Decomposing subdued inflation in the Euro Area (Martin Ertl)

- Euro Area inflation has remained broadly unchanged in February with core inflation at 1 %.

- The historical average of core inflation is 1.4 % (1999-) and 1.6 % during the pre-crisis period.

- Lower than average inflation in services is the underlying factor of subdued inflation post 2017.

- Additional support from non-core components is needed for the ECB to fulfil its inflation target.

Last week Eurostat has released its flash estimate for Euro Area inflation for February 2018. Euro Area inflation was reported at 1.2 % (y/y) compared to 1.3 % in January. The flash estimate attributes the decline in inflation to slower price growth within the category food, alcohol & tobacco (1.1 %, y/y). Energy prices increased by 2.1 % (y/y) and core inflation, which excludes the categories energy and food, alcohol & tobacco from the overall HICP index, has remained constant at 1.0 % (y/y). Thus, price developments have remained broady stable and do not show signs of a sustainable upward trend. The European Central Bank (ECB), as the guardian of price stability, will see accomodative monetary policy to remain crucial in oder to achieve a sustained adjustment in the path of inflation consistent with its inflation target.

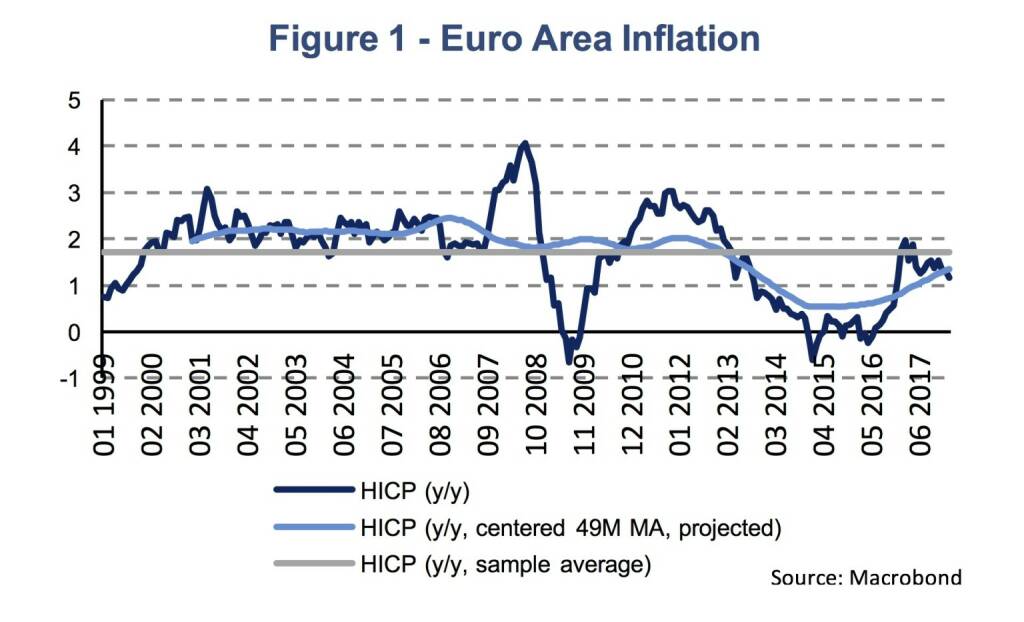

The ECB’s primary objective is to maintain price stability aiming inflation rates of below, but close to, 2 % over the medium term. Before the drop in prices following the financial crisis inflation averaged 2.2 % between 1999 and 2008 (Figure 1). The average over the total period since the introduction of the harmominsed index of consumer prices (HICP) in 1999 is 1.7 %. Over the medium term, which we define as a 4 year centered moving average, inflation has remained close to 2 % until 2013. It was only after 2013 that the ECB has consistently failed to achieve its price stability objective.[1]

