German business cycle strengthens despite weak sentiment (Martin Ertl)

- Q1 GDP growth at 0.4 % (q/q) was driven by household consumption and investment activity.

- Strong service sector performance compensated for a continued decline in manufacturing.

- Sentiment indicators support the divergence between manufacturing and service sectors despite indications of weaker service sentiment.

The German business cycle has still some steam left. After stagnating during the second half of 2018, growth in gross domestic product (GDP) bounced back to 0.4 % in Q1 2019 (quarter-on-quarter, seasonally and calendar day adjusted). This translates into 0.7 % GDP growth when compared to Q1 2018 (year-on-year). Thus, the German economy has regained some of its momentum growing at a pace which is similar to the first two quarters of the previous year (Q1-Q2 2018: 0.4 % q/q growth).

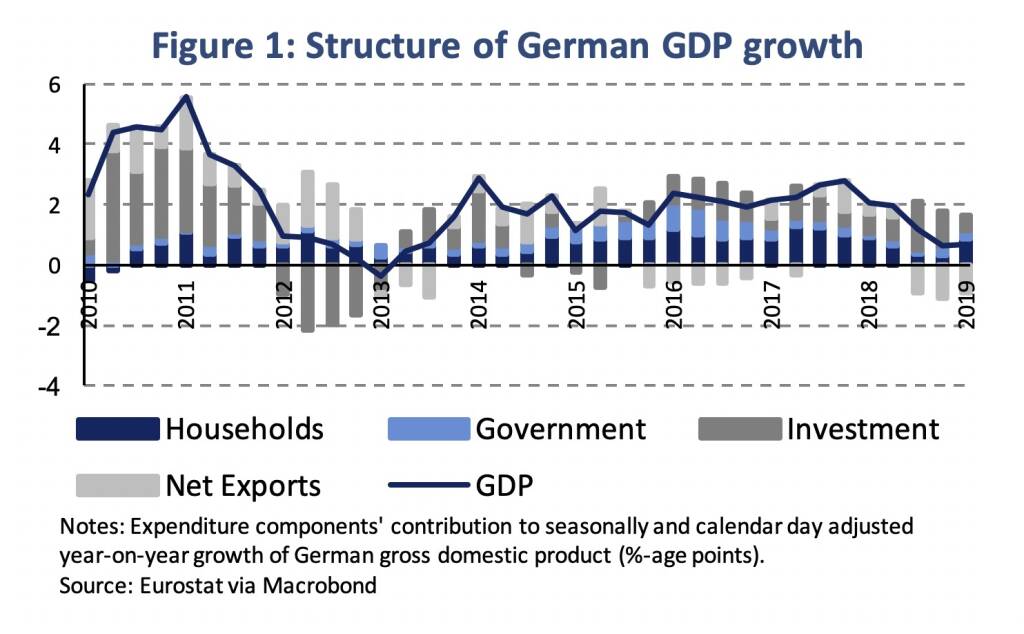

Domestic demand has been the main driver of growth. Households consumption increased by 1.2 % (q/q, sa) while investment, excluding changes in inventories, picked up by 1.1 % compared to the final quarter of 2018. A decline in inventories lowered the positive contribution of investment, though. External demand improved, with exports expanding more rapidly (1.0 %, q/q) than imports (0.7 %, q/q). Figure 1 shows the contribution of expenditure components to year-on-year GDP growth (in %-age points). It can be seen that the contribution from external demand remains negative and sizeable. Among the components of domestic demand, the pick-up in household consumption compensated for a lower contribution from investment (inventories).

