Global economy in full swing, Eurozone - the years of discontent come to an end (Martin Ertl)

Global economy in full swing

- President Trump kept a promise pushing a tax reform through the Congress. Its impact on the US economy remains a source of uncertainty.

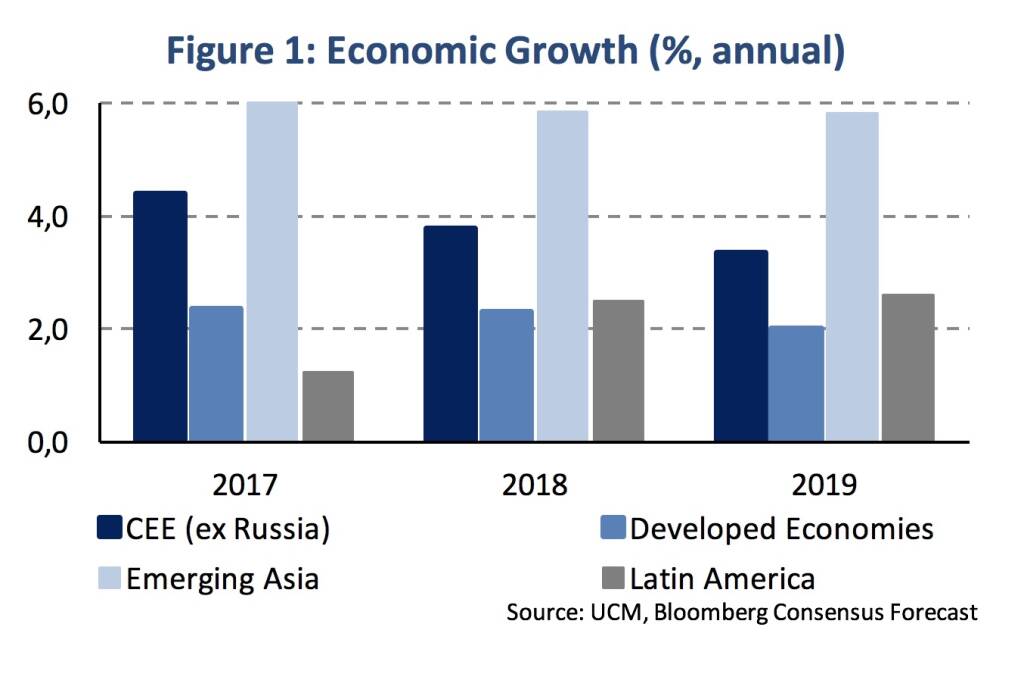

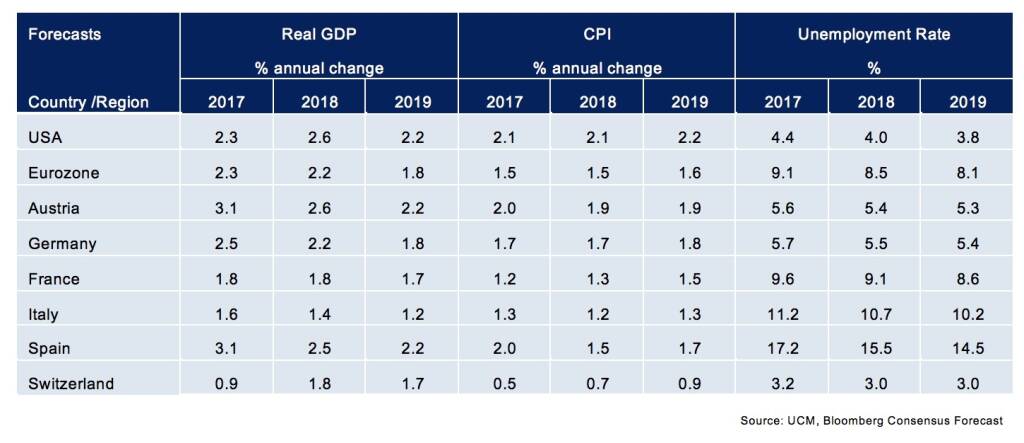

The global economy is in good shape with both developed and emerging markets growing solidly (Figure 1). In Europe, a hard Brexit is seen as less likely after negotiations have moved on to phase two. Japan has revised its GDP growth upwards (1.3 % in 2018) and a sharp slowdown of China’s growth (2018: 6.5 %) became less likely with stronger than expected export growth.

The US economy is expanding at an accelerated pace. GDP growth in Q3 increased to 3.3 % (q/q, annualized) after 3.1 % in Q2, in spite of storm related disturbances. Positive fiscal impulses can support growth in 2018. The Federal Reserve Board has recently raised the GDP projection for 2018 from 2.1 % to 2.5 % (y/y).

