Business cycles in the US, Euro Area and Austria (Martin Ertl)

USA:

- Solid domestic demand by year-end

- No changes at Chair Yellen’s last FOMC

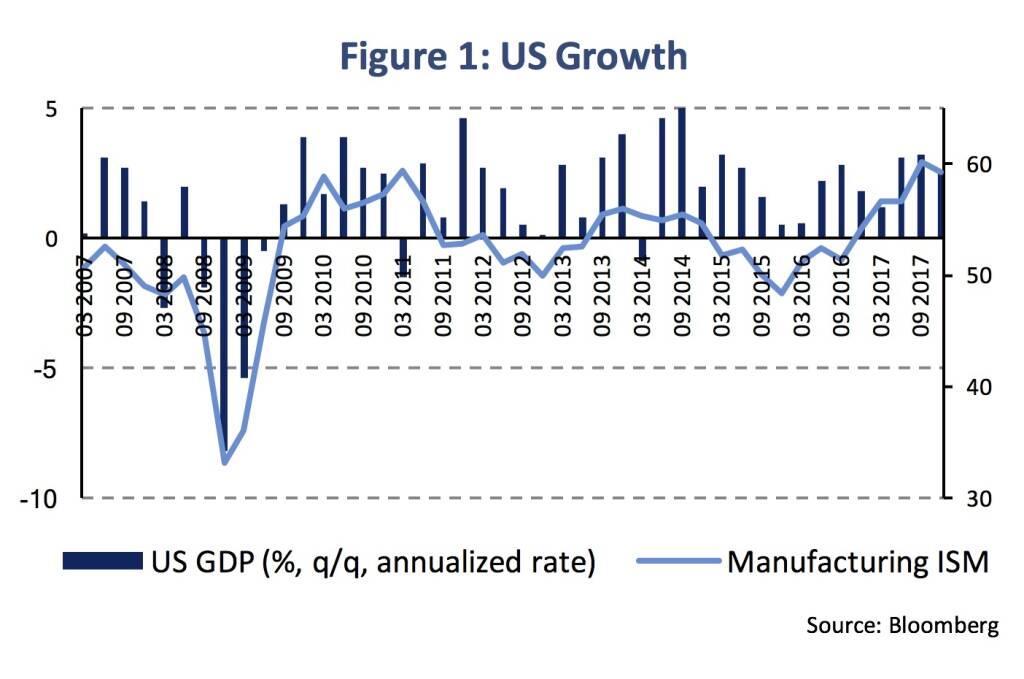

In the final quarter of 2017, the US real GDP rose by 2.6 % (q/q, annualized rate) after 3.2 % in Q3 (Figure 1), according to the first release of the Bureau of Economic Analysis (BEA). While the headline GDP remained below expectations (Bloomberg consensus estimate: 3.0 %, Atlanta Fed GDPNow: 3.4 %, NY Fed GDP nowcast: 3.9 %), the details revealed a solid state of the domestic US economy. Personal consumption expenditure and fixed investments increased by 3.8 % and 7.9 %. The investments breakdown shows that investment in equipment and structures rose by 11.4 % and 1.4 % and residential investment increased by 11.6 % drawing a positive picture of the cyclical components of GDP. On the other side, firms had to run down inventories in order to meet domestic demand (deducting 0.7 %-age points from GDP growth). In addition, net exports put a drag of 1.1 %-age points on growth as exports (+6.9 %) were outpaced by strong import growth (13.9 %).