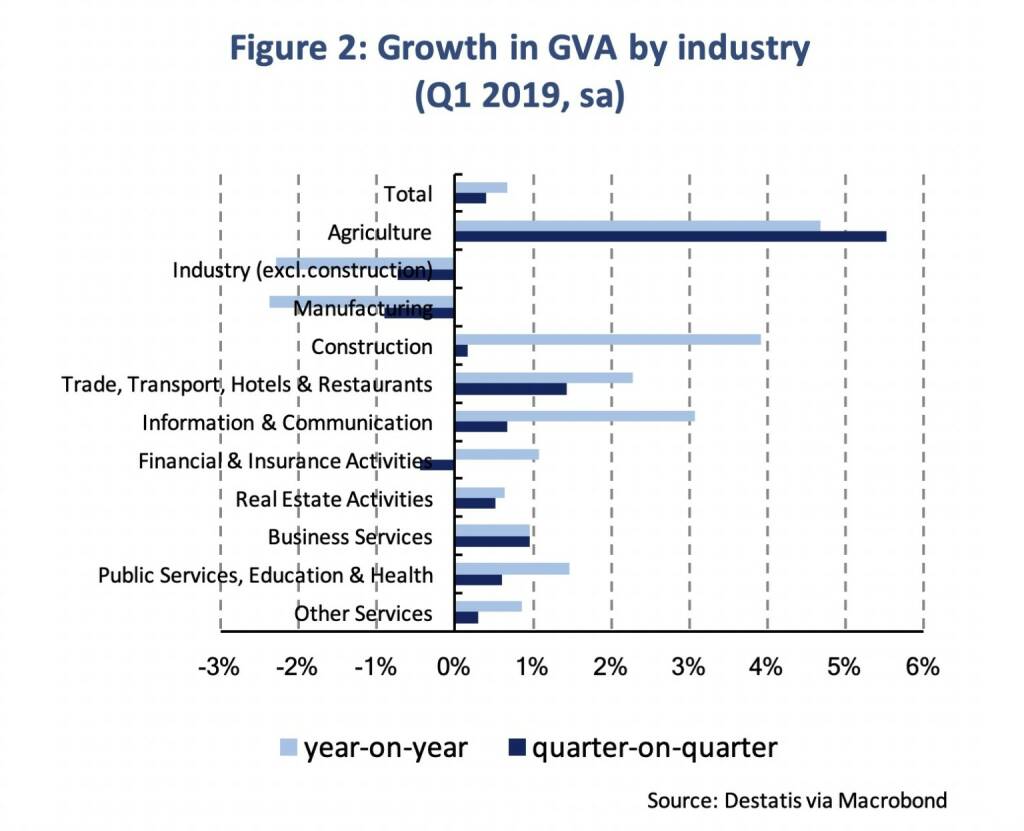

Service sector industries keep the German economy afloat while the manufacturing sector continues its decline. Figure 2 plots growth rates of gross value added by industries in Q1 2019 compared to Q4 2018 (quarter-on-quarter) and Q1 2018 (year-on-year). Similar to the previous quarters the manufacturing sector declined by 0.9 % (q/q) in early 2019 while the construction industry expanded slightly (0.2 %, q/q), though much less dynamically than in previous quarters (1.2 %, q/q, avg. 2018). Agricultural output picked up markedly in Q1 2019 (5.5 %, q/q), given the sector’s small size (< 1 % of GDP) also the effect is small. The service sector was the true driver of growth in Q1, in particular, the sub-sector ‘trade, transport, hotels & restaurants’ which expanded by 1.4 % (q/q) and accounts for 16 % of German gross value added.

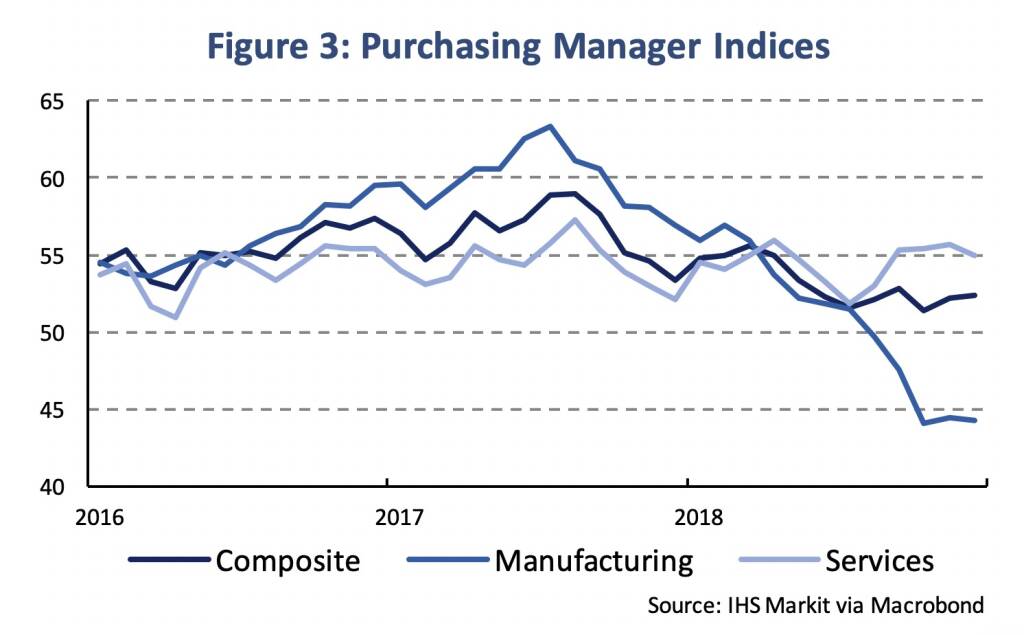

The service sector has prevented Germany to fall into a technical recession during the second half of 2018. Industrial production has declined since the second half of 2018 while the service sector has remained stable. This is also reflected in sentiment indicators, like Purchasing Manager Indices (PMI), which show a deterioration within the manufacturing sector with a stable sentiment in the service sector (Figure 3). In May, however, the service sector component of the ifo business climate index dropped quite substantially. The growth contribution of the service sector could weaken in Q2, yet remains positive.

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» SportWoche Podcast #106: Persönliches Fail...

» Börse-Inputs auf Spotify zu u.a. Invest St...

» BSN Spitout Wiener Börse: Palfinger dreht ...

» Österreich-Depots: Wochenendbilanz (Depot ...

» Börsegeschichte 26.4.: Mike Lielacher (Bör...

» PIR-News: Analysten Einschätzungen zu den ...

» Nachlese: Addiko vs. Marinomed, Bayer, Pat...

» Wiener Börse Party #638: I wer narrisch be...

» Wiener Börse zu Mittag stärker: S Immo, Wi...

» Börsenradio Live-Blick 26/4: DAX rauf, Bay...

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...