Lenzing AG / Lenzing Group Achieves Best Quarterly Results in its History

Lenzing AG / Lenzing Group Achieves Best Quarterly Results in its History

16.05.2017, 6212 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Financial Figures/Balance Sheet/Quaterly Report/Company Information

Lenzing -

Revenue up 14.3 percent to EUR 586.2 mn\nEBITDA increase of 46.6 percent to EUR 135.1 mn\nNew sales offices established in Turkey and Korea\nFurther progress made on expanding production capacities for specialty fibers\nLenzing - The Lenzing Group got off to a very good start in the year 2017. It succeeded in significantly improving first-quarter revenue and earnings and thus achieved the best quarterly results in the company's history. The corporate strategy sCore TEN will continue to be implemented in a disciplined manner in order to further enhance customer intimacy and further expand the offering of specialty fibers.

Compared to the prior-year quarter, consolidated revenue climbed 14.3 percent in the first three months of 2017 to EUR 586.2 mn. This rise can be attributed to higher selling prices related to the Chinese New Year as well as an improved product mix, the reduction of inventories and more favorable currency exchange rates. Consolidated earnings before interest, tax, depreciation and amortization (EBITDA) were up 46.6 percent to EUR 135.1 mn, corresponding to an EBITDA margin of 23 percent in comparison to 18 percent in the prior-year period. Earnings before interest and tax (EBIT) of the Lenzing Group increased by 72.1 percent to EUR 102.3 mn, resulting in a higher EBIT margin of 17.5 percent (Q1 2016: 11.6 percent). The profit for the period improved by 69.6 percent to EUR 75 mn, and earnings per share rose 67.9 percent to EUR 2.75 per share.

"The first quarter of 2017 was the best in our company history. A key factor is the disciplined implementation of our sCore TEN corporate strategy. The opening of new sales offices in Turkey and Korea enables us to serve our customers more effectively. We are progressing well with the expansion of our production capacities for specialty fibers. This will support our customers in their own expansion efforts by providing products made of our botanic fibers", states Stefan Doboczky, Chief Executive Officer of the Lenzing Group. "Assuming that fiber market conditions remain at current levels, we expect a substantial earnings improvement this year compared to 2016."

Better customer support

The Lenzing Group opened up new sales and marketing offices in Turkey and Korea. The direct contact to customers and well equipped showrooms featuring products made of LenzingTM fibers serve as the basis for providing even better support to our customers.

Expansion of production capacities for lyocell fibers has started off well

With the ground-breaking ceremony at the Lenzing Group's production site in Heiligenkreuz, Burgenland (Austria), the end of March marked the beginning of the construction phase to expand capacities for TENCEL® branded lyocell fibers. As of mid-2018, customers will have an additional 25,000 tons of lyocell specialty fibers at their disposal. The construction of the new production facility for TENCEL® fibers in Mobile, Alabama (USA), has started already as well and will be finished at the end of the first quarter of 2019. Lenzing is currently examining several potential sites in Asia for a further lyocell plant.

Outlook

The macroeconomic environment appears to be somewhat more favorable than in the prior-year quarter, but continues to be impacted by political factors. Developments on the fiber markets should be slightly more positive, but still volatile. The wood-based cellulose fiber segment, which is relevant for Lenzing, should again outpace the overall fiber market. The demand for these wood-based cellulose fibers was very good at the beginning of 2017 with the long-term trend pointing towards further growth in viscose and, above all, wood-based cellulose specialty fibers. On the supply side, the market is not expected to see the entry of any notable new production capacities in 2017.

Under the assumption of unchanged conditions in the fiber market and stable exchange rates, the Lenzing Group confirms its expectation of achieving a considerable improvement in results in the fiscal year 2017 compared to 2016.