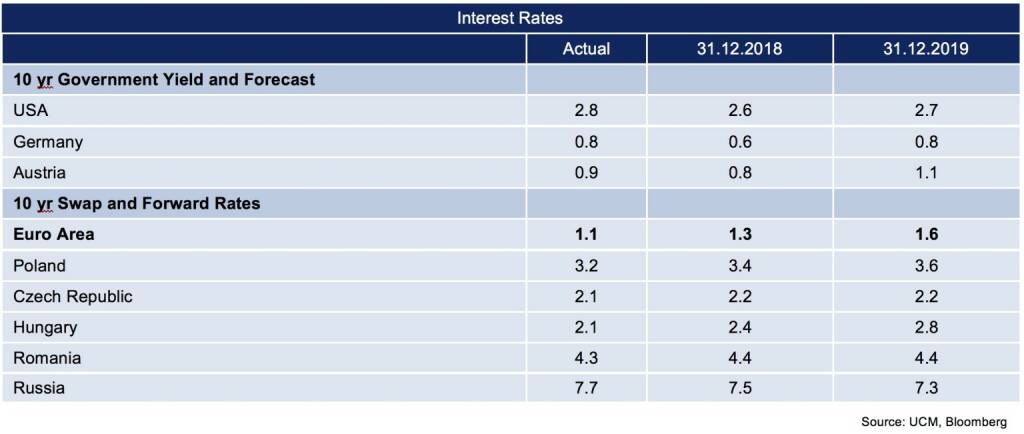

There were no changes in Chair Yellen’s last federal open market committee (FOMC) last week. The FOMC maintained the target range of the federal funds rate at 1.25 % to 1.50 %. The statement that was released last Wednesday says that the labor market continued to strengthen and economic activity has been rising at a solid pace. The FOMC skipped references to hurricane related disruptions compared to the December statement and expects that inflation will move up this year. The FOMC expects that economic conditions will evolve in a manner that will warrant further gradual increases in the fed funds rate. Market odds for a key rate hikes are currently at 88.6 % (March), 66.5 % (June) and 43.2 % (September) adding up to three rate increases this year. In line with that, in December, the Fed’s quarterly Summary of Economic Projections had indicated 2-3 interest rate steps for 2018 as well as for 2019.

Eurozone:

- Buoyant growth continues in the Euro Area and Austria, while EA headline inflation drops to a temporary low.

- No interest rate hike this year (Draghi)

In line with expectations, in the 4th quarter of last year Eurozone real GDP increased by 0.6 % (q/q) and 2.7 % in annual terms. Annual GDP accelerated significantly (2.5 %) in 2017 compared to the previous year (1.8 %). GDP details will be released on 14th February. The business cycle is set to remain elevated: An early dynamic projection for Q1 2018 of our GDP Tracker suggests a mild deceleration in quarterly GDP growth (0.5 %), however, this estimate is expected to rise with solid incoming data.