President Trump kept his promise and signed the Republican tax reform, the Tax Cuts and Jobs Act, on Friday 22nd of December, after both the Senate and the House agreed on an identical version. The bill makes substantial changes to individual income tax rates and the taxation of business income. Besides other changes, the top individual income tax rate is lowered from 39.6 % to 37 % and the corporate income tax is set at 21 % from 35 % previously. The Joint Committee of Taxation, a nonpartisan committee of the United States Congress, estimates the tax reform to increase the deficit by 1,071 billion USD over a ten-year period (2018-2027), already considering deficit reducing effects of the tax reform’s GDP growth stimulus.

Italy is holding a general election on the 4th of March. The Euro-sceptic Five-Star-Movement (MS5) is leading most opinion polls, expected to gain between 26 and 29 % of the votes. Nevertheless, a centre-right coalition with Berlusconi’s Forza Italia as the dominant party is seen as most likely to win the election. The regional election in Sicily in early November, which is perceived as an important indicator for the general election, has shown exactly this result.

Eurozone: The years of discontent come to an end

- Besides supportive monetary policy and the positive external impetus, the labor market trends, bright sentiment and the credit sector recovery sustain the solid business cycle into 2018.

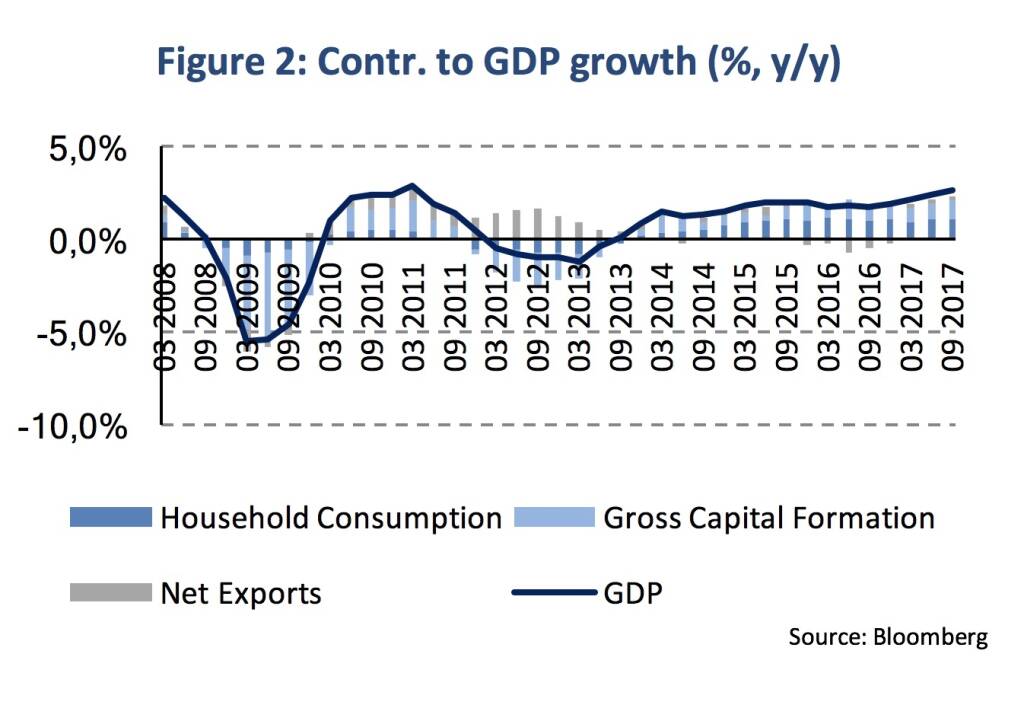

Confidence in the Euro Area economy is returning after years of discontent. In Q3 2017, quarterly real GDP rose by 0.6 % and in annual terms growth accelerated to 2.8 % (after 2.3 % in H1). Growth is well balanced as private consumption and fixed investment contributed 1.0 % and 0.9 % and net exports added 0.3 % to annual GDP growth (Figure 2).

The manufacturing sector recovered during the last year. In November, industrial production expanded by 3.5 %. Construction activity also recovered rising by 2.5 % in October (y/y, 3 months average).

Sentiment surveys reach multi-year highs in the Euro Area indicating bright business expectations among firms and households. Industrial orders rose strongly by 7.8 % and 7.9 % in Q3 in Germany and Italy.

