Macroeconomics a decade after the Great Recession (Martin Ertl)

- What has changed during the last ten years

- Modern macroeconomics under fire

- Extensions of the baseline New Keynesian macro model

“Economist have learned nothing from the crisis, stick to their wrong models, operate within a very constrained model world and stubbornly believe in the homo oeconomicus” are regularly formulated accusations vis-à-vis the profession (Martin Halla).

Famously, right at the onset of the Great Recession in 2008, Olivier Blanchard wrote an article which concluded that “the state of macro is good” what kind of went terribly wrong. Although Blanchard discussed mainly how a convergence in methodology had emerged (sometimes called the “new neoclassical synthesis”), after the “field looked like a battlefield” before the 1970s. [1]

The summer issue of the Journal of Economic Perspectives (JEP) is dedicated to “Macroeconomics a Decade after the Great Recession”. The prestigious journal of the American Economic Association “aims to fill the gap between general interest press and most other academic journals”. Well-known academics, usually leading in its field of economic research discuss current issues, lessons learned or new lines of research in a non-technical, narrative style. While academic papers in economics are often loaded with illegible lingo, nasty mathematical models and filling pages of formal appendixes, the JEP stories are sometimes a nice Sunday afternoon read. [2]

What has changed during the last ten years?

A major critique of the workhorse macroeconomic models was the seemingly absence of a financial sector or the assumption of frictionless financial markets, while on the other hand it seems clear that the global financial crisis originated in the financial sector. To tackle this shortcoming a lot of progress has been made in macro research during the last ten years. Contemporary macroeconomic models capture the interactions between the financial and real sectors (Gertler and Gilchrist). Although major contributions (for example, Bernanke and Gertler’s credit channels from 1995, Bernanke, Gertler and Gilchrist’s financial accelerator model from 1999, Kyotaki and Moore’s credit cycles from 1997) were already there long before the crisis. In theory, the borrowers’ (including firms, households and banks) access to credit is constrained in imperfect capital markets. The strength of a borrower’s balance sheet, measured by the value of assets net of debt (net worth), affects access to credit and thus the ability to spend. Financial crisis are periods where borrower balance sheets contract sharply, leading to a significant disruption of credit flows. Significant declines in spending and economic activity then follow. Leverage plays an important role. The exposure of an economy to a financial crisis is closely related to the degree to which borrowers rely on debt. The higher the fraction of financing that is debt, as opposed to equity, the more sensitive the balance sheet becomes to fluctuations in asset prices. New empirical evidence underscores the importance of the household balance sheet channel versus the disruption of banking for employment during the Great Recession. Gertler and Gilchrist’s chapter “The Financial Crisis through the Lens of the Theory” gives a very nice account of the crisis’ evolution.

We must understand the boom to make sense of the bust. The expansion of credit supply, operating primarily through household demand, has been an important driver of business cycles. Mian and Sufi call this the credit-driven household demand channel. The larger the increase in household leverage prior to the recession, the more severe the subsequent recession. Here, the contractionary phase of the business cycle is a consequence of the excesses generated during the expansionary phase. Shocks that lead to a rapid influx of capital into the financial system often trigger such extension in credit supply. Recent manifestations of such shocks were for example inequality in the US or a rapid rise in savings by many emerging markets (the “global savings glut”). Longer-run factors have been the decline in the real long-term interest rates, the rise in within-country inequality and across-country “savings gluts” (Mian and Sufi).

New Keynesian macroeconomics under fire

The New Keynesian (NK) paradigm was and is dominant in macroeconomics to understand business cycles and inflation and their relation to monetary and fiscal policies. It is also the core of models developed and used by central banks and policy institutions throughout the world. The criticisms have focused on the failure to predict the crisis and the lack of a financial sector in the model as well as assumptions of rational expectations (in other words, economic agents are forward-looking, interest in the future and know a lot about it), perfect information and an infinitely lived representative household (Galí).