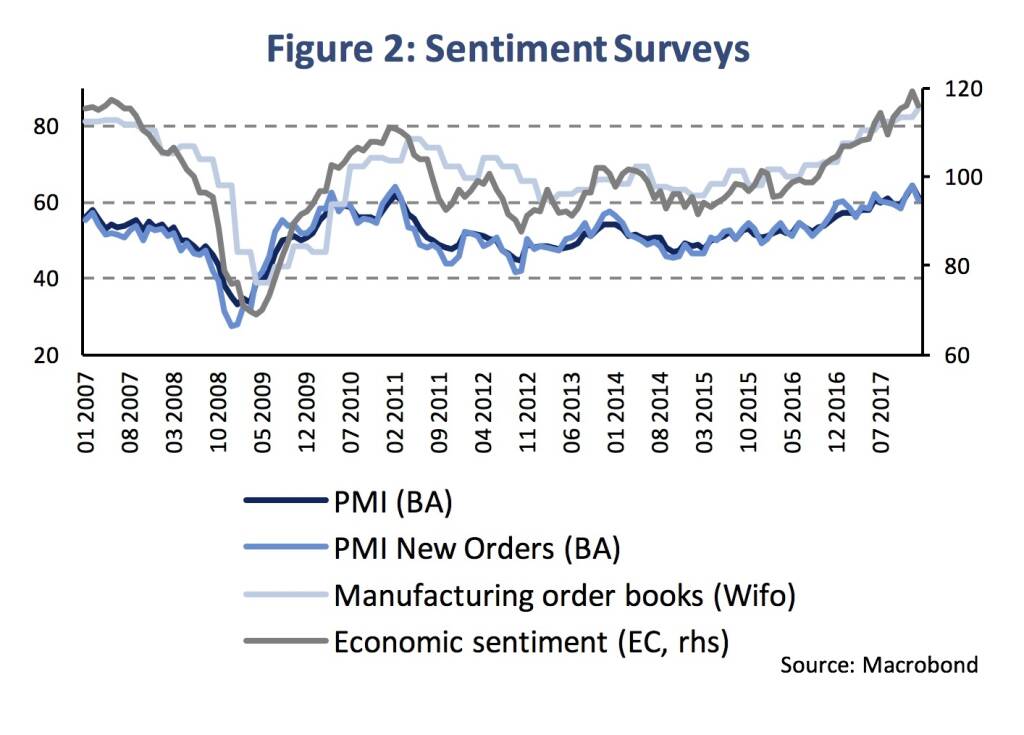

In 2017, Austria’s economy also got into gear. According to the flash estimate from the Austrian Institute of Economic Research (Wifo), the real GDP increased by 0.8 % (q/q, trend-business cycle component, Eurostat methodology: 0.7 %) and 2.8 % (y/y) in Q4 2017. Export dynamics accelerated during the final quarter of 2017 (+1.8 %) as well as import growth (1.7 %). In addition, domestic demand remained lively with household consumption rising by 0.4 % (unchanged to the previous two quarters) and gross fixed investments growing by 1.0 %. Across sectors, growth was broad-based with construction showing the highest quarterly growth rate (0.9 %). In the total of 2017, the Austrian GDP expanded by 2.9 %. During Q1 2018, we expect the business cycle to remain strong. The projection for Q1 2018 of our GDP Tracker currently suggests 0.6 % q/q-growth. Some sentiment surveys retreated a bit in January after reaching highs at the end of last year (Figure 2).

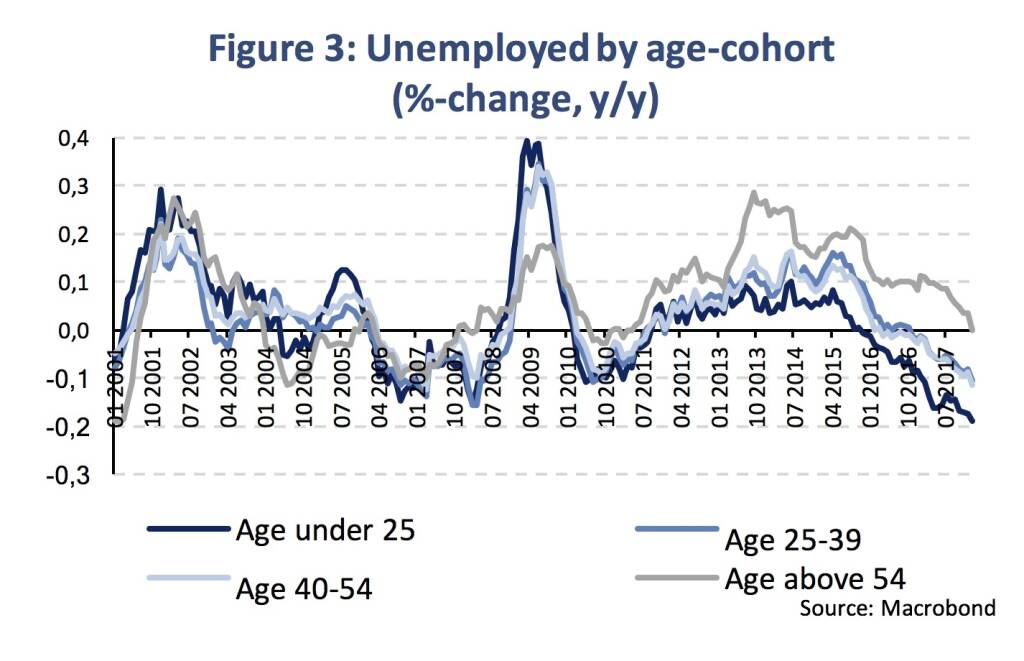

The Austrian labor market has been gaining from the business cycle momentum. In January, the total number of unemployed persons (379,209) fell by 10.2 % compared to January 2017. Across age-cohorts, the %-age change in the number of unemployed persons was most pronounced among the young and to a bit lesser extent also among the middle-ages, while elder persons gained less. The number of unemployed aged above 54 (65,080 persons) stagnated in January compared to a year ago (Figure 3). As a percentage of the total unemployed, this age-cohorts increased rapidly from 10.5 % in 2011 to 17.1 % in 2017.