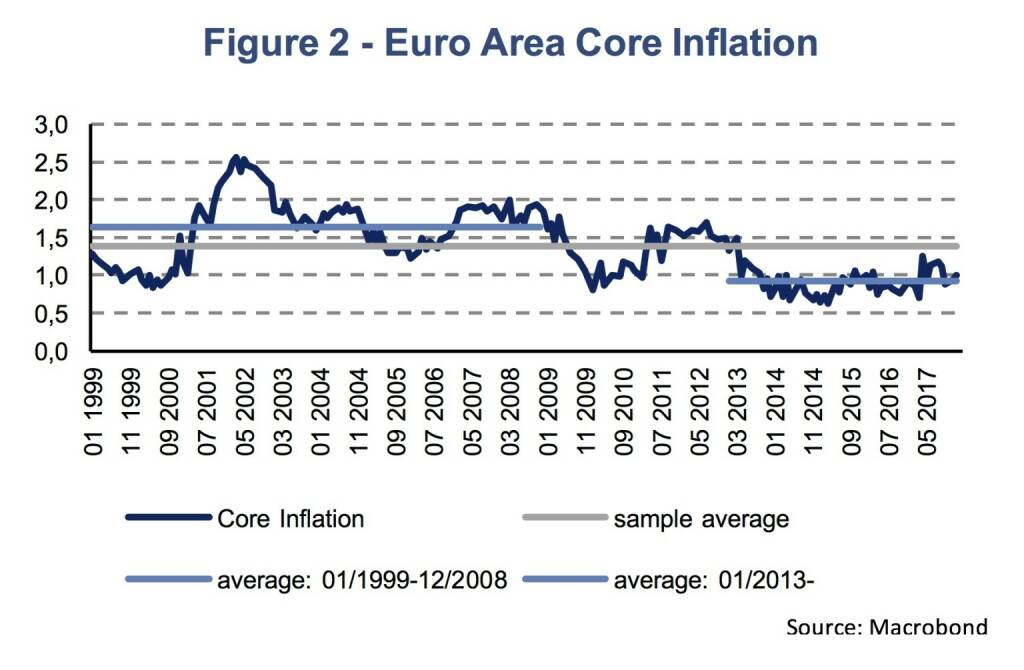

Looking at core inflation instead of headline inflation, however, shows that the pre-crisis average was below the 2 % target, at 1.6 % (Figure 2). This was also pointed out in the last monetary policy meeting of the Governing Council of the ECB in late January: “in the absence of persistent positive contributions to price developments from food and energy components in the future, underlying inflation would need to be higher than its pre-crisis average if the ECB was to meet its inflation aim on a sustained basis”. This said, with core inflation at 1 % in February a reversal to the pre-crisis level would already be a strong sign of sustained adjustment in the path of inflation (average since 2013: 0.9 %).