Sentiment and growth are supported by fast improvements in the labor markets, which have been weak for several years. The Euro Area-wide unemployment rate is about to reach its long-term average (~8.5 %) in 2018. It had declined to 8.7 % until last November. On the other side, labor compensation has not shown a significant upward drift (+1.7 % y/y in Q3 2017).

In addition, the credit sector has been catching up and is increasingly becoming supportive for growth. Loans to the household sector have been accelerating and rose by 7.1 % (consumer loans) and 3.3 % (mortgage loans) in November. The corporate loans have been lagging and started to recover last year (1.8 % y/y in November).

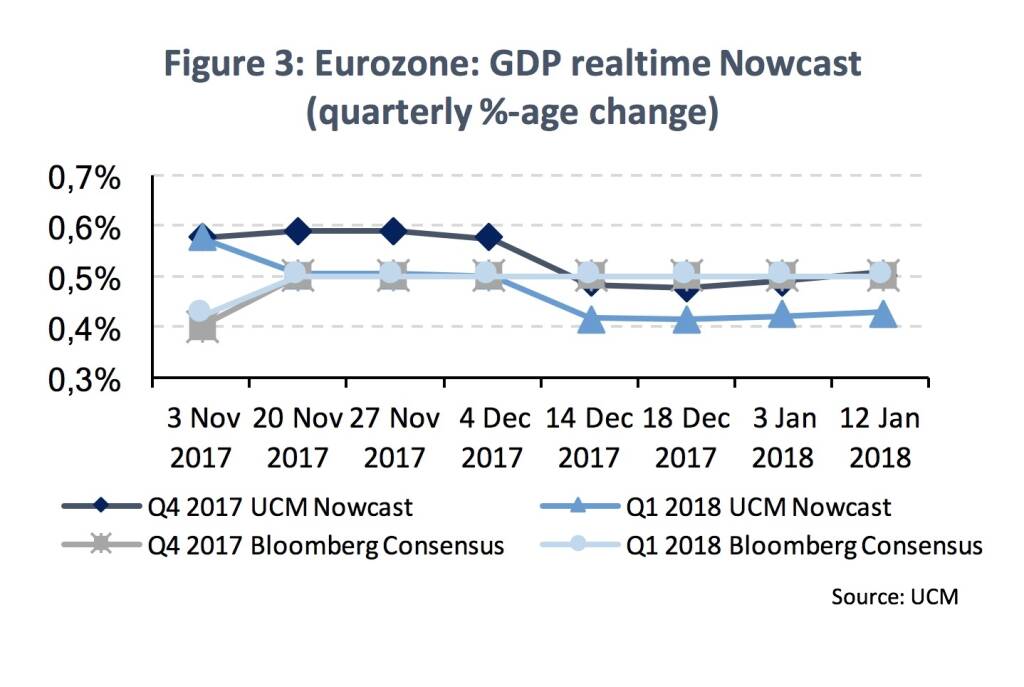

Our newly established Eurozone coincidence indicator (“now-casting” model) signals quarterly real GDP growth of 0.5 % in Q4 2017 and projects sustained momentum in Q1 2018 (Figure 3). The positive impulse will likely be maintained during 2018 and annual GDP growth is expected to linger around 2.2 % for the total of the year.

CEE: Goldilocks economics

- We have upgraded the growth outlook for the CEE region in 2018 und included forecasts for 2019. Macroeconomic tailwind is set to persist over the projection horizon.