Modern macroeconomic models have micro foundations meaning that these models are based on decisions of economic agents, i. e. households and firms (policymakers, etc.). Households decide between consumption (work) and leisure to optimize their life-time utility and subject to budget constraints. By combining labor, capital (machines, factories) and technology to produce output firms maximize profits. Economic agents’ decisions are aggregated across space and time (“dynamic”) in a general equilibrium. Whereas a partial equilibrium would apply to one market, the general equilibrium includes outcomes (quantities, prices) in all markets (goods markets, labor market, etc.) in the economy. The formal framework is referred to as dynamic stochastic general equilibrium models (DSGE). Shocks are exogenous (i. e. not determined in the model) and hit the economy randomly: In other words, we can say less about, for example, when recessions occur but more about how households, firms and policymakers react and how this on aggregate affects the main macroeconomic outcomes (GDP, employment, inflation, interest rates, wages, etc.). As we know, not all markets are perfectly competitive (maybe not even one) and prices do not adjust instantaneously (for example, wages are set time-fixed in contracts). The NK framework adds such frictions to the classical economy. It has done fairly well in predicting the statistical moments (mean, variation, co-movements) of the main macroeconomic variables and, hence, became macroeconomists’ workhorse model. There is not too much left in NK theory of what most people would associate with John M. Keynes’ ideas except for that price rigidities give rise to real effects of economic policies (non-neutrality) in the short-term. Otherwise, one could argue that there is no case for economic policy at all. (Much of the NK research agenda has focused on monetary policy.) For those familiar with the ISLM model (usually taught in undergraduate classes at business schools), one could sloppily say that the NK model is essentially a dynamic version of it.

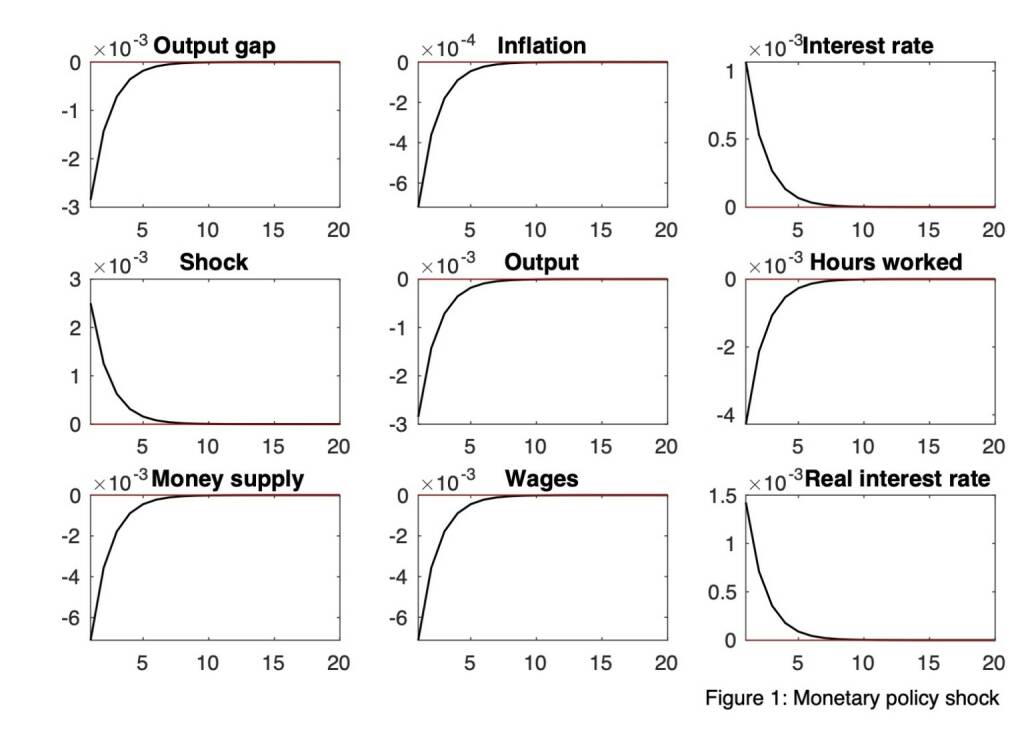

To illustrate the dynamics effects, figure 1 shows impulse response functions of a contractionary monetary policy shock (one a standard deviation rise in the nominal interest rate) hitting the economy. The real interest rate increases, the inflation rate, output and hours worked decrease. The output gap becomes negative. The central bank engineers a reduction in the money supply.