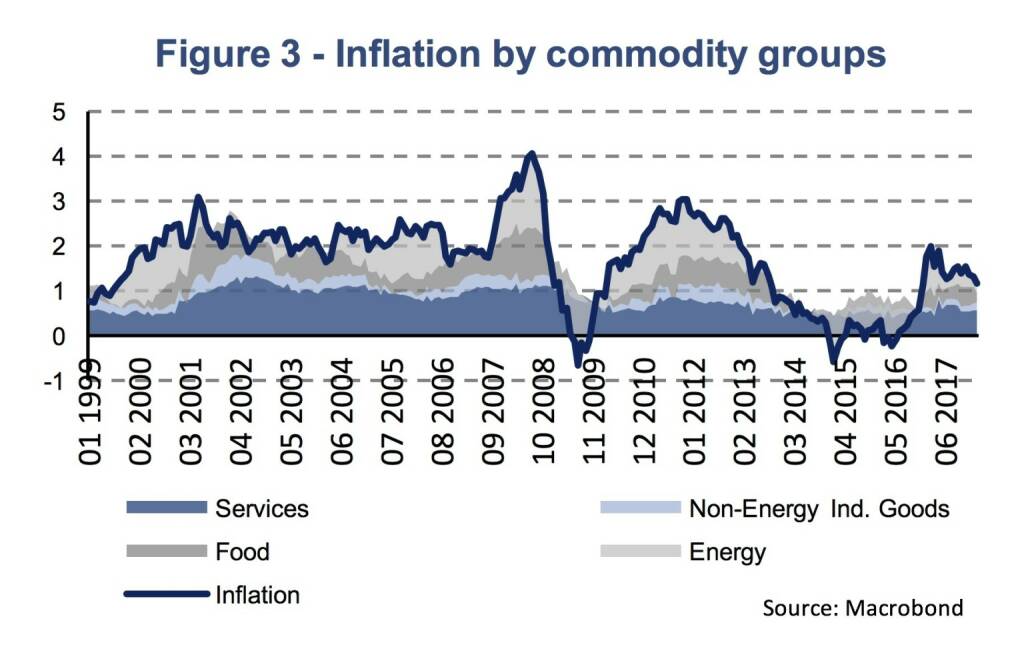

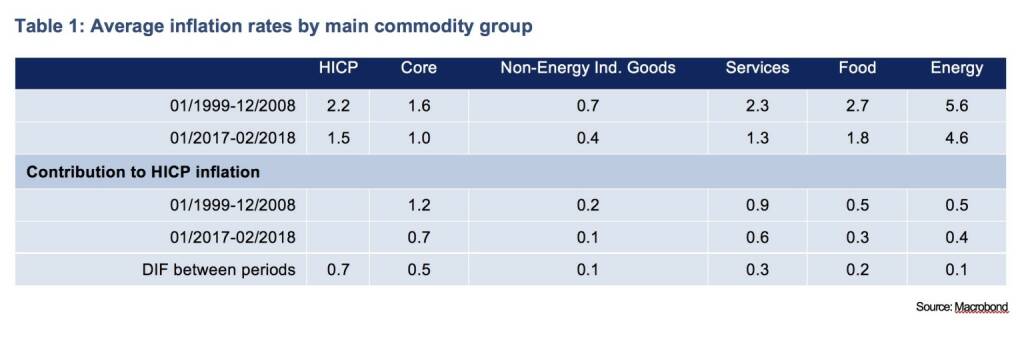

Decomposing Euro Area inflation by its main commodity groups, shows that more volatile energy and food, including alcohol & tobacco, prices have contributed significantly to Euro Area inflation in all periods (Figure 3). However, it also becomes evident that the main driver of core inflation is the price development of services. Prices of services increased by 2.3 % on average in the pre-crisis period. Since early 2017 the average inflation rate of services has only been at 1.3 %. Given that services have the largest weight in the overall inflation index (44.4 % in 2018), the subdue price development of services can be identified as the single most important reason why inflation remains below pre-crisis levels. Table 1 shows the average inflation rates by main commodity group for the pre-crisis period and the period starting in 2017. Moreover, the last three rows of table 1 give the contributions to the headline inflation rate. Services is the main factor. However, it is also important to note that no single group of commodities shows price developments above pre-crisis averages. The importance of service prices for HICP inflation is further emphasised by the fact that its weight in the HICP index has increased by 10 %-age points since 1998.

Services have contributed 0.9 %-age points to HICP inflation between 1999 and 2008, which has declined to 0.6 %-age points since 2017. Among services lower price developments in the following categories show the most substantial contributions to lower headline inflation compared to the pre-crisis period: catering services (0.1 %-age points lower contribution), health services (0.05 %-age points), housing rents (0.04 %-age points), education (0.04 %-age points) and social protection (0.03 %-age points). Subdued price developments in the category Restaurants, Cafés & the Like has the single most important impact with a weight of 7.1 % in the HICP index. The category Actual Rentals for Housing is weighted with 6.4 % in the overall index.