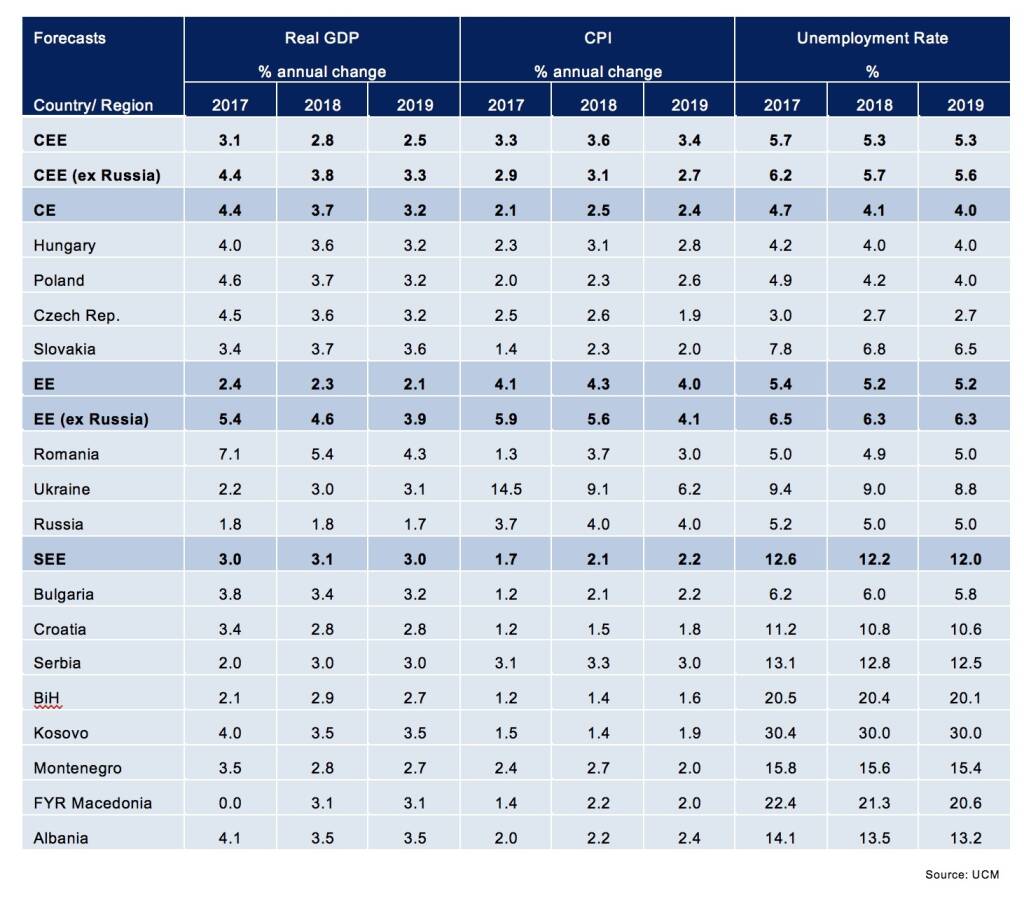

Central European (CE) economies continue catching up to the European core (see table below). The countries show solid macro-economic performance with exceptional GDP growth. Poland and the Czech Republic, in particular, surprised to the upside with 5.2 % and 5 % annual, seasonally-adjusted GDP growth in Q3 but also Hungary (4.1 %) and Slovakia (3.5 %) experienced their highest growth rates last year in Q3. Household consumption continues to be an important driver of economic growth with investment activity starting to play a more prominent role.

Interestingly, however, the non-Eurozone central banks of the CE region show very diverse monetary policy trajectories. While the Czech National Bank has already increased interest rates twice in 2017, the National Bank of Poland has kept its monetary policy unchanged so far and intends to do so until the end of 2018. The National Bank of Hungary has further eased monetary policy in spite of rising inflation.

Economic growth is exuberant in Romania (8.6 % in Q3 2017) and the central bank embarked on an interest rate hiking cycle last week (see detailed report below). Strong wage growth fuels prices such that inflation was already well above the central bank’s target.

South Eastern Europe (SEE) shows a more mixed though overall sound picture. High unemployment rates in many SEE economies remain a major problem, even though they are declining. In 2018, unemployment rates will remain above 20 % in Bosnia & Herzegovina, Macedonia and Kosovo. Construction activity (Montenegro, Albania) and easier credit availability (Albania, Kosovo, Macedonia) are important growth drivers.

Central Banks: Confidence

- In December, the US Fed’s economic projections outlined a stronger labor market and higher GDP growth.

- Long-term confidence of the ECB to reach the inflation target is mitigated by a soft short-term inflation trajectory.

A significant reduction in economic slack gives the European Central Bank (ECB) ground for greater confidence that inflation will converge towards the inflation goal. At the same time, price pressures remain muted overall. An ample degree of monetary stimulus will remain and be gradually lifted during 2018. The ECB macroeconomic projections forecast Eurozone GDP growth of 2.3 % and subdued inflation of 1.4 % for the year.

The ECB‘s net asset purchases (‚QE‘) of 30 bn EUR per month are intended to run until September and most likely will be gradually adjusted towards zero afterwards. Hence, there is some chance that the ECB will start an interest rate hiking cycle in 2019.