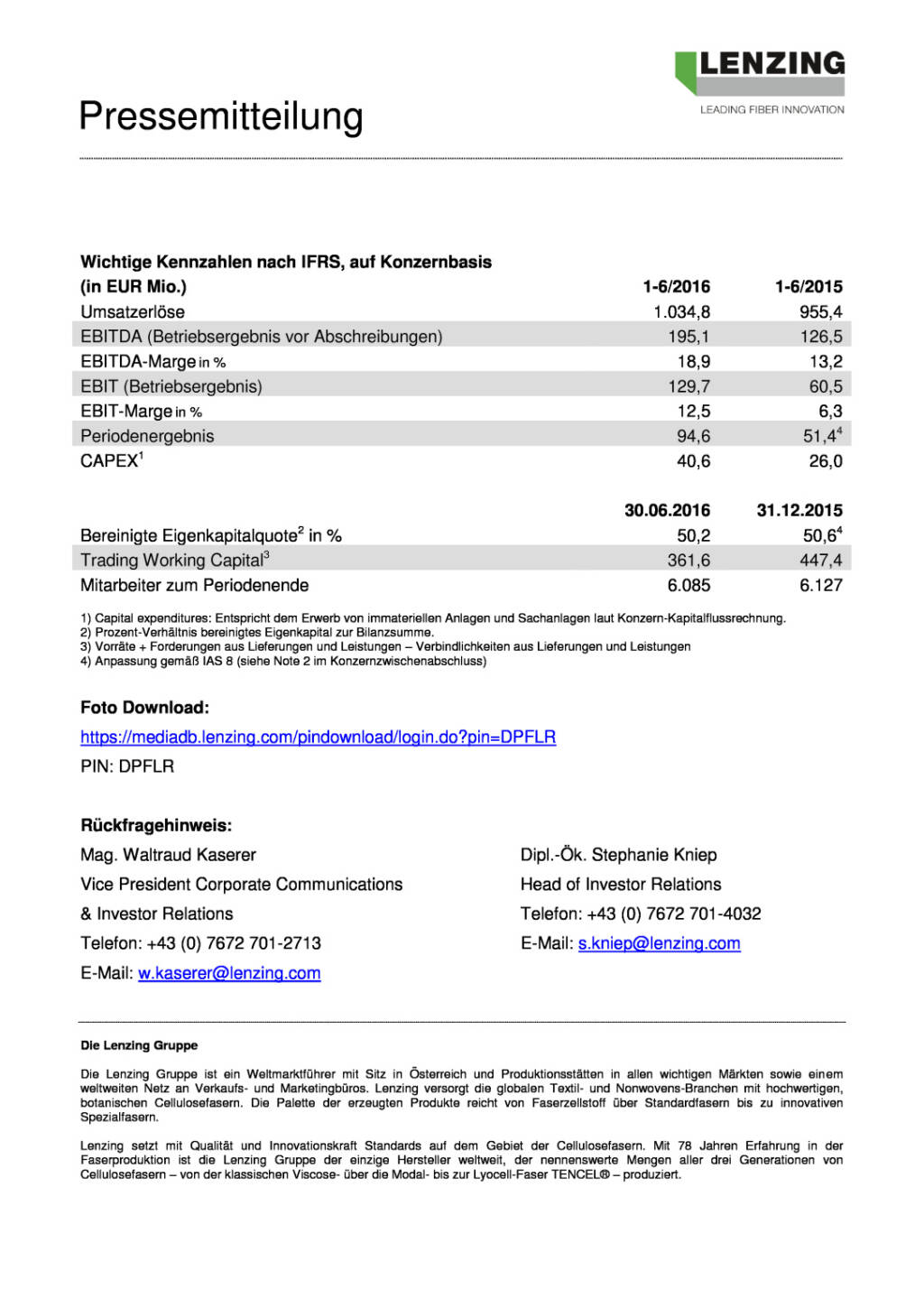

Key Group indicators (IFRS) 1-3/2017 1-3/2016(1) in EUR mn Revenue 586.2 512.8 Earnings before interest, tax, depreciation and 135.1 92.2 amortization (EBITDA) EBITDA margin in % 23.0 18.0 Earnings before interest 102.3 59.5 and tax (EBIT) EBIT margin in % 17.5 11.6 Net profit for the period 75.0 44.2 CAPEX(2) 26.9 15.9 31.03.2017 31.12.2016 Adjusted equity ratio(3) 54.3 53.0 in % Number of employees at 6,304 6,218 period-end