Extensions of the baseline NK model following the global financial crisis

In the JEP issue, NK pioneer Jordi Galí describes some interesting extension of the basic NK model among which we pick out the research on the zero lower bound (ZLB) of interest rates. The monetary policy response of central banks to the financial crisis was seriously jeopardized when policy rates hit the lower bound of zero percent. When an adverse shock brings the natural rate of interest (the interest rate that equilibrates planned savings and investment) into negative territory, there is an inability to match the decrease with a reduction in the policy interest rate generating a negative output gap (a recession) and deflation. Given this setting, it is shown that monetary policy with commitment can significantly cushion the recession if the central bank credibly promises that it will keep the nominal rate at zero even after the shock is no longer effective. The optimal monetary policy with commitment can be interpreted as an illustration of the power of forward guidance policies. Such policies have been adopted by the European Central Bank and the Federal Reserve in recent years.

Another stream of literature shows that in case that the ZLB is hit in a recurring setting, optimal policy implies a disproportionately strong response to shocks. With the central bank reducing the nominal rates more aggressively in response to adverse shocks, the probability of a binding ZLB down the road is reduced. Optimal policy can even call for sustained monetary easing even when the natural interest rate is no longer negative. Another line of literature takes more properly into account the contemporaneous effects of anticipated future changes in the policy rate than in previous versions (“forward guidance puzzle”). In case of a liquidity trap, in which the interest rate is near zero and inflation is below the targeted level and possibly negative, a central bank’s adoption of a Taylor rule does not guarantee price stability. A proposed rule calls for a strong fiscal stimulus in form of lower taxes and another one calls for a switch to a rule that would peg the rate of money growth.

Generally, fiscal policy becomes a more important role when interest rates are at the ZLB. For example, it is argued that a reduction in taxes on labor or capital income is expansionary, whereas an increase in government purchases has a strong expansionary effect on output. The reason is that tax cuts generate disinflationary pressures which are not matched by a policy interest rate cut, leading to an increase in the real interest rate and a drop in aggregate demand. On the other hand, an increase in government purchases has a stronger expansionary effect under a binding ZLB than in normal times, because the inflationary pressures generated by the fiscal expansion, combined with the absence of a nominal rate adjustment, lead to a drop in the real interest rate, thus amplifying the effect of the fiscal stimulus. Furthermore, it is found that the fiscal multiplier at the ZLB might increase in the neighborhood of two, while usually fiscal multipliers are estimated at below one.

We picked out some innovations in macroeconomic research since the global financial crisis which might be of interest to or could have implications for financial investors or practitioners. It might seem obscure or an unrealistic simplification of the world, that baseline DSGE models rely on the assumption of a representative, infinitely-lived household. Professor Galí also discusses how the assumption that all households are identical has been relaxed recently to improve the understanding of real world phenomena like the global financial crisis. Naturally, he concludes that NK economics is alive and well.

[1] Blanchard, O. (2009): „The State of Macro”, Annual Review of Economics 1:209-228

[2] Journal of Economic Perspectives 32(3) Summer 2018, Symposium: Macroeconomics A Decade After The Great Recession, free download: https://www.aeaweb.org/issues/518

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» Börse-Inputs auf Spotify zu u.a. Verena Sp...

» SportWoche Podcast #129: Verena Spreitzer,...

» Wiener Börse Party #752: ATX stärker, Do&C...

» Wiener Börse zu Mittag stärker: Do&Co, AT&...

» Österreich-Depots: Weekend-Kommentar (Depo...

» Börsegeschichte 4.10.: Bitte wieder so wie...

» PIR-News: In den News: Uniqa, Erste Group,...

» Nachlese: SLG wird Partner bei kapitalmark...

» Börsepeople im Podcast S15/04: Stefan Kainz

» ATX-Trends: Wienerberger, AT&S, Polytec ...

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...