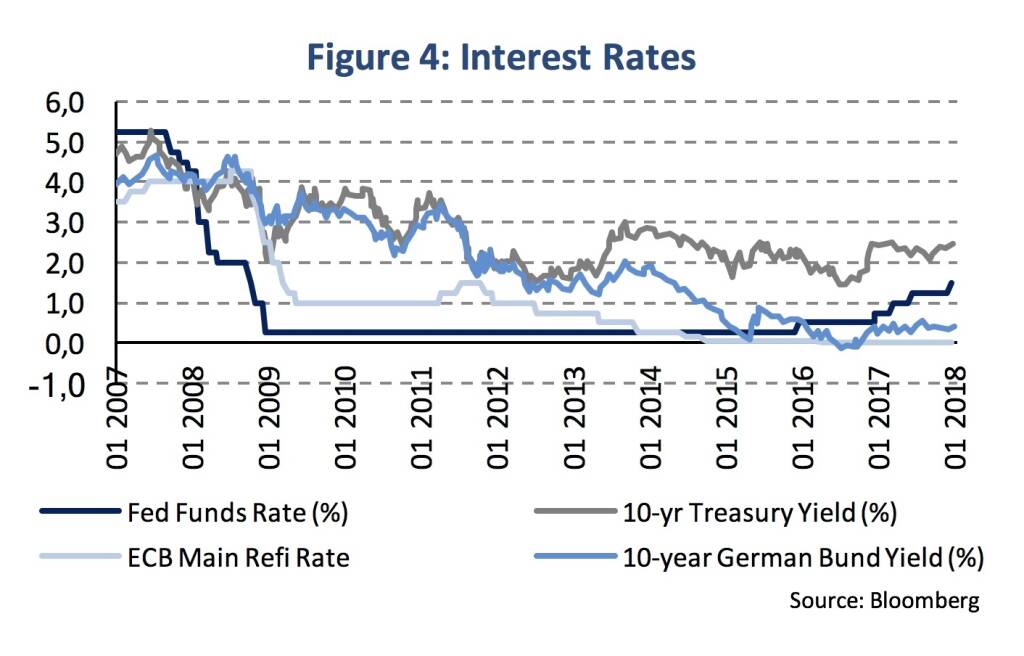

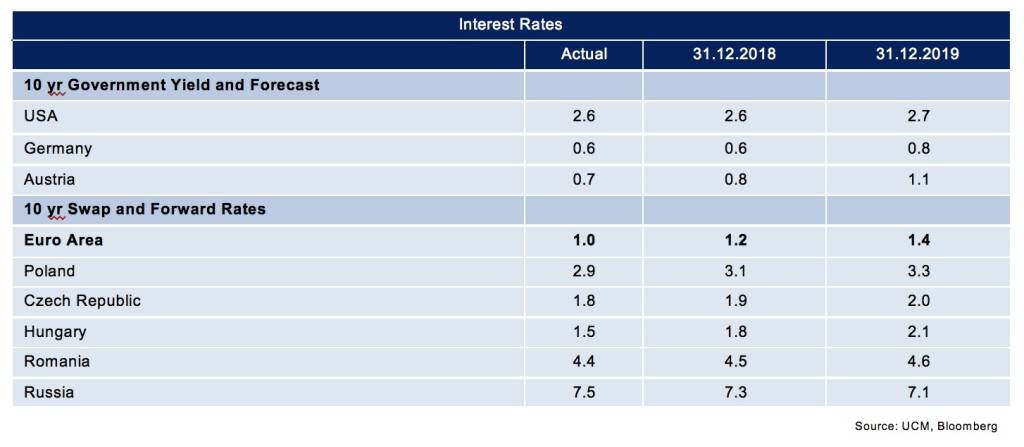

US treasury interest rates might rise gradually over the course of 2018 (Figure 4). The Federal Reserve is set to continue a rate hiking cycle. In the 3rd step in 2017 and the 5th step in total, the Fed raised the key interest rate to 1.5 % in December last year. Two or three further steps (each 25 basis points) are indicated for this year as well as for 2019. The central bank’s guidance is based on a solid growth of the US economy (2.5 %), a very low unemployment rate expectation (3.9 %) and a stable price development (1.9 %) near the Fed’s inflation objective in 2018. The fiscal easing by the Trump tax reform might pose some upside risk to growth and inflation. In addition, the reduction of the Fed’s balance sheet over time that started in October, might assert some upward pressure on the US yield curve. In a staff paper, the Fed had estimated a term-premium effect of 15 basis points for 2018 upon the redemption of the portfolio of balance sheet holdings.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» BSN Spitout Wiener Börse: Mit Erste, Bawag...

» SportWoche Party 2024 in the Making, 23. A...

» SportWoche Party 2024 in the Making, 25. A...

» Österreich-Depots: Unverändert (Depot Komm...

» Börsegeschichte 25.4.: RBI, Porr (Börse Ge...

» Zahlen von Strabag, News von Marinomed, S ...

» Wiener Börse Party #637: Egalite Addiko Ba...

» Nachlese: Marcel Hirscher, Hannes Roither,...

» Wiener Börse zu Mittag schwächer: Frequent...

» MMM Matejkas Market Memos #35: Gedanken üb...

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...