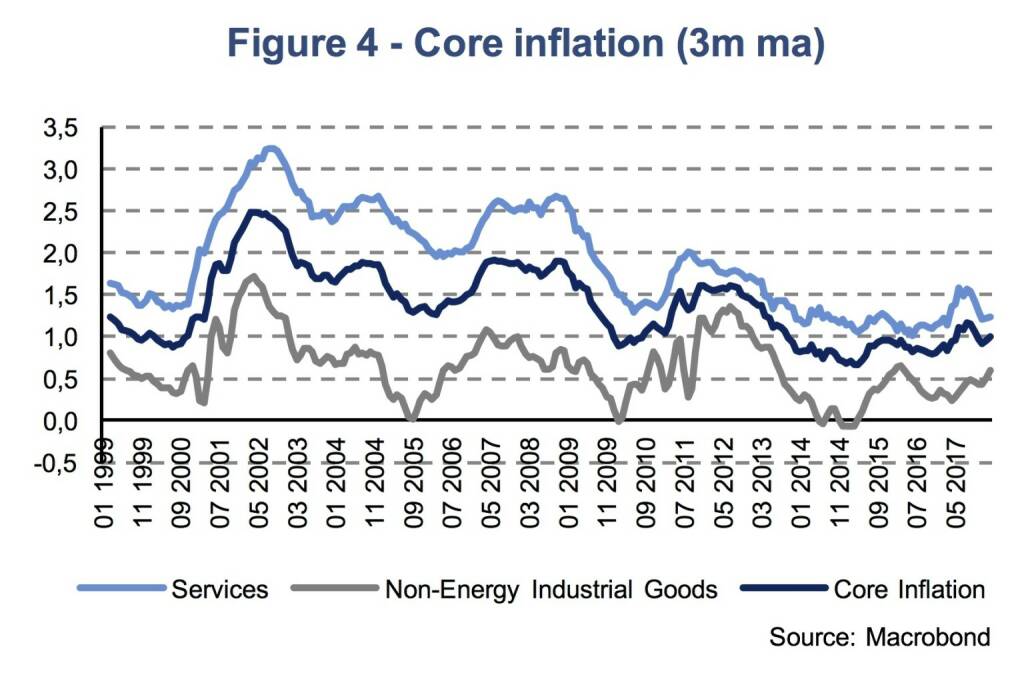

Overall, we conclude that an acceleration in service prices is crucial for Euro Area core inflation to converge to pre-crisis levels. Firstly, service price inflation tends to be higher than inflation in non-energy industrial goods (Figure 4). Secondly, service prices have by far the largest weight in the HICP index. Moreover, for the ECB to fulfil its inflation target support from non-core components is additionally needed. Ending on a positive note, we want to highlight that labor shares tend to be higher in service industries such that service prices should rise more strongly with wage increases.[2] Given the favorable macro-economic conditions, the strong cyclical movement and a further tightening of labor markets should support wage growth to accelerate.

[1]The centered moving average is based on projections of HICP inflation from historical patterns of quarter-on-quarter growth rates for the period post February 2018.

[2]Service industries, excluding real estate activities, showed a labor share of 63 % in Q3 2017 compared to 52 % in industry, excluding construction. Labor shares are defined as compensation of employees divided by gross value added (Source: Eurostat).

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» Börse-Inputs auf Spotify zu u.a. Fussballc...

» Österreich-Depots: Weekend-Bilanz (Depot K...

» Börsegeschichte 27.9: Sehr viel dabei (Bör...

» In den News: AT&S sucht, Post testet, CA I...

» Nachlese: Florian Heindl, Silvia Resnik so...

» Wiener Börse Party #747: ATX stärker, CA I...

» Wiener Börse zu Mittag fester: CA Immo, Po...

» Börsenradio Live-Blick 27/9: DAX steigt am...

» Börse-Inputs auf Spotify zu u.a. Sartorius...

» ATX-Trends: AT&S, RBI, Immofinanz ...

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...