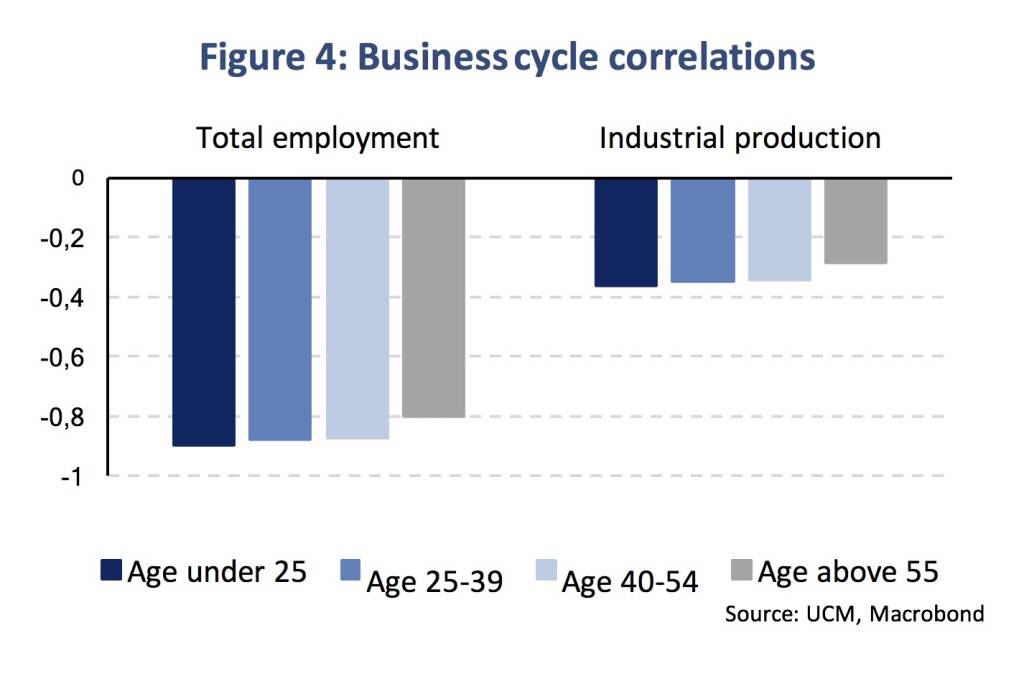

Do elder unemployed profit less from the improving cyclical conditions in the economy? The assumption seems reasonable since structural unemployment (due to a skills mismatch) and long-term unemployment is particularly high among elder persons. Given that, we calculate business cycle correlations – with total employment and industrial production – since 2015 (Figure 4). Simple correlations suggest that old-age unemployment still bears a cyclical component although less pronounced than for other age cohorts.