1) The figures were partially adjusted (for further details please refer to "Notes on the Financial Performance Indicators of the Lenzing Group", available at the following link http://www.lenzing.com/Notes-Financial-Performance- Indicators-Lenzing-Group-2017-Q1 [http://www.lenzing.com/Notes-Financial- Performance-Indicators-Lenzing-Group-2017-Q1]) 2) Capital expenditures: acquisition of intangible assets, property, plant and equipment as per statement of cash flows 3) Ratio of adjusted equity to total assets in percent

Photo download: https://mediadb.lenzing.com/pindownload/login.do?pin=UQQGS [https:// mediadb.lenzing.com/pindownload/login.do?pin=UQQGS] PIN: UQQGS

end of announcement euro adhoc

issuer: Lenzing AG

A-A-4860 Lenzing phone: +43 7672-701-0 FAX: +43 7672-96301 mail: office@lenzing.com WWW: http://www.lenzing.com ISIN: AT0000644505 indexes: ATX, WBI stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/1597/aom

Wiener Börse Party #651: Addiko mit höflichem neuen Bieter, Polytec stark, dazu Inputs & Ideen von Wolfgang Plasser (Pankl)

Lenzing

Uhrzeit: 22:27:38

Veränderung zu letztem SK: 0.14%

Letzter SK: 35.80 ( 0.14%)

Bildnachweis

Aktien auf dem Radar:FACC, Rosenbauer, AT&S, Amag, Flughafen Wien, Frequentis, Addiko Bank, Rosgix, Palfinger, Pierer Mobility, Erste Group, Österreichische Post, Marinomed Biotech, Gurktaler AG Stamm, Polytec Group, S Immo, Agrana, CA Immo, EVN, Immofinanz, Kapsch TrafficCom, OMV, Telekom Austria, Uniqa, VIG, Wienerberger.

Random Partner

Cleen Energy AG

Die Cleen Energy AG ist im Bereich nachhaltige Stromerzeugung durch Photovoltaik-Anlagen und energieeffiziente LED-Lichtlösungen für Gemeinden, Gewerbe und Industrie, einem wichtigen internationalen Zukunfts- und Wachstumsmarkt, tätig.

Ein Fokusbereich ist das Umrüsten auf nachhaltige Gesamtlösungen. Zusätzlich baut CLEEN Energy den Bereich Leasing und Contracting von Licht- und Photovoltaikanlagen aus, der einen wachsenden Anteil am Umsatz ausmacht.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2UVV6 | |

| AT0000A32SW4 | |

| AT0000A39G83 |

- BSN Spitout Wiener Börse: Palfinger nach 307 Tage...

- Wiener Börse: ATX am Donnerstag schwächer, AT&S s...

- Wiener Börse Nebenwerte-Blick: Gurktaler wieder m...

- Wiener Börse: ATX am Donnerstag etwas schwächer, ...

- Wie Gurktaler AG Stamm, Addiko Bank, RHI Magnesit...

- Wie AT&S, Verbund, Bawag, VIG, SBO und OMV für Ge...

Featured Partner Video

Wiener Börse Party #639: KESt-Story bei Addiko,, Bawag stark, die 1900er-Anekdote und VIG vs. Commerzbank?

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse....

Books josefchladek.com

erotiCANA

2023

in)(between gallery

Berlin. Symphonie einer Weltstadt

1959

Ernst Staneck Verlag

操上 和美

2002

Switch Publishing Co Ltd

Jerker Andersson

Jerker Andersson Ed van der Elsken

Ed van der Elsken Dominic Turner

Dominic Turner Sebastián Bruno

Sebastián Bruno Emil Schulthess & Hans Ulrich Meier

Emil Schulthess & Hans Ulrich Meier Kristina Syrchikova

Kristina Syrchikova Igor Chekachkov

Igor Chekachkov