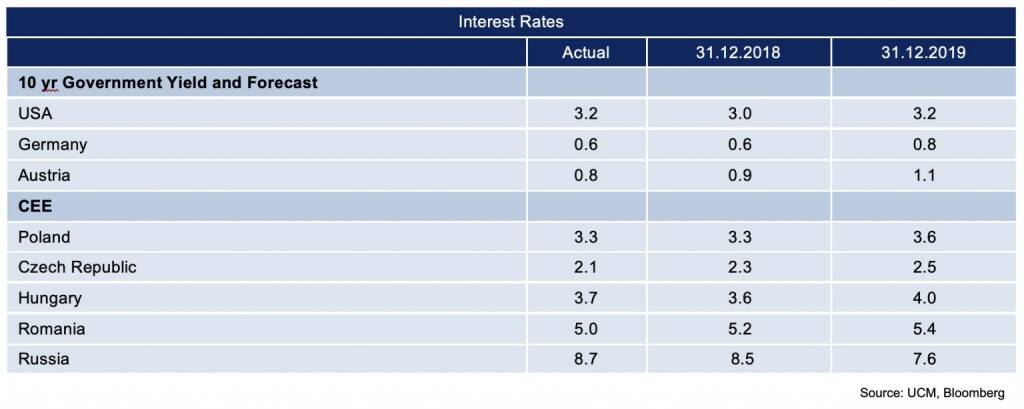

The Central European (CE) economies are either expanding more rapidly than before (PL & HU) or continue to grow at a solid pace (CZ & SK). Capacity constraints are, however, becoming more restrictive and labor shortages, in particular, limit the expansion of production (Figure 5). Growth rates will, therefore, converge to a more sustainable level from 2019 onwards. Unemployment rates are at historic lows and labor force participation has increased gradually. Tight labor markets have caused wage growth to accelerate. Inflationary pressures have built up and are most severe in the Czech Republic being followed by Slovakia. Core inflation remains more subdued in Hungary and particularly in Poland. Monetary policy, therefore, differs among the CE economies with the Czech Republic being most advanced in tightening monetary conditions.

Economic growth is slightly lower in the Eastern European (EE) region (Table 1). The Russian economy maintains high macroeconomic stability amid a solid business cycle and conservative economy policy. We project GDP growth to be above its long-term potential (1.5 %) in 2018 and 2019. In Ukraine the recovery has accelerated lately amid rising domestic demand which is supported by rising real wages and credit growth. Nevertheless, GDP growth is likely to only gradually converge to its long-term potential. In Romania, economic growth will slow down in 2018, approaching more sustainable levels after excessive growth in 2017. Similar to the situation in the CE region, labor market conditions continue to improve gradually. Wage growth, however, is even more buoyant which has translated into accelerated inflation.

The economic outlook for South Eastern Europe (SEE) has further brightened in the short-term and continues to remain solid in the medium-term. We have revised our GDP projection slightly upwards for the year 2018, from 2.9 % to 3.2 %. All economies are growing around or even above 3 %; except for Bosnia & Herzegovina and Macedonia. Among important growth drivers are tourism (Croatia), construction and investment (Serbia, Montenegro) and credit expansion (B&H, Albania, Kosovo, Macedonia). For the SEE region as a whole it is worth emphasizing that labor markets are improving continuously which is reflected in historically low unemployment rates (Figure 6). Trends of increasing labor force participation are important to sustain long-term economic growth.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» Österreich-Depots: Wochenendbilanz (Depot ...

» Börsegeschichte 26.4.: Mike Lielacher (Bör...

» PIR-News: Analysten Einschätzungen zu den ...

» Nachlese: Addiko vs. Marinomed, Bayer, Pat...

» Wiener Börse Party #638: I wer narrisch be...

» Wiener Börse zu Mittag stärker: S Immo, Wi...

» Börsenradio Live-Blick 26/4: DAX rauf, Bay...

» Börsepeople im Podcast S12/11: Patrick Kes...

» ATX-Trends: Strabag, S Immo, Erste Group, ...

» Wiener Börse Party 2024 in the Making, 25....

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...