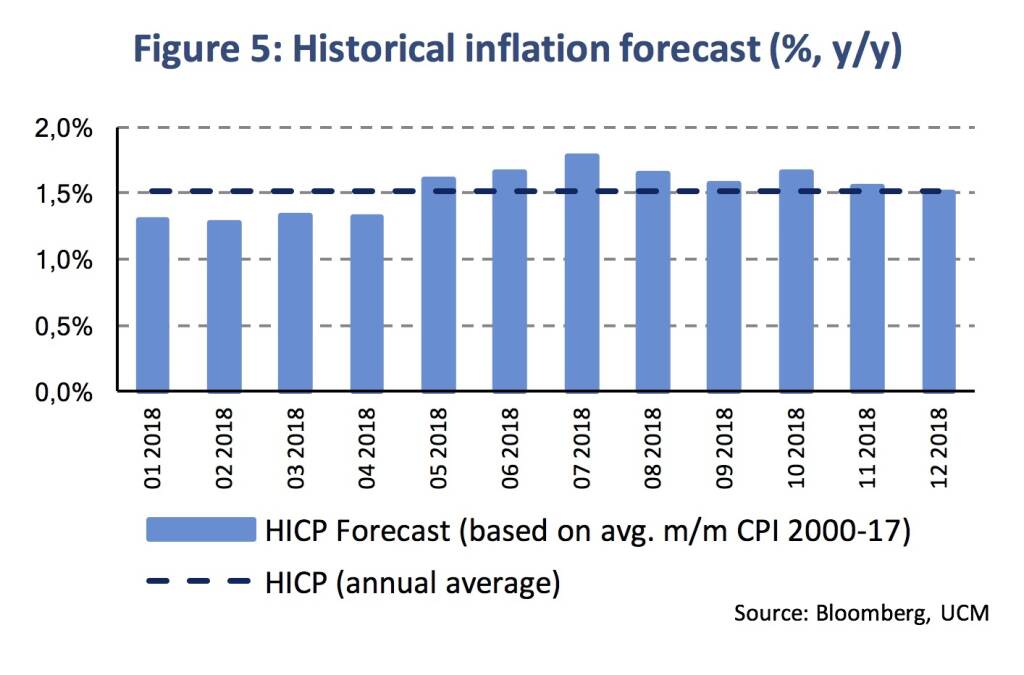

According to the flash estimate, the Euro Area inflation rate fell to 1.3 % in January from 1.4 % (y/y) in the previous month. The core inflation printed at 1.0 % (y/y) up from 0.9 % in December. The drop was mainly caused by a base effect from energy price increases early last year and, hence, the January headline inflation release might mark the low for the rest of the year. Based on past average month-over-month price changes, the 12-months inflation rate would rise and reach a peak in summer (Figure 5).

In its monetary policy meeting in January, the European Central Bank (ECB) left its monetary policy stance unchanged what has widely been expected. There were a couple of interesting take-aways from the Q&A session. President Draghi was unusually explicit in pointing out that based on today’s data he “can see very few chances that interest rates could be raised at all this year.” Asked about the end of the asset purchases in September, he said that the question was not discussed yet in the governing council (GC). As far as Draghi himself is concerned, he would “never stop the programme abruptly.” Hence, a gradual phasing out (‘tapering’) seems likely until the end the year, reducing the monthly asset purchases (from 30 bn until September) by 10 bn EUR each month from October to zero in December. However, the material difference to an abrupt end in September would in fact be small (as additional net asset purchases would amount to 30 bn EUR in total).

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Latest Blogs

» SportWoche Party 2024 in the Making, 17. A...

» SportWoche Party 2024 in the Making, 16. A...

» Österreich-Depots: ATX-Folgen schwer (Depo...

» Börsegeschichte 17.4.: Extremes zu Frauent...

» Q1 von A1, Grundsteinlegungen bei UBM und ...

» Nachlese: DAX hatte gestern schwächsten Ta...

» Wiener Börse Party #631: XXL-Folge mit ATX...

» Wiener Börse zu Mittag stärker: Warimpex, ...

» Börsenradio Live-Blick 17/4: DAX nach schw...

» Börse-Inputs auf Spotify zu u.a. Beiersdor...

Weitere Blogs von Martin Ertl

» Stabilization at a moderate pace (Martin E...

Business and sentiment indicators have stabilized at low levels, a turning point has not yet b...

» USA: The ‘Mid-cycle’ adjustment in key int...

US: The ‘Mid-cycle’ interest rate adjustment is done. The Fed concludes its adj...

» Quarterly Macroeconomic Outlook: Lower gro...

Global economic prospects further weakened as trade disputes remain unsolved. Deceleration has...

» Macroeconomic effects of unconventional mo...

New monetary stimulus package lowers the deposit facility rate to -0.5 % and restarts QE at a ...

» New ECB QE and its effects on interest rat...

The ECB is expected to introduce new unconventional monetary policy measures. First, we cal...